Established companies with market-tested products frequently face a common problem at some point: a declining close rate. After years of solid performance, once-steady win rates start going down.

But, the underlying culprits are often unclear. Is the product feature set no longer relevant? Has the sales team lost its ability to add value? Perhaps there are issues with pricing and financing, or challenges with the production or delivery side of the equation? Or, maybe everything stayed the same while the competition upped their game.

These dips can erode confidence and create a sense of urgency. However, they’re also an opportunity to uncover hidden weaknesses, recalibrate, and return to strong close rates once again.

Start By Looking At Your Current Data

Step one of exploring declining close rate problems is finding patterns in your closed-won versus closed-lost data.

Specifically, start with looking at some of the following dimensions:

- Customer Size: Analyze the win/loss ratios based on company size such as SMB versus enterprise.

- Customer Industry: Tag won and lost accounts by the industries they represent (e.g., financial services, manufacturing, technology) to see if certain industries have especially strong, or weak, close rates.

- Product / Service Mix: Look at the specific product or service requested by each account. Then see if this skews based on accounts won versus lost.

- Sales Channel: If applicable, look at your win/loss rates by the way accounts engage with your business. For instance, if there is an option to work with a sales team versus to buy direct via a website, see if close rates change by channel.

Your analysis may find no close rates differences across categories. However, if it does, you now have an anchor point around which to begin further investigation. Root cause analysis is still needed. But, you now have a stronger starting point.

Begin To Brainstorm Potential Problem Areas

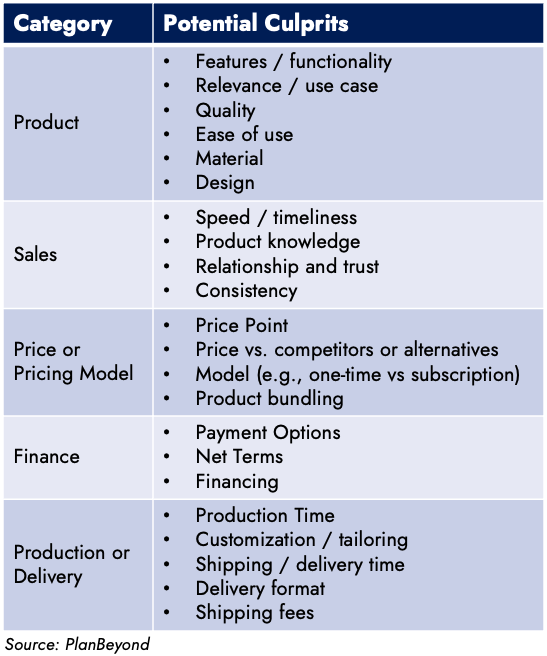

Once you have a sense for what customer categories, if any, need more attention, begin assessing what specific issues could be at play. In B2B settings, this spans the gamut of areas from product and sales to pricing, financing, and delivery.

On the product side of things, we see issues like features and functionality, relevance, and ease of use as frequent culprits. However, if it’s a tangible good, this could mean materials and design.

With sales, problems like communication speed and timeliness, product knowledge, and consistency often arise. Additional challenges include the degree to which trust is built, especially when a relationship-based sale is part of the process.

Of course, price and pricing models get a lot of attention when evaluating declining close rate issues. This includes the price point itself, as well as the price point relative to competition and alternative options. Sometimes, however, it is less the price than it is the pricing model (e.g., a one-time price versus subscription) or what may come bundled within a single price.

For more complex or high-value transactions, financing may play a role in close rate issues. Factors like payment options, net terms, and financing availability could impact a deal’s closure.

Lastly, in the case of hard goods, production and delivery could be the culprits. This includes everything from production times and customization capabilities to delivery times, delivery options, and shipping fees.

The problem could be one of these underlying issues, or multiple. This is why we need to explore each one and determine what specifically prospects want to improve overall close rates.

Design Your Declining Close Rate Root Cause Research

As we just saw above, a declining close rate is the result of potentially many underlying issues. But, we do not know which ones. As a result, we enter into root cause analysis via interview-based research.

Interviews let us leverage open-ended questions but in a structured way. As a result, they let us dig into expected problem areas while also providing a way for incremental ideas or issues to surface.

Let’s breakdown how this all comes together.

Build An Interview Discussion Guide

Interview-based research to explore declining close rates starts with building a discussion guide. This will be the series of questions you ask throughout each and every interview. Thanks to the earlier brainstorming of potential issues, you know what you need to include. The guide ensures that these potential culprits are explored in a systemic way.

Typically, interview guides go from high-level to specific, starting off with general impressions of the organization and then delving into particular problem areas. This puts participants into the right head space to really get into details. Additionally, we suggest structuring guides so that everything is covered in a 45-minute interview. This keeps guides focused while also respecting respondents’ time.

Invite & Interview Participants

Once the discussion guide is ready, it is time to start inviting individuals to participate in the interviews. Of course, this begs the question: Who should be in the study?

To begin with, you want an even number of prospects or opportunities that did close versus did not close. This ensures that you capture enough data points to compare and contrast these groups during the analysis phase.

Nevertheless, depending on your customer mix, you may need to consider other elements. For instance, do clients behave differently based on company size (e.g., SMB vs. Enterprise), geography (e.g., US vs. Europe), or other elements? If so, determine if one of these elements is most relevant and only invite participants form that cohort. Conversely, if several elements matter, invite individuals to represent these cohorts.

Keep in mind that you generally want at least eight participants from any given segment. As a result, be very thoughtful about what segments or cohorts you do want represented to help cap the necessary volume of interviews.

Analyze Responses By Won vs Closed Prospects

Once you complete all of the interviews across all of the participants, it’s time to analyze the results. At this stage, compare and contrast how your Won customers respond to each and every discussion guide question relative to your Lost customers.

First, look at where you see inconsistencies in responses. For instance, do Lost customers have one thing to say about your check out experience versus Won customers? Or, do Lost customers share a different project need than Won customers? These differences typically are strong “smoking guns.” They indicate exactly where your organization is misaligned with certain customer needs and therefore unable to close these customers.

Additionally, look for where you see consistent but negative responses. First instance, maybe both Won and Lost customers have negative things to say about the quoting experience or communication turnaround. These may not be bad enough (yet) to completely lose customers. But, they likely push Closed customers over the edge. And, they may be pushing Won customers to being Closed customers soon.

Prioritize Your Findings

The upside of doing researching on a declining close rate is that you will have a wealth of knowledge to act on. But, this is often the challenge of this work too. You may have so much new data that you don’t know where to start.

When faced with this problem, we suggest two prioritization approaches:

1. Focus On The Easiest To Resolve Issues

Consider ranking the issues from easiest-to-fix to hardest-to-fix. Addressing some of the “easy” fixes shows a bias for action and a desire to immediately address problems. Additionally, you’ll enjoy some quick wins that build goodwill, boost internal morale, and buy you time to continue making longer term improvements.

2. Focus On The Most Widespread Issues

Another approach says focus on the issues you hear across the most Lost opportunities. For instance, if each and every Lost participant referenced the same issue as driving their move away from your business, this tells you it is a pervasive problem impacting every deal.

Tackling these pervasive issues first means you are beginning to “right the ship” for each new deal that comes into your pipeline.

Which prioritization approach you follow depends on the nature of the feedback you receive. Regardless of which approach you choose, you must choose one and act on it. The failure to act doesn’t just make the research worthless. It also fails to fix underlying issues impacting your long term performance and viability.