We often think about benchmarks as internal tools to see how our business is performing. While this is a great reason to use benchmarks, it often takes priority over another great use case: Using them to tout a business (and its know-how) to outside audiences.

Because benchmarks are generally fairly simple numbers, they are easy to share and communicate. This makes them valuable tools to leverage in PR, content, and trade publications. They give you a way to showcase new, original knowledge about a category while also promoting your business as a category leader.

What Is An (External) Benchmark

Let’s first differentiate an internal benchmark from an external benchmark. Internal benchmarks, as their name imply, are for internal audiences. For instance, organizations who are about to spend significant funds on advertising may want to collect brand awareness benchmarks to see if their brand awareness improves over time. Or, businesses building out their sales teams may want internal metrics to see how well prospects move down a sales funnel.

Meanwhile, external benchmarks are for external audiences. This means they are designed to share with individuals outside of your organization. These audiences could be prospective customers whose attention you want. Or, they could investors. And, they could even include existing customers. Any audience whose eye you’re looking to catch could fit within this “external audience” category.

Category Indices As Key External Benchmarks

The most common external benchmark, and the one we’ll focus on for the bulk of this post, is the category index.

Category indices are ways of benchmarking elements that are relevant to your specific category. For instance, companies in cybersecurity may want to produce content or reports on how organizations feel about data protection or IT security. Meanwhile, organizations in the energy space may want to track and report on perceptions regarding energy-generating or energy-saving products.

What’s important about these benchmarking activities is that they are done with the express purpose of sharing them with external audiences. Why? To get these audiences’ attention!

Think about the audiences we mentioned earlier: prospective customers, existing customers, and investors. These audiences are very busy. And, they have a lot of groups vying for their attention. It’s going to take a lot to catch their attention. What better way to catch their eye with intel you know they care about. Hence, the benchmarks.

Being at the forefront of collecting and publishing benchmarks (a.k.a. category indices) in your sector makes you the go-to expert in your category. It’s a vaunted position for any organization, affording you the attention of the audiences you want.

How to Build Benchmarks

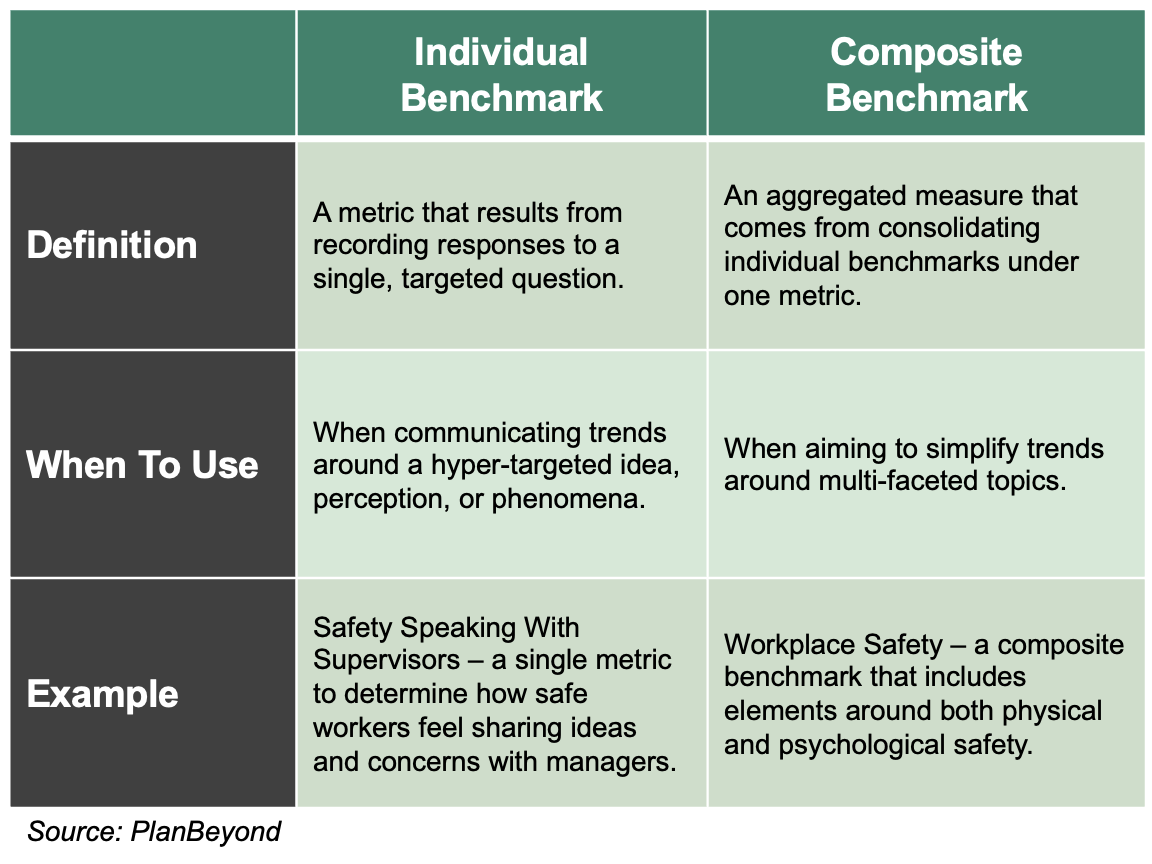

There tend to be two types of benchmarks used when developing category indices: individual and composite benchmarks. We’ll use the example of a pretend organization, an organizational behavior consultancy, to show these two types of benchmarks in action.

Individual Benchmarks

An individual benchmark measures one specific thing. Individual benchmarks require one question and one set of fixed answer choices. The benchmark is the tabulated response to that question.

As a result, these are fairly straightforward to develop. First, start with the item you want to measure. Then, follow up with the answer choices that let you best answer it.

Let’s say our pretend organizational behavior consultancy wants to create a benchmark around feeling safe speaking with peers. The question would be something like: “On a scale of 1 to 10, where 1 is not at all and 10 is completely, how safe do you feel sharing your perspectives and opinions with your peers?”

We tabulate all the answers to this question to see where the average falls. As an example, we might do this and find an average peer safety benchmark of 6.7.

Meanwhile, we could do a similar benchmark around safety speaking with supervisors and measure a 7.9. We now have two benchmarks and an ability to see the relative difference across the benchmarks.

Individual benchmarks are ideal when exploring multiple facets within a given area. In the case above, we used two different benchmarks to explore the idea of Workplace Safety. This lets us demonstrate that we understand Workplace Safety is comprised of many things. And, it lets us measure the many things that lead to Workplace Safety.

Composite Benchmarks

Composite benchmarks, as the name implies, are a combination of multiple benchmarks.

Let’s use the idea of the Workplace Safety benchmark as an example. We saw earlier two safety-related benchmarks: “safety communicating with peers” and “safety communicating with supervisors.” Each of these were measured on a 10-point scale giving us individual benchmarks.

But now we want to pull them together for one single Workplace Safety benchmark. How do we do this? We have a few options.

We could certainly average them together to get a single measure. However, this assumes that each measure of safety is equally important.

If they are not equally important, we’ll want to assign unique weights to each one. For instance, let’s say it’s more important to be able to speak freely with supervisors. If that’s the case, we can weight that individual benchmark 60% importance while assigning 40% importance to safety with peers. We then combine our metrics into one, knowing it more heavily takes into account safety speaking with supervisors.

Composite benchmarks are especially valuable when wanting to simplify communicating a multifaceted topic. They let us take complex ideas, like Workplace Safety, and convert them into simple, at-a-glance ways to see how things measure up.

What You Must Avoid When Building Benchmarks

Creating benchmarks is a mix of art and science. On the surface, it seems extremely easy to construct 10-point scale questions. Yet, it takes careful thought to construct a question that effectively and succinctly captures a fundamental concept. This is largely because it’s all too easy to fall into the trap of using a question type you must avoid: the double barrel question.

A double-barrel question is a question that covers more than one topic, but only allows individuals to give one answer. Individuals can only reasonably answer one topic and therefore you never know which topic they are answering.

For instance, let’s say we revised one of our Safety questions to read, “On a scale of 1 to 10, where 1 is not at all and 10 is completely, how safe do you feel sharing your perspectives and opinions with your peers and supervisors?”

In this example, we ask about the safety people feel sharing perspective with peers. But we also appended supervisors. Because people may feel differently about speaking with peers versus supervisors, we won’t know if their response ties back to their attitude about peers, supervisors, or both.

This is why the correct way to tackle this is to break the question into two. By separating the idea of safety speaking with peers from safety speaking with supervisors, we build crisp questions that yield unambiguous answers.

Where To Promote Your Benchmarks

Remember that the underlying goal for creating your benchmarks, be they individual or composite benchmarks, is to catch the eye of external audiences. This means you need to promote your benchmarks where your audience will see them.

This typically comes to life by developing, and publishing, benchmark reports. These could be annual reports your organization develops to showcase a breadth of topics. Or, it could be smaller, quarterly pieces that focus in on one key area.

Regardless of the approach you take, you need to make your reports, and the benchmarks within them, public. It’s the only way press outlets will have something to review and link to when they write about your findings. And, in turn, it’s the only way audiences like customers and prospective customers will be able to easily review your findings.

A lot goes into the process of getting your benchmark reports ready for PR and press pitches, and you can read more about that in this earlier blog post. Nevertheless, the most important thing to keep in mind is that this is a key reason to develop benchmarks in the first place. As a result, always keep these PR audiences in mind when developing the benchmarks you want.