Brand awareness is often the first metric marketers reach for when gauging brand health. It’s a clear signal that your efforts are putting your name on the map. But while knowing how many people recognize your brand is important, it’s only part of the equation.

Awareness alone doesn’t reveal how people feel about your brand, whether they’d choose you over a competitor, or if recognition is translating into real business results. To truly understand your brand’s impact and unlock new opportunities for growth, it’s essential to look beyond simple recognition and dig into the deeper story your brand metrics can tell.

A Primer On Brand Awareness

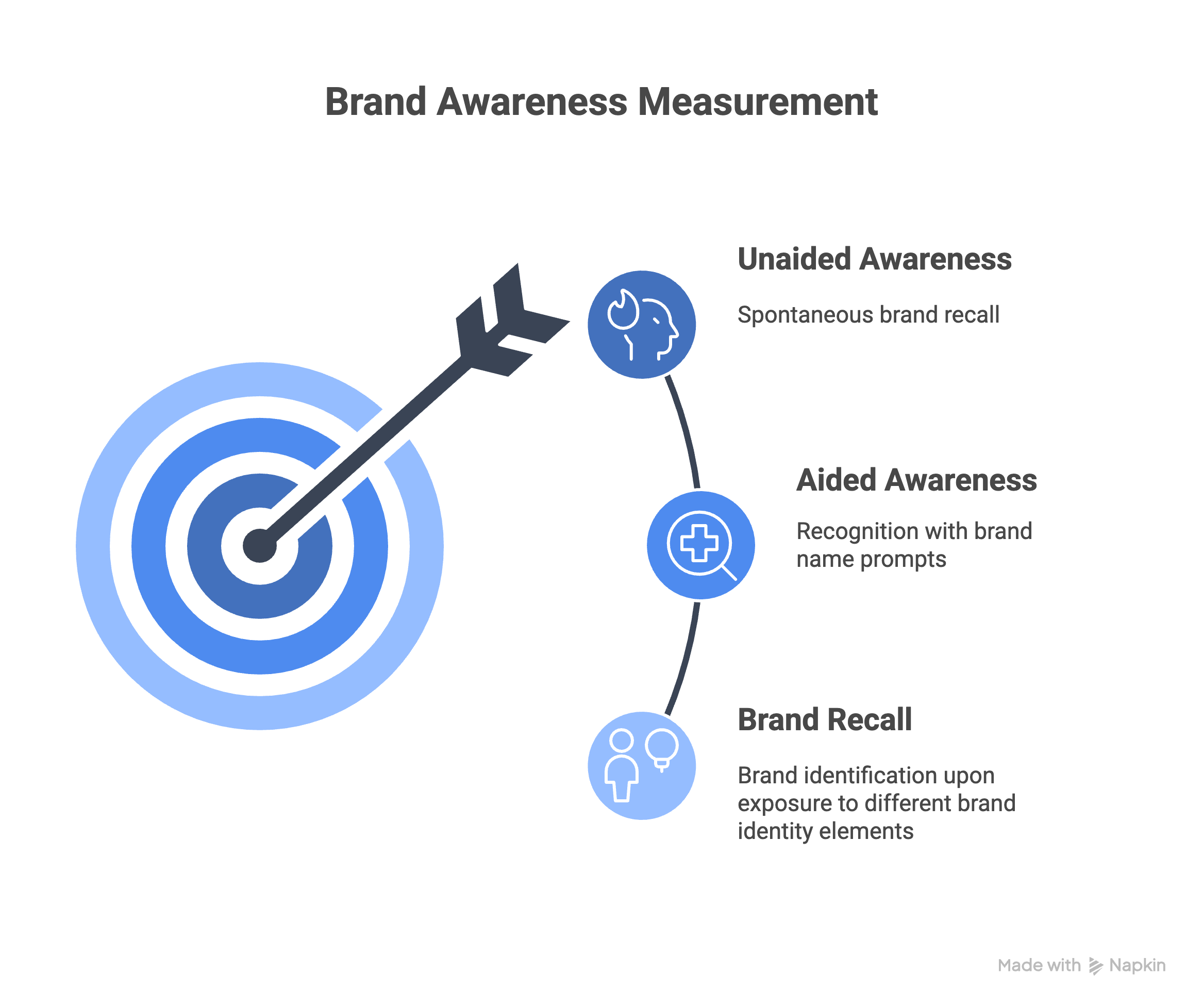

Brand awareness is the degree to which consumers recall a brand, its products, or its services. It’s usually measured via two approaches:

- Aided Awareness: This measures whether consumers recognize your brand when prompted with its name. For example, “Have you heard of Brand X?”

- Unaided Awareness: This assesses whether your brand comes to mind without any prompts. For example, “What brands of smartphones can you name?” Unaided awareness is a stronger indicator of top-of-mind presence.

Other brand recall measures can be collected at the same time. For instance, do customers remember a brand name after seeing a logo, color scheme, jingle, or packaging.

Why Brand Awareness Is Valuable But Limited

Brand awareness matters because it lays the groundwork for everything else a brand hopes to achieve. When consumers recognize and recall your brand, you gain a critical advantage: familiarity breeds trust, and trust is often the deciding factor in a crowded category.

Brands that are top of mind don’t have to waste time introducing themselves. They can focus on persuading and converting.

Nevertheless, despite the value of brand awareness, it has clear limitations:

- Surface-Level Insight: Awareness only shows if someone recognizes or recalls your brand. It does not tell you how they feel about it.

- No Indication of Intent: High awareness doesn’t mean consumers will choose your brand when it matters. People might know your name but still prefer a competitor.

- Lack of Context: Awareness metrics don’t explain why people know your brand or what specific associations they have. You don’t see whether recognition is tied to positive or negative experiences.

In short, while brand awareness is a vital starting point, it’s only one piece of the puzzle. To truly understand your brand’s position and opportunities for growth, you need to go beyond simple recognition and dig deeper into what drives consumer decisions.

Metrics To Build A More Robust Brand Health Picture

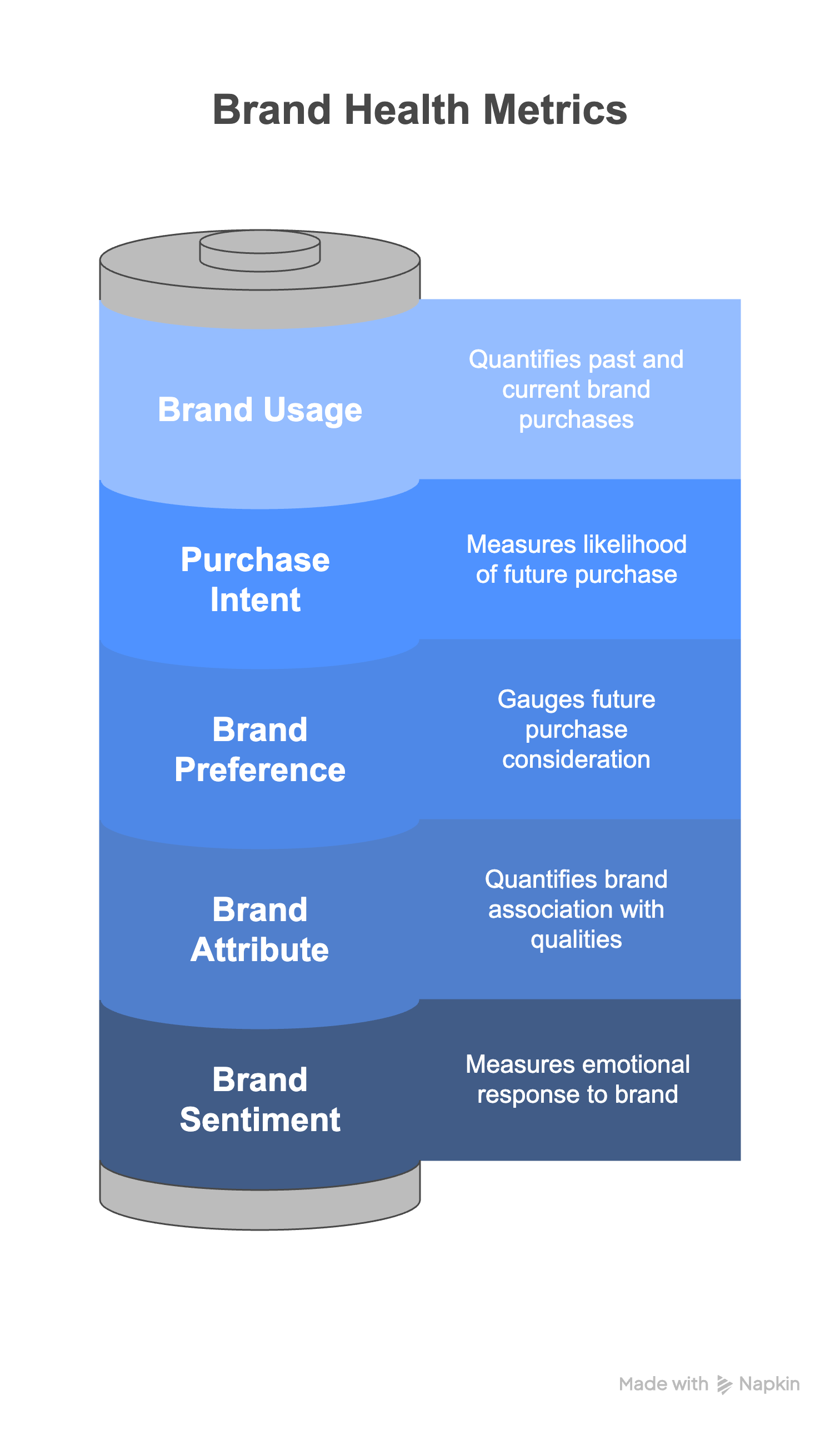

To overcome the limitations of basic brand awareness measurement, it’s essential to incorporate a suite of additional tangible metrics. These incremental KPIs build off of awareness while directly addressing known limitations.

Understand How Consumers Feel About Your Brand

While brand awareness tells you if people do or do not know the brand, it does not tell you how they feel about the brand. Consider the following additional metrics to get a broader picture of brand perception:

Brand Sentiment Ratings: Use scaled questions (e.g., 1–5 or 1–7) to measure overall impressions and emotional responses toward your brand (“How would you rate your overall impression of [Brand]?”).

Brand Attribute Associations: Ask respondents to rate how strongly they associate your brand with specific qualities (e.g., trustworthy, innovative, value for money). This quantifies not just recognition, but the nature of perceptions.

Understand Consumers’ Intent For Your Brand

Additionally, keep in mind that high awareness does not mean consumers will choose your brand when it matters. In fact, in times of brand crises, awareness is high but intent to buy is likely extra low (e.g., Chipotle’s E. coli outbreak). This is is why we suggest layering in brand intent questions. For instance:

Brand Preference: Ask which brands respondents would prefer or consider purchasing from in the future (“Which of these brands would you consider buying from in the next 6 months?”).

Purchase Intent: Use direct questions to gauge likelihood of purchase (“How likely are you to purchase from [Brand] in the next 3 months?”).

Brand Usage: Quantify how many respondents have ever purchased or currently use your brand to link awareness to actual behavior.

Building Your Brand Health Picture

If you want a clear, actionable view of your brand’s true market position, surveys are the essential tool to get you there. Surveys let you systematically measure not just who knows your brand, but how they feel about it, whether they’d choose it, and what they associate with it.

To get started, launch a baseline survey that covers the full suite of brand health metrics: aided and unaided awareness, sentiment, preference, purchase intent, and key brand associations. This initial read gives you a benchmark for brand health and highlights immediate strengths and vulnerabilities.

But measurement isn’t a one-time event. To truly understand how your brand is evolving, and how your marketing activities are influencing perception, repeat your survey at regular intervals. For many brands, an annual or semi-annual cadence is ideal. It’s frequent enough to capture the impact of campaigns and market shifts, but not so frequent that you risk survey fatigue or data noise. But, for brands with heavy and active campaigns spread across the year, consider a quarterly cadence. Meanwhile for brands planning a major one-time campaign, pre- and post-initiative surveys more effectively measure brand health lifts.

Making this a regular practice is non-negotiable for brands that want to compete and grow. Longitudinal survey data transforms brand health from a vague concept into a measurable, actionable business asset. You’ll be able to track progress, diagnose issues early, and make smarter, faster decisions about where to focus your resources.