Most B2B product failures share a common thread: companies skip rigorous concept validation and jump straight into development based on internal assumptions about what customers need. The result is predictable: millions invested in products that solve problems customers don’t prioritize, offer features they won’t pay for, or require implementation efforts they can’t realistically manage.

B2B product concept research isn’t just about reducing failure risk. It’s about building products that customers actually want to buy and can successfully implement. The methodology helps companies understand not just whether demand exists for their ideas, but how to position, price, and develop solutions that align with real market needs.

What is B2B Product Concept Research?

B2B product concept research is the systematic process of evaluating and validating new business product ideas before committing significant development resources. At its core, this research methodology helps companies answer a fundamental question: Will business customers actually want, buy, and use this product?

Unlike traditional market research that might focus on existing products or general market trends, concept research specifically targets the viability of new product ideas in their earliest stages. It’s the bridge between initial product inspiration and full-scale development, providing data-driven insights that can save companies millions of dollars in misdirected effort.

Core Objectives of B2B Product Concept Research

Validate Market Demand

The primary goal is determining whether genuine demand exists for your proposed solution. This goes beyond asking “Do you like this idea?” to uncovering whether businesses have a real problem that your concept solves, and whether they’re willing to invest resources to address it.

Identify Critical Features and Capabilities

B2B products often require complex functionality to integrate with existing business processes. Concept research helps prioritize which features are must-haves versus nice-to-haves, ensuring development efforts focus on capabilities that drive actual purchase decisions.

Optimize Market Positioning

Understanding how potential customers perceive your concept relative to existing alternatives is crucial for positioning. This research reveals which benefits resonate most strongly and how to differentiate your product in a crowded marketplace.

Reduce Launch Risk

Perhaps most importantly, concept research significantly reduces the risk of costly product failures. By identifying potential issues early—whether technical, market-related, or competitive—companies can pivot or refine their approach before substantial investments are made.

When to Conduct B2B Product Concept Research

The optimal timing for concept research is during the early development phase, after you have a clear product vision but before you’ve committed to major resource investments. This typically occurs:

- After initial ideation but before detailed specifications are written

- Before hiring additional development staff or expanding teams

- Prior to seeking major funding for product development

- When considering product line extensions or entering new market segments

Conducting research too early, when concepts are still vague, yields limited insights. Waiting too long, after significant development has begun, reduces your ability to make meaningful changes based on findings.

The ROI of Proper Concept Research

The financial case for thorough concept research is compelling. Consider that the average B2B software product costs between $500,000 and $5 million to bring to market. Failed products don’t just lose their development costs. They also consume opportunity costs, team morale, and market credibility.

Research consistently shows that products validated through proper concept research have significantly higher success rates. While B2B product concept research represented an upfront investment, this represents a fraction of total development costs and can prevent far more expensive failures.

Moreover, concept research often uncovers insights that improve successful products. Companies frequently discover that their initial product assumptions were partially correct but needed refinement. This leads to products that not only succeed but exceed initial projections by better matching market needs.

Considerations That Make B2B Concept Testing Unique

While the fundamental principles of concept research apply across markets, B2B product validation requires a fundamentally different approach than consumer research. The stakes are higher, the audiences are more complex, and the decision-making processes are dramatically different. Understanding these differences is crucial for designing research that generates actionable insights rather than misleading data.

Complex Decision-Making Structures

The most significant difference between B2B and B2C concept research lies in who makes purchasing decisions. Consumer purchases typically involve one person making a relatively quick decision based on personal preferences and immediate needs. B2B purchases, however, involve multiple stakeholders with different priorities, concerns, and influence levels.

A typical B2B purchase might include end users (who care about functionality and ease of use), IT administrators (focused on security and integration), procurement teams (concerned with cost and contract terms), and executives (evaluating strategic impact and ROI). Each stakeholder evaluates your product concept through a different lens, making it essential to research across these various perspectives.

This complexity means that simply surveying “potential customers” is insufficient. You need to identify and research each stakeholder group, understanding not just their individual preferences but also how they interact during the decision-making process. A product concept might be loved by end users but rejected by IT, or vice versa.

Extended Sales Cycles and Deliberation Periods

B2B purchases rarely happen impulsively. While a consumer might buy a new app or service within minutes of discovery, business purchases typically involve weeks or months of evaluation. This extended timeline affects how you should conduct concept research.

First, it means that initial concept appeal doesn’t necessarily predict purchase behavior. A concept that generates moderate interest might actually be more successful than one that creates initial excitement but doesn’t hold up under extended scrutiny. Your research methodology needs to account for this deeper evaluation process.

Second, the extended timeline means that market conditions, competitive landscapes, and internal priorities can all change between concept evaluation and actual purchase. This makes it crucial to understand not just current appeal but also how robust the concept is against changing conditions.

Higher Financial Stakes and Risk Aversion

Individual B2B purchases are typically worth significantly more than consumer purchases. Sometimes 10x to 1000x more. A failed consumer app purchase might waste $10; a failed enterprise software implementation can cost millions in both direct costs and lost productivity.

This higher financial exposure makes business buyers more risk-averse and more thorough in their evaluation processes. They’re not just asking “Will this solve our problem?” but also “What happens if it doesn’t work?” and “How difficult will it be to change course if needed?”

Your concept research must address these risk concerns directly. This means testing not just product appeal but also confidence levels, implementation concerns, vendor stability perceptions, and fallback options. Questions about proof-of-concept programs, pilot implementations, and success guarantees become crucial elements of concept evaluation.

Smaller, More Specialized Target Audiences

Consumer products often target millions of potential customers. B2B products typically serve much smaller, more specialized markets. A new consumer social media app might target “young adults,” but a B2B product might target “compliance managers at mid-market financial services firms.”

This smaller audience size creates both challenges and opportunities for concept research. The challenge is that statistical significance becomes harder to achieve—you simply don’t have access to thousands of potential respondents. The opportunity is that you can often access higher-quality respondents who are genuinely representative of your target market.

This dynamic requires adjusting your research methodology to emphasize quality over quantity. In-depth interviews become more valuable than large-scale surveys. Expert panels and advisory groups can provide insights that would be impossible to obtain in consumer research.

Integration and Implementation Complexity

Consumer products are typically designed for immediate use with minimal setup. B2B products, especially software and technology solutions, often require significant implementation effort, integration with existing systems, and organizational change management.

This implementation complexity must be incorporated into your concept research from the beginning. It’s not enough to test whether people like your product idea—you need to understand whether they can realistically implement it within their organizational constraints.

This means your concept descriptions need to include implementation details, not just feature benefits. You need to research potential integration challenges, change management concerns, training requirements, and ongoing maintenance considerations. These factors often influence purchase decisions as much as core functionality.

Relationship-Driven Purchasing Decisions

B2B purchases are inherently relationship-based in ways that consumer purchases rarely are. Business buyers are not just buying products; they’re entering into ongoing relationships with vendors. This relationship component becomes part of the product concept itself.

Your research needs to explore how potential customers perceive your company as a vendor partner, not just your product as a solution. Questions about support quality, vendor stability, industry expertise, and long-term commitment become integral parts of concept validation.

This relationship focus also means that concept research should explore the entire customer experience, from initial sales process through implementation, ongoing support, and future product evolution. The product concept includes not just what you’re building but how you’ll deliver and support it over time.

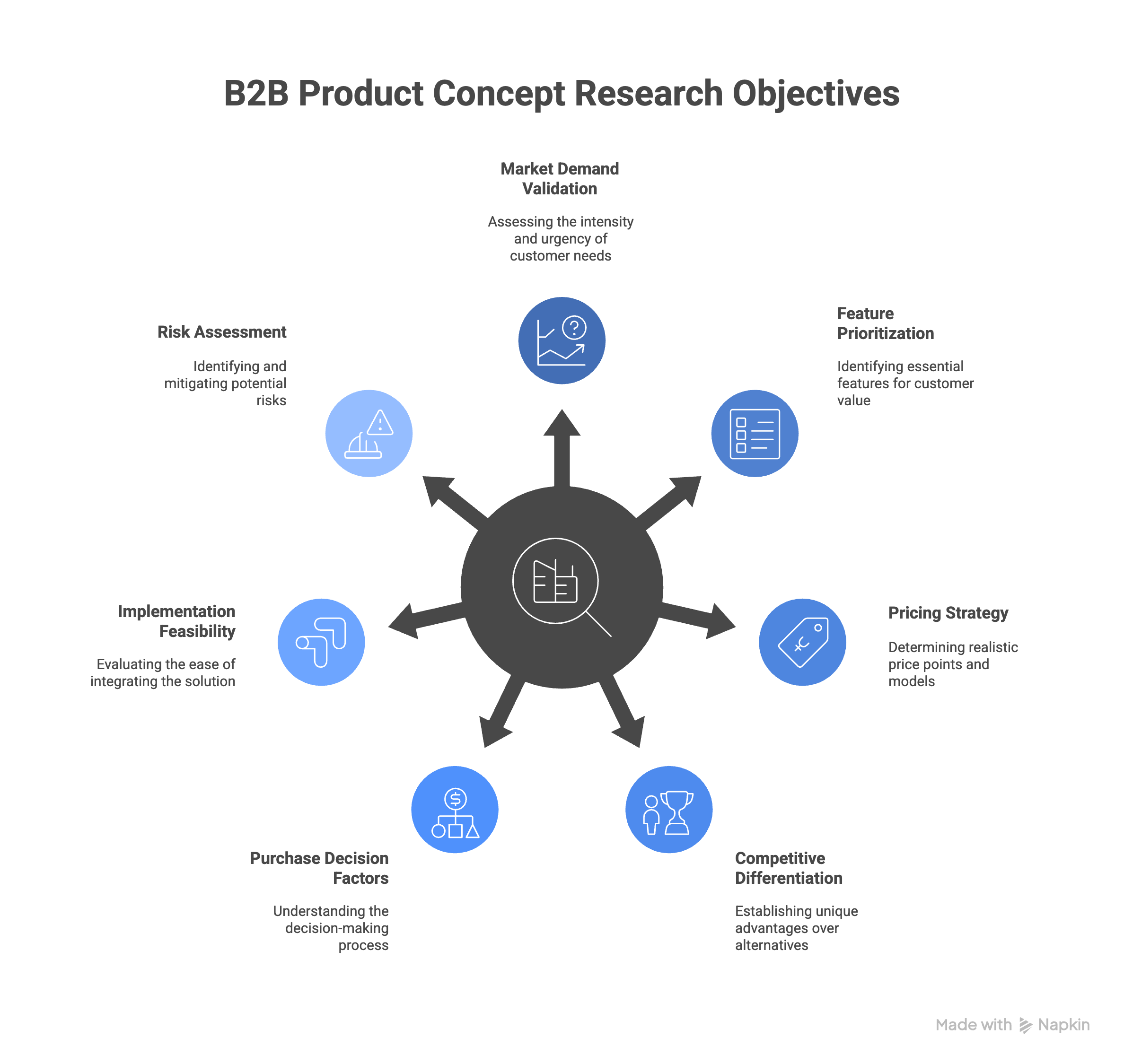

Key Research Objectives for B2B Product Concepts

Successful B2B product concept research requires clearly defined objectives that go beyond simple appeal testing. Unlike consumer research that might focus primarily on purchase intent, B2B concept validation must address the complex, multi-layered decision-making process that characterizes business purchases. Here are the critical objectives that should guide your research design.

Market Demand Validation: Beyond “Do You Like It?”

The foundational question for any product concept is whether genuine market demand exists. However, in B2B markets, this validation requires more sophistication than asking potential customers if they like your idea.

True demand validation explores the intensity and urgency of the problem your concept addresses. It examines whether target customers are actively seeking solutions, have budget allocated for addressing the issue, and possess the organizational capability to implement a solution. This means researching not just interest levels but also current workarounds, existing solution satisfaction, and the business impact of the problem your concept addresses.

Effective demand validation also investigates the competitive landscape from the customer’s perspective. You need to understand what alternatives customers consider, how they currently address the problem your concept solves, and what would motivate them to change their current approach. This provides insight into both market size and the competitive challenges you’ll face.

Feature Prioritization and Product Definition

B2B products typically offer extensive functionality, but not all features are equally important to purchase decisions. Concept research should systematically prioritize features based on their impact on customer value and purchase likelihood.

This prioritization goes beyond simple feature ranking. It should explore how different features work together to create complete solutions, which capabilities are table stakes versus differentiators, and how feature importance varies across different customer segments or use cases.

The research should also investigate feature trade-offs that customers are willing to make. In resource-constrained development environments, understanding whether customers would prefer fewer features with better implementation versus broader functionality with lighter execution can guide fundamental product strategy decisions.

Pricing Strategy and Value Perception

B2B pricing decisions are complex, often involving multiple pricing models, negotiated contracts, and total cost of ownership calculations. Concept research should explore how customers think about pricing for your proposed solution and what price points are realistic for different market segments.

This involves more than traditional price sensitivity testing. You need to understand how customers budget for solutions like yours, what ROI expectations they have, and how they compare the value of your concept against both direct competitors and alternative approaches to solving the same problem.

The research should also explore pricing model preferences. Do customers prefer subscription versus one-time purchases? How do they think about implementation costs versus ongoing usage fees? Understanding these preferences can inform not just price levels but fundamental business model decisions.

Competitive Differentiation and Positioning

Your concept research must clearly establish how potential customers perceive your solution relative to existing alternatives. This requires understanding not just direct competitors but also indirect competition, including do-nothing alternatives and internal solutions.

The research should explore which aspects of your concept are most differentiating in the eyes of potential customers, and whether these differentiators align with factors that actually drive purchase decisions. It’s possible to be differentiated in ways that don’t matter to customers, or to overlook differentiation opportunities that would be highly valued.

Competitive research should also investigate how customers make decisions when evaluating multiple solutions. What criteria do they use? How do they weight different factors? Understanding this decision-making process helps position your concept more effectively and identifies potential vulnerabilities in competitive situations.

Purchase Decision Factors and Process Understanding

B2B purchases involve complex decision-making processes that concept research should map and understand. This includes identifying all stakeholders involved in decisions, understanding their individual priorities and concerns, and exploring how organizational factors influence purchase decisions.

The research should investigate practical purchase considerations like procurement processes, approval requirements, and implementation timelines. These factors often influence product design decisions and go-to-market strategies as much as core functionality.

This objective also includes understanding the customer journey from initial awareness through purchase decision. What triggers initial interest? How do customers evaluate and compare options? What factors accelerate or delay purchase decisions? This intelligence informs both product development and marketing strategy.

Implementation and Integration Feasibility

Unlike consumer products that customers can typically start using immediately, B2B solutions often require significant implementation effort. Concept research should thoroughly explore implementation considerations and how they influence purchase decisions.

This includes understanding technical integration requirements, change management challenges, training needs, and ongoing maintenance considerations. The research should explore whether customers have the internal capabilities to implement your solution or would require external support, and how these factors influence their willingness to purchase.

Implementation research should also investigate success criteria and measurement approaches. How will customers determine whether your solution is successful? What metrics will they use? Understanding these success factors helps ensure your concept addresses not just functional requirements but also the outcomes customers need to achieve.

Risk Assessment and Mitigation

B2B buyers are inherently risk-averse, and concept research must explore the various risks customers associate with your solution and how these concerns influence purchase decisions. This includes technical risks, vendor risks, implementation risks, and opportunity costs.

The research should investigate what evidence or assurances would reduce customer risk perceptions. This might include references, pilot programs, guarantees, or specific vendor capabilities. Understanding risk mitigation requirements helps inform both product development and sales strategy.

Risk research should also explore competitive risk factors. How do customers perceive the risks of choosing your solution versus alternatives? Are there specific risk concerns that consistently favor competitors? This intelligence helps identify areas where your concept or go-to-market approach might need strengthening.

B2B Product Concept Research Methodology

Selecting the right research methodology for B2B product concept validation requires balancing depth of insight with practical constraints like sample size limitations and respondent availability. Unlike consumer research where large-scale surveys often dominate, B2B concept research typically benefits from a mixed-methods approach that emphasizes quality over quantity while still generating statistically meaningful results.

Quantitative Methods for B2B Concept Research

Online Surveys

Survey design for B2B audiences must account for the complexity of business decision-making. This means including questions that explore organizational context, decision-making processes, and implementation considerations alongside traditional concept appeal metrics. Questions should be written in professional language that respects respondents’ expertise while remaining clear and unambiguous.

The primary challenge is achieving adequate sample sizes when your target market might include only hundreds or thousands of potential respondents rather than millions. For B2B surveys, focus on representativeness over raw sample size. A well-designed survey with 120-175 carefully screened respondents from your target market often provides more actionable insights than a consumer survey with 1,000+ respondents. The key is ensuring your sample accurately reflects your target customer profile across dimensions like company size, industry, role, and current solution usage.

Conjoint Analysis

Conjoint analysis is particularly valuable for B2B concept research because it mirrors the complex trade-off decisions that business buyers actually make. Rather than asking respondents to evaluate features in isolation, conjoint analysis presents complete product profiles and asks respondents to make choices between alternatives.

For B2B products, conjoint studies should include not just product features but also vendor characteristics, pricing models, and service offerings. A typical conjoint design might include attributes like core functionality, integration capabilities, vendor size, support options, pricing structure, and implementation timeline.

MaxDiff Analysis

Maximum Difference Scaling (MaxDiff) is ideal for prioritizing long lists of potential product features, benefits, or use cases. This methodology asks respondents to identify the most and least important items from sets of options, producing a rank-ordered list of priorities.

In B2B concept research, MaxDiff works particularly well for feature prioritization exercises where you might have 15-20 potential capabilities to evaluate. Traditional rating scales often produce inflated scores where everything seems important, but MaxDiff forces respondents to make the same difficult prioritization decisions they face in real purchase situations.

The methodology is also effective for understanding benefit hierarchies and messaging priorities. You can test different ways of describing your product’s value proposition and identify which benefits resonate most strongly with different customer segments.

MaxDiff results are particularly actionable for product managers working with resource constraints. The methodology produces clear priority rankings that can guide development roadmaps and feature release sequences.

Concept Scoring

Traditional concept scoring remains valuable for B2B research when adapted for business contexts. Key metrics should include overall appeal, uniqueness, relevance to business needs, purchase likelihood, and implementation feasibility.

However, B2B concept scoring requires more sophisticated measurement than simple appeal ratings. Include questions that explore different aspects of appeal—functional appeal (does it solve important problems), emotional appeal (does it feel innovative and trustworthy), and practical appeal (can we realistically implement this).

Purchase intent questions need careful framing for B2B contexts. Rather than asking “Would you buy this product?”, explore likelihood of recommending evaluation, requesting a demonstration, or including in a competitive evaluation process. These intermediate steps better reflect B2B buying processes.

Qualitative Methods for B2B Concept Research

In-Depth Interviews: One-on-One Stakeholder Conversations

Individual interviews are often the most valuable component of B2B concept research. They provide the depth of insight necessary to understand complex business contexts and allow for real-time exploration of concepts based on individual respondent feedback.

Structure interviews to explore not just reactions to your concept but also the broader business context in which purchase decisions occur. Begin with current situation analysis—what solutions are currently used, what problems exist, how decisions get made—before introducing your concept.

Use interviews to test different ways of explaining and positioning your concept. Business buyers often need to understand solutions in the context of their specific operational environment, so be prepared to adapt your concept presentation based on individual company situations.

Interview protocols should include time for respondents to ask questions about your concept. These questions often reveal important considerations that structured surveys might miss and provide insight into the concerns and interests that drive real purchase decisions.

Focus Groups

B2B focus groups can be particularly valuable for understanding how business decisions are made collaboratively. Since most B2B purchases involve multiple stakeholders, observing group discussions can reveal dynamics that individual interviews might miss.

However, B2B focus groups require careful management to be effective. Professional participants may be less willing to share sensitive information in group settings, and hierarchical relationships can influence group dynamics if you inadvertently mix decision-makers with influencers.

Consider organizing focus groups by role or seniority level to encourage more open discussion. A group of IT directors might discuss technical implementation concerns more freely than a mixed group including both IT staff and C-level executives.

Use focus groups to explore consensus-building processes around new concepts. How do different stakeholders raise concerns? What types of evidence or reassurance help build group confidence in new solutions? These insights inform not just product development but also sales and marketing strategies.

Concept Workshops

Interactive workshops where participants help refine and improve concepts can generate exceptional insights while building stakeholder buy-in for research findings. These sessions work particularly well with small groups of highly knowledgeable participants.

Structure workshops as collaborative problem-solving sessions rather than traditional research interviews. Present your concept as a starting point and engage participants in improving it based on their industry expertise and operational experience.

Workshops can include exercises like feature prioritization, use case development, implementation planning, and competitive positioning discussions. These activities generate actionable insights while giving participants a sense of ownership in the final concept.

Document workshops carefully, capturing not just final outputs but also the reasoning and discussion that led to specific recommendations. The thought process behind suggestions is often as valuable as the suggestions themselves.

The B2B Product Concept Research Process

Conducting effective B2B product concept research requires a systematic approach that accounts for the unique complexities of business markets. Unlike consumer research where you might survey hundreds of respondents quickly, B2B concept validation demands careful planning, precise targeting, and methodical execution. Here’s our proven six-step framework for validating product concepts in business markets.

Step 1: Define Research Objectives

Before diving into survey design or interview scripts, establish clear, measurable objectives that will guide every aspect of your research program.

Specific Hypotheses to Test

Move beyond broad questions like “Will customers buy this?” to testable hypotheses such as:

- “Mid-market companies (500-2000 employees) will prioritize automated reporting features over advanced analytics capabilities”

- “Decision-makers in manufacturing will pay a 15% premium for industry-specific integrations”

- “Current users of competitor X experience frustration with onboarding that our solution addresses”

Each hypothesis should be specific enough that your research can definitively support or refute it.

Success Criteria and Decision Frameworks

Establish clear benchmarks before collecting data to avoid post-hoc rationalization of results. Define specific thresholds such as:

- Minimum 60% of target segments rate the concept as “very appealing” or higher

- At least 25% express definite purchase intent within 12 months

- Feature importance scores that clearly differentiate must-have from nice-to-have capabilities

- Pricing acceptance rates that validate your target price points

Create decision trees that map research outcomes to product development actions. If purchase intent falls below 25%, will you pivot the concept, adjust pricing, or conduct additional research?

Stakeholder Alignment on Priorities

Ensure product management, marketing, sales, and executive leadership agree on what constitutes actionable insights. Different stakeholders often have competing priorities—sales teams might prioritize competitive differentiation while product teams focus on technical feasibility. Document these perspectives upfront and design research that addresses each group’s key concerns.

Step 2: Develop Research Materials

Your research materials serve as the bridge between your product vision and market reality. In B2B contexts, these materials must communicate complex value propositions clearly while providing enough detail for informed evaluation.

Concept Descriptions: Clear, Jargon-Free Explanations

Write concept descriptions as if you’re explaining the product to a smart executive with limited time. Avoid technical jargon and focus on business outcomes rather than features. Instead of “Our AI-powered natural language processing engine leverages machine learning algorithms,” try “Automatically extracts key insights from customer feedback, saving your team 10+ hours per week.”

Structure descriptions consistently:

- What it does: Core functionality in plain language

- Key benefits: Specific business outcomes and value drivers

- How it works: High-level process without technical details

- Target users: Who would use it and in what situations

Visual Mockups: Prototypes, Wireframes, or Demonstrations

B2B buyers struggle to evaluate abstract concepts, especially for complex software or technical solutions. Invest in visual materials that help respondents understand the user experience:

- Wireframes or screenshots: Show actual interface elements and workflows

- Process diagrams: Illustrate how the solution fits into existing business processes

- Before/after scenarios: Demonstrate the transformation your product enables

- Video demonstrations: Brief walkthroughs of key functionality (2-3 minutes maximum)

Keep visuals focused on core functionality rather than trying to show every possible feature. The goal is comprehension, not comprehensive feature coverage.

Use Case Scenarios: Real-World Application Examples

Develop 2-3 specific scenarios that show your product solving actual business problems. Base these on real customer situations whenever possible:

Scenario Example: “DataCorp’s marketing team receives 500+ customer survey responses monthly. Currently, two analysts spend 15 hours each month manually categorizing feedback themes and creating summary reports. With [Product Name], the same analysis happens automatically overnight, and analysts receive prioritized insights highlighting the most critical customer concerns.”

Include relevant context like company size, industry, existing tools, and specific pain points. Scenarios help B2B respondents evaluate concepts within their own operational reality.

Competitive Context: How It Compares to Alternatives

B2B buyers always evaluate new solutions against existing alternatives, whether that’s competitors, internal tools, or maintaining the status quo. Provide clear competitive positioning without disparaging specific competitors:

- Alternative approaches: Current solutions buyers might be using

- Key differentiators: What makes your concept unique or superior

- Switching considerations: What would motivate change from existing solutions

Be honest about trade-offs. If your solution requires more upfront investment but delivers long-term savings, acknowledge both aspects. Credibility improves when you present balanced comparisons.

Step 3: Identify and Recruit Target Audience

B2B recruitment presents unique challenges that require strategic planning and often significant lead times.

Decision-Maker Mapping: Who Influences vs. Decides

Map the complete buying committee for your target accounts. In most B2B purchases, multiple stakeholders influence the decision:

- Economic buyer: Budget authority and final purchasing decision

- Technical buyer: Evaluates functional requirements and implementation feasibility

- End users: Day-to-day product users who influence satisfaction and adoption

- Champions: Internal advocates who promote your solution

- Blockers: Stakeholders who might resist change or prefer alternatives

Design research to capture perspectives from each role. A technical buyer might prioritize integration capabilities while an economic buyer focuses on ROI and vendor stability.

Screening Criteria: Company Size, Industry, Current Solutions

Develop specific screening criteria that identify your ideal research participants:

Company characteristics:

- Revenue range or employee count that matches your target market

- Industry verticals where your solution provides the most value

- Geographic regions you plan to serve initially

- Technology stack or business model requirements

Individual qualifications:

- Job titles and decision-making authority levels

- Experience with relevant product categories or business processes

- Timeline for potential purchases or solution evaluations

- Budget authority or influence over purchasing decisions

Be realistic about criteria balance. Overly restrictive screening might make recruitment impossible, while too-broad criteria can include irrelevant perspectives.

Step 4: Execute Data Collection

Successful B2B concept research requires structured yet flexible data collection that adapts to busy schedules and varying communication preferences.

If you’ve opted for a qualitative method, you’ll need to develop discussion guides that cover essential topics while allowing natural conversation flows. Prepare follow-up probes for key topics but don’t interrogate participants. The best insights often emerge from unexpected tangents when participants share experiences you hadn’t considered.

If, instead, you’re going with a quantitative methodology, you’ll need to develop clear, structured survey designs that allow for objective measurement.

In both cases, be sure to stay away from leading questions. Use neutral language like, “How would you evaluate this concept?” rather than “What do you like about this concept?” Additionally, present concepts in random order when testing multiple ideas, and vary the sequence of evaluation criteria across participants.

Step 5: Analysis and Interpretation

B2B concept research analysis requires balancing quantitative rigor with qualitative insights, often with smaller sample sizes than consumer research allows.

B2B quantitative samples rarely reach the hundreds of respondents common in consumer research. Work within these constraints by:

- Focusing on effect sizes: Large differences between segments matter even without statistical significance

- Using Confidence intervals: Report ranges rather than point estimates for key metrics

- Considering practical significance: A 20-percentage-point difference in purchase intent matters even if not statistically significant

- Leveraging directional insights: Use quantitative data to identify trends for further investigation

With B2B qualitative samples, be sure to review insights systematically rather than cherry-picking compelling quotes:

- Use Thematic analysis: Identify recurring themes across interviews and note their frequency

- Include Participant mapping: Track which themes emerge from different roles, industries, or company sizes

- Document Context: Capture the circumstances that drive specific reactions or concerns

Regardless of methodology, consider viewing results by unique segments. This could be role, company size or industry. B2B markets often contain distinct segments with different needs and priorities. Analyzing respondents by these unique segments with further help refine concept appeal and viability.

Step 6: Reporting and Recommendations

Transform your research insights into actionable business intelligence that drives product decisions and market strategy. This includes deliverables that feature:

- Executive Summaries: Busy executives need critical insights upfront. Structure your executive summary around decision-making needs:

- Go/No-Go Recommendation: Clear direction based on market validation results

- Market Opportunity: Size, segments, and growth potential supported by your research

- Critical Success Factors: Must-have features, positioning requirements, and competitive considerations

- Risk Mitigation: Key concerns identified and strategies for addressing them

- Resource Requirements: Investment levels needed for successful market entry

The comprehensive documentation—pull quotes for interviews or charts and graphs from surveys—should follow. You’ll need to demonstrate that you have concrete data to back up the summarized findings and recommendations, and give those who want to see it a clean way to review that data.

Best Practices for B2B Concept Research Success

These best practices separate effective B2B concept validation from research programs that miss critical market insights.

1. Test Concepts in Realistic Contexts

Present product concepts within actual business workflows and use cases rather than in isolation. Show how your solution fits into existing processes, integrates with current tools, and addresses day-to-day operational challenges. B2B buyers evaluate concepts based on implementation reality, not theoretical benefits. Include relevant constraints like budget cycles, technical requirements, and organizational change management in your concept presentations.

2. Include Multiple Stakeholders from Target Accounts

Design research to capture perspectives from the complete buying committee—economic buyers, technical evaluators, end users, and influencers. Different roles prioritize different benefits and have varying concerns about implementation, cost, and risk. A solution that appeals to end users but fails technical evaluation won’t succeed, regardless of user enthusiasm.

4. Validate Through Progressive Testing

Don’t rely on single-wave research to validate complex B2B concepts. Start with qualitative exploration, refine concepts based on initial feedback, then conduct quantitative validation. Consider pilot programs or prototype testing with select customers before full market launch. Progressive validation catches concept flaws early and builds confidence in market readiness through multiple confirmation points.

5. Plan for Follow-Up Research as Concepts Evolve

B2B product development is iterative, and your research program should be too. As concepts evolve based on initial feedback, technical constraints, or competitive developments, plan additional research waves to validate significant changes. Budget for follow-up studies that test refined positioning, modified feature sets, or new target segments that emerge during development. Continuous market validation prevents concept drift from customer needs.

Performing B2B Product Concept Research FAQs

What sample size do I need for B2B concept research?

Unlike consumer research that often requires 500+ respondents, B2B concept research can generate reliable insights with much smaller samples. For quantitative studies, even 100 carefully screened respondents from your target market often suffice. For qualitative research, about 15 in-depth interviews typically provide sufficient insight saturation. The key is ensuring your sample accurately represents your target customer profile across company size, industry, role, and current solution usage rather than pursuing large numbers.

How long does B2B concept research typically take?

Plan for 8-14 weeks for comprehensive concept research, depending on complexity and methodology. This includes 2-3 weeks for study design and material development, 4-8 weeks for fieldwork (recruiting and data collection), 2-3 weeks for analysis and reporting. B2B research takes longer than consumer research due to recruitment challenges. Business decision-makers are harder to reach and schedule.

Should I test multiple product concepts at once?

Testing 2-3 related concepts simultaneously can be effective and cost-efficient, but avoid overwhelming respondents with too many options. When testing multiple concepts, ensure they’re distinct enough that customers can meaningfully differentiate between them. Consider sequential testing for dramatically different concepts, as customers need adequate time to process and evaluate complex B2B solutions.

How do I handle confidential or sensitive product information?

Protecting intellectual property while conducting meaningful research requires careful balance. Use non-disclosure agreements with all participants and research vendors. Consider testing concept benefits and use cases without revealing proprietary technology details. Focus on customer problems and desired outcomes rather than specific technical solutions. You can validate market need and positioning without exposing sensitive competitive information.

Should I research existing customers or prospects?

Both audiences provide valuable but different insights. Existing customers understand your company and can evaluate concepts within the context of your current relationship, but they may be biased toward your approach. Prospects provide unbiased market perspective but may lack context about your capabilities. The ideal approach includes both groups, clearly identifying which insights come from which audience in your analysis.

How do I test concepts that require significant customer education?

Complex B2B concepts often require substantial explanation before customers can provide meaningful feedback. Use progressive disclosure techniques that gradually build understanding. Start with the problem your concept solves, then introduce the solution approach, and finally cover specific features and implementation. Include visual aids, use cases, and analogies to help customers grasp unfamiliar concepts. Plan for longer research sessions to accommodate education time.

How do I know if my concept research results are reliable?

Look for consistency across different research methods and respondent groups. Strong concepts typically show similar patterns whether tested through surveys, interviews, or focus groups. Pay attention to the reasoning behind responses—customers should be able to articulate why they like or dislike concepts. Be cautious of results that seem too positive (social desirability bias) or inconsistent with market realities.

Should I research features or benefits?

Focus primarily on benefits and outcomes, but include enough feature detail for customers to understand how benefits are delivered. B2B buyers care about functional capabilities but make decisions based on business outcomes. Test features in the context of specific use cases and business problems rather than in isolation. Understanding which features drive which benefits helps prioritize development efforts.

What if my research results contradict internal assumptions?

Conflicting results often provide the most valuable insights. First, verify that your research methodology was sound and your sample was representative. Then explore why assumptions diverged from market reality—this often reveals important market dynamics or customer needs that weren’t initially understood. Use conflicting results as opportunities to refine concepts rather than reasons to dismiss research findings.

When should I conduct follow-up research?

Plan follow-up research when initial findings raise new questions, when you’ve made significant concept changes based on feedback, or when you’re ready to test refined concepts with the market. Consider follow-up research if your initial sample was limited or if you need to validate findings with different customer segments. Iterative research is particularly valuable for complex B2B products where initial concepts typically require refinement based on market feedback.