Building strong brand awareness is foundational to long-term business success, influencing everything from customer acquisition to loyalty and market share. Yet, many brands struggle to accurately measure the true reach and impact of their brand presence. Without this clarity, they risk missing opportunities to optimize marketing investments and growth.

Robust brand measurement enables smarter resource allocation and optimized campaign effectiveness, making it an indispensable practice for growth-focused organizations. In fact, research shows consumers are 2.5 times more likely to purchase brands they recognize, underscoring the power of awareness on buyer behavior.

Understanding the best metrics, methods, and strategies for measuring brand awareness empowers brands to pinpoint their position in the marketplace, track progress over time, and make informed decisions to strengthen their brand equity.

What Is Brand Awareness

First, let’s dive into why organizations should care about brand awareness, and what goes into brand awareness as a whole.

Why Brand Awareness Matters for Growth

Brand awareness represents how well consumers recognize and recall a brand’s name, logo, and key attributes in their minds, often long before they make a purchasing decision. High brand awareness puts a company “on the map,” increasing the chances that buyers will consider, seek out, and choose it when the need arises. For both established brands and up-and-comers, awareness is the critical first step in the purchase funnel and a foundation for building trust and future sales.

Brand Awareness Explained—Simple and Advanced Definitions

At its simplest, brand awareness means that a person has heard of a brand and can recognize it among alternatives. But awareness goes deeper than mere recognition:

- Recognition: Consumers can pick out the brand when prompted with a list or visual cue (“aided awareness”).

- Recall: Consumers can name the brand on their own without any prompts (“unaided awareness”).

- Association: People remember the unique qualities or feelings tied to the brand (think visuals, slogans, or emotional responses).

While high awareness opens doors, it doesn’t guarantee preference or loyalty on its own. Combining awareness with positive associations and consideration is essential for long-term competitive strength.

Core Metrics for Brand Awareness

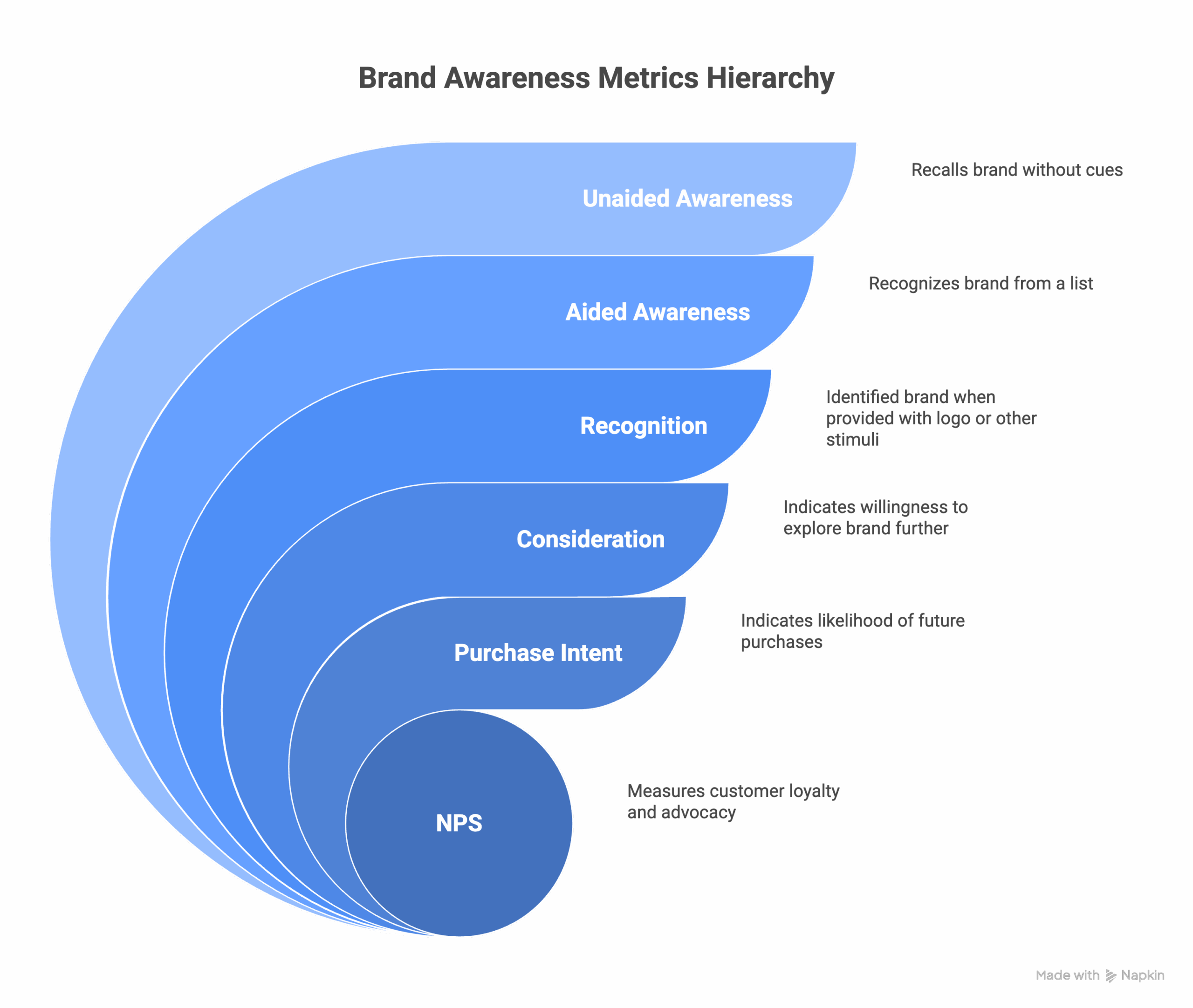

Brand awareness isn’t just one metric. Rather, it is a series of different types of brand-oriented benchmarks to assess brand familiarity and loyalty.

Core Metrics for Brand Awareness

Brand awareness isn’t just one metric. Rather, it is a series of different types of brand-oriented benchmarks to assess brand familiarity and loyalty.

Unaided vs. Aided Awareness

Brand awareness is typically measured through two core survey metrics: unaided awareness and aided awareness.

- Unaided Awareness: Respondents are asked to name brands in a category without any cues. This assesses which brands are truly “top of mind.” An example of the type of question used to gauge unaided awareness is: “When you think of [product category], what brands come to mind?”

- Aided Awareness: Respondents are presented with a list of brands and asked which ones they recognize. This captures a more comprehensive picture of brand familiarity. And example of this type of question is: “Which of the following brands have you heard of?”

Both metrics are essential. Unaided awareness reveals spontaneous mindshare. Meanwhile, aided awareness shows the full spectrum of recognition, including brands that are familiar but not top-of-mind.

Brand Recognition (versus Brand Awareness)

Brand Recognition is about identifying a brand when provided with a logo or product image. High recognition signals that branding efforts are working, but doesn’t always translate to purchase intent.

This is a supplement to the idea of brand awareness which measures whether a respondent can remember a brand without assistance. Strong awareness is often step 1 in building brand familiarity. But, recognition shows that additional branding elements are taking hold.

Supplementary Metrics (Purchase Intent, Consideration, NPS)

Measuring awareness in isolation can hide deeper insights. Top-performing brand tracking programs also gauge:

- Consideration: Of the brands you recognize, which would you consider trying or buying? This signals commercial potential built on awareness.

- Purchase Intent: How likely are you to buy from this brand in the future? Strong intent usually depends on both awareness and positive brand associations.

- Net Promoter Score (NPS): While NPS is primarily a loyalty metric, tracking NPS among respondents with differing brand awareness levels helps isolate awareness’s impact on advocacy.

Combining these metrics delivers a 360-degree view of a brand’s market position and ensures that awareness translates to business results, not just name recognition.

| Metric | Definition | Advantages | Limitations | Typical Use Cases |

|---|---|---|---|---|

| Unaided Awareness | Percentage of respondents who recall a brand without prompts (top-of-mind recall) | Reveals spontaneous brand recall; strong indicator of mindshare | Can be low for new or niche brands; harder to capture fully | Measuring brand strength and mental availability |

| Aided Awareness | Percentage of respondents recognizing a brand from a list or prompts | Captures broader familiarity; easier to measure across audiences | May overestimate true recall; can be biased by brand list | General brand recognition tracking |

| Brand Recall | Ability of respondents to name a brand spontaneously | Reflects deep brand penetration and salience | Similar to unaided awareness; may vary based on survey design | Understanding customer priority brands |

| Brand Recognition | Ability to identify a brand when presented with its name or logo | Easier to measure; useful for newer brands | Doesn’t guarantee purchase intent or preference | Tracking familiarity during brand launches |

| Purchase Intent | Likelihood that respondents intend to buy a brand | Directly linked to sales potential | Influenced by many variables beyond awareness | Evaluating commercial impact of brand awareness |

| Consideration | Brands respondents would consider buying from | Signals potential demand beyond awareness | Does not guarantee actual purchase | Prioritizing brands for conversion efforts |

| Net Promoter Score (NPS) | Measures likelihood of recommending a brand | Insight into advocacy and loyalty influenced by awareness | Loyalty metric, less focused on initial awareness | Understanding brand strength in retention and advocacy |

Proven Methods to Measure Brand Awareness

There are several ways to approach measuring brand awareness and interest. Though, as you’ll see below, brand awareness surveys are the most targeted and accurate given their approach and measurement style.

Brand Awareness Surveys

Brand awareness surveys remain the most precise, reliable, and actionable way to measure both spontaneous and prompted recognition for any brand. Surveys can be meticulously designed to target the exact customer segments, geographies, and competitive sets that matter most, yielding statistically robust results. They provide direct, first-hand insights into brand recall, recognition, associations, and consideration levels, something no other approach provides.

Additionally, quantitative survey data enables year-over-year tracking and benchmarking, ensuring brands can diagnose real changes rather than chasing surface-level signals.

Google Trends, Search Volume, and Share of Search

Digital tools like Google Trends and branded search volume analysis give a real-time pulse on how often a brand is being looked for online relative to competitors. “Share of Search”—the percentage of category searches attributed to a brand—can closely track with market share in some industries. However, these metrics are indirect. They reflect behavior from those already interested in the category, and do not always capture initial awareness among broader target audiences.

Social Listening & Online Monitoring Tools

Social listening platforms monitor brand mentions across social media, forums, blogs, and news sites. These can surface organic discussions and spot viral moments, but suffer from sample bias. They over-represent highly social or vocal consumers and can underrepresent less active demographics. Sentiment can also be hard to parse, with false positives and context-dependent mentions limiting accuracy.

Web Analytics (Direct Traffic, Branded Search Queries)

Website analytics like direct traffic, branded search queries, and referral sources, can signal rising interest and familiarity with a brand. Spikes in branded traffic often reflect campaign effectiveness or buzz. These measures, though, are only proxies for awareness, since they capture those who are motivated enough to seek out a brand, rather than the full opportunity universe.

While each of these methods add value, it’s brand awareness surveys that deliver the most nuanced, representative, and actionable understanding of how brands live in the minds of their target audiences, setting the gold standard for strategic measurement.

Brand Awareness Surveys—Step-by-Step Guide

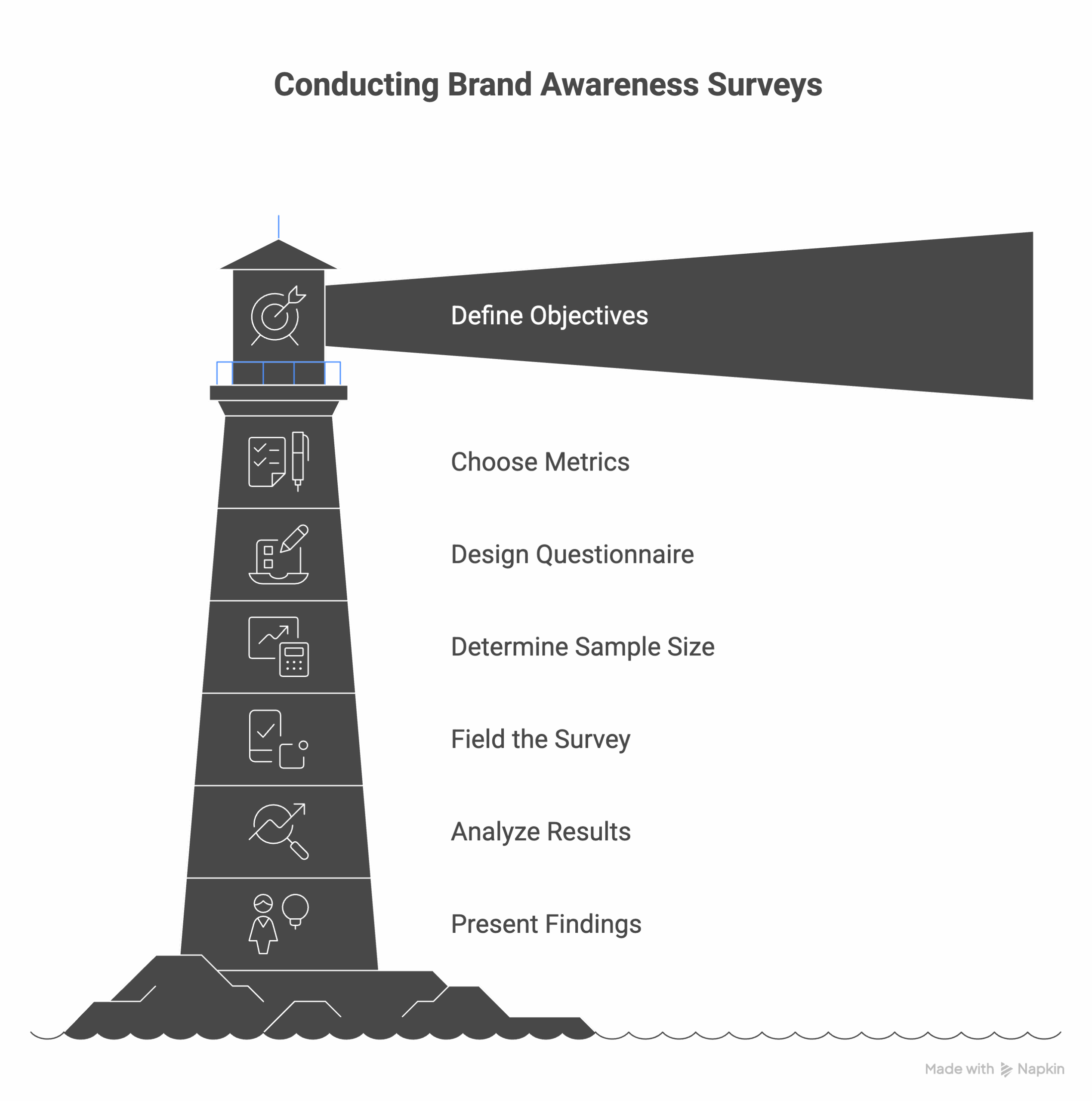

Conducting a well-designed brand awareness survey is the most accurate way to capture true brand recall, recognition, and consideration within your target market. Follow these key steps to build a robust survey that generates actionable insights.

Step 1: Define Objectives and Target Audience

Clarify what you want to measure. Are you tracking overall brand health, comparing against competitors, or evaluating campaign impact? Identify your specific audience segments by demographics, behaviors, or purchase criteria to ensure results are relevant and representative.

Step 2: Choose Metrics and Question Types

Select the core questions to measure:

- Unaided Awareness: Open-ended prompts asking respondents to name brands they associate with your category.

- Aided Awareness: Recognition questions listing brand names or logos to gauge familiarity.

- Associations and Consideration: Follow-up questions on feelings, attributes, and likelihood to try or purchase.

Additional questions can include purchase intent, usage, and Net Promoter Score to enrich insights.

Step 3: Design the Questionnaire for Clarity and Engagement

Keep questions clear, concise, and avoid bias or leading language. Be sure to structure your questions to balance depth and analysis ease. Use randomized brand lists to minimize order bias in aided awareness questions.

Step 4: Determine Sample Size and Sampling Method

Calculate the needed sample size based on population, margin of error, and confidence level requirements. Use representative sampling methods such as random sampling or stratified sampling to accurately reflect your target audience’s diversity.

Step 5: Field the Survey

Choose the right mode (online panel, phone interviews, intercepts) based on budget, reach, and respondent quality. Monitor fielding progress and data quality in real time to ensure you meet screening and representativeness criteria.

Step 6: Analyze Results with Rigor

Segment responses by demographics and behavior for layered insights. Calculate unaided and aided awareness percentages, and cross-tabulate these with consideration and purchase intent. Look for trends, shifts, and gaps to identify strengths and opportunities.

Step 7: Present Findings and Actionable Recommendations

Create clear reports combining quantitative data, visuals, and narrative explaining implications. Include benchmarks where possible and advise on next steps such as creative adjustments, target refinement, or further qualitative research.

Running a Brand Awareness Survey—Tips and Best Practices

Successfully running a brand awareness survey requires more than just crafting questions. It demands careful planning, quality control, and strategic timing to maximize accuracy and actionability. Below are essential tips for executing your brand awareness measurement effectively.

Tip 1: Avoid Common Survey Pitfalls

- Overloading with Questions: Keep surveys focused and concise to reduce respondent fatigue and improve data quality. Aim for no more than 10 minutes in length.

- Leading or Confusing Questions: Use clear, neutral language to avoid biasing responses. Randomize brand lists in aided awareness to prevent order effects.

- Insufficient Sample Size: Underpowered surveys can give misleading results. Always calculate sample size based on desired confidence levels and margins of error.

- Poor Screening: Be diligent in screening for target audiences to avoid irrelevant or out-of-market respondents diluting your insights.

Tip 2: Ensure Representative and Consistent Sampling

To track awareness over time, maintain consistent sampling criteria and methodology. Use quota or stratified sampling to reflect key demographics and customer segments accurately. This consistency allows you to detect true changes rather than sample variation.

Tip 3: Choose the Right Fielding Frequency

- For brand health tracking, a quarterly or biannual cadence is typical, balancing timely insights with budget constraints.

- For campaign-specific measurement or new brand launches, monthly pulse surveys may be appropriate to capture rapid changes.

- Avoid fielding surveys too frequently, as small shifts may be noise rather than meaningful trends.

Tip 4: Leverage Technology and Tools

Use advanced survey platforms that support randomization, logic branching, and quota management. Automate data validation and early flagging of poor-quality responses to improve survey integrity and turnaround time.

Tip 5: Plan for Actionability in Advance

Design your survey and reporting formats with decision-making in mind. Include benchmarks, segment breakout, and clear KPIs so stakeholders can quickly interpret results and prioritize actions.

Customizing Your Approach To Your Specific Organization

Measuring brand awareness requires tailoring your approach to fit the unique characteristics of your target market, business model, and brand maturity. What works for a large consumer brand may need adjustment for a B2B context or a startup just getting off the ground.

CPG and Retail Example Scenarios (B2C)

Consumer packaged goods (CPG) and retail brands often target broad audiences with frequent buying cycles. Surveys here focus heavily on mass awareness and unaided recall within large demographic segments such as age, gender, and geography. Since purchase decisions are often habitual or driven by convenience, measuring brand recognition alongside emotional associations helps uncover true brand equity beyond just familiarity.

SaaS, Services, and Digital-First Brands (B2B and B2C Hybrid)

For software-as-a-service (SaaS), professional services, and digital-first brands, the awareness journey is typically more complex, with longer decision cycles and multiple buyer personas involved. Awareness surveys should include targeted questions about brand positioning, perceived expertise, and trust, alongside traditional recall metrics. Sampling often requires precision screening to reach decision-makers or influencers in a niche market segment.

Startups and Emerging Brands

Emerging brands and startups face unique challenges. They may have low baseline awareness and limited budget for wide-scale measurement. Early-stage surveys should emphasize niche targeting to understand awareness within priority adopter groups or geographic areas, rather than broad population measures. These surveys can also include qualitative elements to capture nuanced feedback on brand perception and messaging.

Key Takeaways for Customization

Tailor sample design and recruitment to fit the brand’s audience complexity and size.

- Adjust survey length and depth based on maturity: lighter, pulse-style studies for startups versus comprehensive trackers for established players.

- Incorporate business model-specific metrics such as brand trust and expertise for B2B, or emotional connection and convenience for B2C.

- Use flexible reporting formats that cater to different stakeholders, from marketing teams to executive leadership.

Analyzing Brand Awareness Study Results & Benchmarks

After collecting brand awareness data, the critical step is to analyze results rigorously and interpret them in the context of meaningful benchmarks. This process turns raw numbers into actionable insights and strategic guidance.

What’s a “Good” Brand Awareness Score?

Brand awareness scores alone provide limited value without context. What constitutes a “good” level depends on factors such as category, market maturity, and competitive landscape. For example, in crowded categories, even modest unaided awareness can be impressive, while in niche markets, high aided awareness among target decision-makers is key. Comparing trends over time within your own brand provides the most reliable progress signals.

Using Industry Benchmarks

Benchmarks are invaluable for comparing your brand’s awareness to peers and competitors. Many market research vendors and industry associations provide benchmark data by sector. For example:

- In CPG, leading brands often enjoy 50%+ aided awareness in target markets.

- Tech brands may prioritize unaided awareness among business decision-makers, with benchmarks varying by sub-sector.

- Service brands focus on brand recognition and trust scores relative to category norms.

Applying relevant benchmarks helps identify gaps and opportunities in your brand positioning and marketing spend.

Bringing Nuance to Your Data

Beyond just looking at your raw data, consider other ways to glean more nuanced learnings.

- Segment Analysis: Break results down by demographics, geography, or customer segments to spot varying awareness levels and tailor strategies.

- Gap Identification: Look for discrepancies between aided and unaided awareness to inform awareness-building versus loyalty strategies.

- Integrate with Other Metrics: Cross-analyze awareness with consideration, purchase intent, and brand sentiment to prioritize high-impact initiatives.

- Continuous Tracking: Establish a regular cadence for brand tracking studies to monitor changes linked to marketing campaigns and broader market shifts.

Measuring Brand Awareness FAQs

How do you distinguish brand awareness from brand consideration?

Brand awareness means the extent to which consumers recognize or recall a brand, while brand consideration measures whether those aware of the brand would seriously think about purchasing it. Awareness is the first step in the customer journey; consideration indicates a deeper level of interest and intent.

What’s the minimum sample size needed for a reliable brand awareness survey?

Sample size depends on your organization, target population, and desired confidence levels. For B2C organizations with general population consumers, sample sizes are often 1,000 or more. More niche B2C brands may pursue studies with 400-600 respondents. Meanwhile B2B organizations may work with samples as low as 100 given the challenges inherent in finding respondents that meet their target profile.

Can small or emerging brands measure awareness cost-effectively?

Yes. Smaller brands can focus on targeted segments or geographic areas to reduce costs. Online surveys and lean pulse studies help measure awareness efficiently without extensive budgets.

How often should a brand awareness study be conducted?

For ongoing brand health, quarterly or biannual surveys suffice. Campaign-specific or launch-related studies may require monthly measurement to track short-term changes.

What are the most common mistakes brands make when measuring awareness?

Common pitfalls include overly long surveys, poor sample targeting, using only aided awareness without unaided recall, and failing to benchmark results for context.

Is social listening enough to accurately measure brand awareness?

Social listening is useful for monitoring brand mentions and buzz but is not comprehensive. It skews toward vocal audiences and misses silent or less active consumers, making surveys still essential.

How do unaided and aided awareness differ and why are both important?

Unaided awareness asks respondents to name brands without help, revealing top-of-mind mindshare. Aided awareness uses prompts or brand lists to assess broader familiarity. Both give complementary views of brand presence.

How can B2B brands effectively measure brand awareness compared to B2C?

B2B measurement often focuses on specific decision-maker groups and incorporates trust and expertise metrics. Sampling and survey design must reflect professional buying processes rather than mass-market approaches.

What role do emotional associations play in brand awareness?

Emotional associations deepen brand memory and impact preference. Measuring not just recognition but also the feelings linked to a brand helps predict loyalty and advocacy.

How do I choose the best method to measure brand awareness for my brand?

Surveys are the most precise, flexible option. Complementary digital tools like search volume and social listening provide additional signals but should not replace structured measurement.

Can digital metrics like Google Trends replace traditional surveys for awareness tracking?

While digital metrics offer real-time insights on online interest, they reflect only those actively searching or engaging and miss broader market awareness captured by surveys.

How should survey results be benchmarked against competitors or industry standards?

Use available industry benchmarks by sector and segment to contextualize your scores. Tracking your own brand over time is crucial to identify trends and measure progress against competition.