“Listen to your customers” is a mantra we hear all of the time. And, while it’s a great mantra, it’s only as good as your follow through. Organizations that truly want to succeed need a systemic process to not just listen to, but also act on, customer feedback.

This is where voice of the customer (VoC) research comes in. As a “closed” loop process for gathering and incorporating feedback into product and service strategy, VoC research serves to address customer needs and find new opportunities for business growth.

What Is The Voice Of The Customer Research

Voice of the customer (VoC) research is a way for organizations to gather feedback from customers about specific brands, products, or services. Via assorted data capture methods, VoC research looks for patterns and trends across customer feedback to inform product and customer service strategy.

When performed in a systemic manner, VoC research is a powerful tool to:

- Get ahead of product / brand issues

- Identify and explore new product ideas

- Evaluate ways to enhance your offering

- Create ways to improve customer service

Keep in mind, VoC research isn’t just about collecting feedback. Rather, it’s about collecting and applying that feedback to improve customer experience. And, in doing so, it drives customer acquisition, satisfaction, and long term retention.

Developing A Voice Of The Customer Feedback Process

As you’ll see below, we’ll go into far more detail about how to collect VoC research. However, none of that matters unless you have a core reason why you’re collecting that research in the first place.

Start With A Strategic Objective

At the onset of any VoC study, gather internal agreement about what you want to learn, and why. For instance, here are a couple of reasons teams may purse VoC research:

- We want to gather customer dissatisfaction data to inform product improvement ideas.

- We want to collect customer feedback to understand how we can make our product or customer experience easier

- We want customer intel to validate / invalidate new product ideas.

At the heart of all of these reasons is a core strategic concern. The first idea centers around product enhancements to improve existing customer satisfaction. Meanwhile, the second idea focuses on customer workflows to improve satisfaction and, possibly, acquisition. In contrast, the last idea delves into product roadmap planning to drive new new revenue growth and market expansion.

In sum, establish your broader strategic goals for VoC research. With that in-hand, you’ll have a better sense for how to collect and evaluate that feedback.

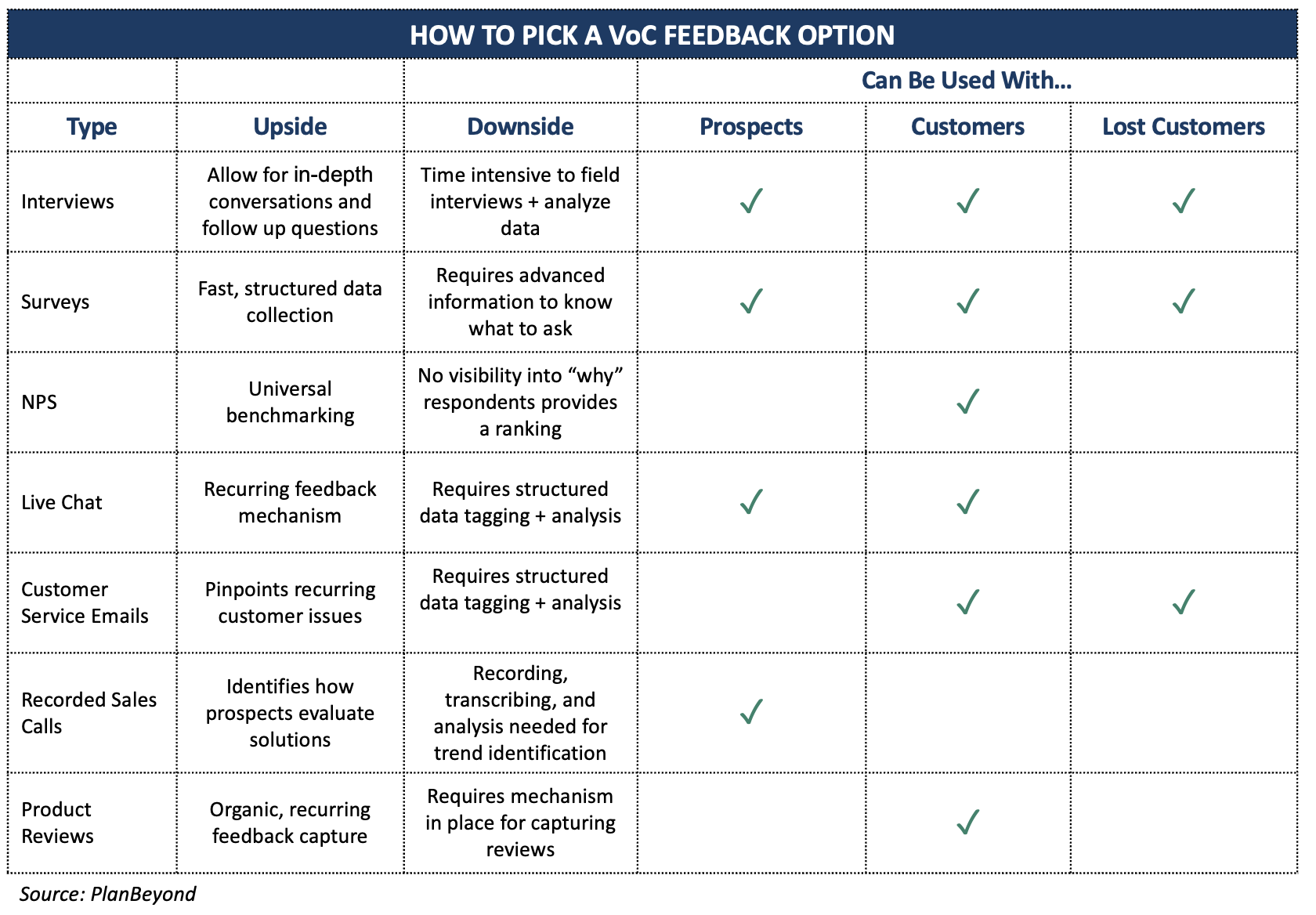

Establish The Method You’ll Use For Feedback Capture

You can gather customer feedback via a wide variety of methods. However, the method you choose must map to your broader strategic goal. This ensures that the data you do collect and analyze actually addresses your fundamental business needs.

Let’s look at just some of the feedback capture methods, and when to use them.

Customer Interviews

Interviews are a traditional method used in VoC research, largely because of their versatility and flexibility. Interviewing customers lets you define a discussion guide in advance to probe on anything from product needs and satisfaction levels to sales experiences, pricing, and other areas. Additionally, interviews let you select who speak with. This lets you see if perspectives vary by a particular group or customer type.

Interviews allow you to explore nuanced topics, and delve deep into any given area. They also have the advantage of free-form dialogue, letting you uncover unexpected topic areas.

However, these are one of the costliest and time intensive ways to capture customer feedback. Deliberate work is needed in advance to develop a structured guide, each conversation lasts for 45-60 minutes, and you need focused efforts to analyze the raw conversation data.

Customer Surveys

Surveys are another traditional VoC research method. They let you collect data fairly quickly, and in a convenient, aggregated format. You can send surveys to prospects, active customers, or recently churned customers.

However, surveys assume that you know what questions to ask in advance. It means you know a lot of about your customers or prospects, and know what questions to use.

Net Promoter Scores

Net Promoter Score, or NPS, is a customer loyalty metric used across industries. It uses a 10-point scale to determine an individual’s likelihood to recommend a product or service to a friend or family member. It then segments respondents into three unique categories—detractor, passive, or promoter—to determine an NPS score.

NPS scores are extremely valuable for benchmarking purposes. They allow you to see overall satisfaction levels with your brand. And, if you include other brands when asking for NPS measurements, you can also benchmark your scores against others.

Nevertheless, NPS scores don’t delve into the “why” behind a given rating. Regardless of whether customers give you positive or negative marks, the NPS score doesn’t provide the rational behind that mark.

Live Chat Transcripts

Live chat lets you collect real-time questions from prospective customers and active customers alike. In the sales or marketing phase, it lets you understand what questions are left unresolved during the consideration process. Meanwhile, from the retention perspective, it lets you see what issues arise for customers.

On the upside, Live Chat feedback allows for completely unfiltered information. Rather than an organization defining questions to ask, prospects and customers provide data organically.

However, it is this organic approach that also makes Live Chat data tricky to work with. It requires data tagging and processing protocols so ensure that the incoming data is actionable.

Customer Service Emails

Customer service emails are similar to live chat, although they allow for longer form feedback. These emails let customers share their challenges in their own words, and are especially valuable when feedback comes from soon-to-be-lost or churned customers.

However, the downside is the same as Live Chat. You’ll need structured data analysis protocols to reap the full value of this feedback.

Recorded Sales Calls

Recorded Sales Calls are recordings of conversations that occur during the sales process. These could include introductory meetings where early prospect qualification is happening, or more detailed product demo or proof of concept meetings. They are a rich format for identifying how prospective customers think about specific solutions. And, you can hear what criteria prospects use to evaluate those solutions.

The downside, however, is the same as all free form feedback. It takes recording, transcribing, and analyzing conversations to identify recurring trends.

Customer Reviews

Online reviews are another rich source for evaluating what drives customer satisfaction or dissatisfaction.

Of course, this approach assumes you have a mechanism in place for collecting product reviews. While there are several review sites like Capterra or G2 Crowd, the review sites may not cover your product area. Or, it may not cover it in a way that lets you evaluate customer sentiment effectively.

Roll VoC Feedback Into Business Strategy

The last piece of the VoC research equation is taking your raw data and any analysis, and using it to inform business strategy. We’ll look at one of the initial goals we started with above to see how this all comes together.

For instance, let’s say we want to explore how to make a prospect’s initial product exploration on a website easier. To do this, we collect one month’s worth of Live Chat data. We then analyze the different types of questions asked during Live Chat sessions.

During this analysis process, we likely create tags to easily segment questions into specific categories. These tags could include things like pricing, software integrations, feature capabilities, and much more. We then look for trends within each given segment. If we find a series of questions about features and capabilities, it may mean a revamp is needed of the Product or Solutions section of the website. Meanwhile, if we see a lot of integration questions, we may need to update support materials or other FAQs.

Of course, implicit in all of this is that your organization is ready and able to enact these recommendations. It means that personnel across verticals are bought into the voice of the customer process and open to receiving customer feedback.

This is no small assumption! Be sure to socialize any VoC work with any and all teams impacted by the feedback. This will let them weigh in on the process early on, and likely increase the odds of action being taken once the feedback is in.