Introduction

As a Seattle-based market research and strategy firm, PlanBeyond gets to collaborate with start-ups as they move from the earliest of idea stages to getting their product to market. It gives us a unique perspective on the start-up world: we get to hear interesting and challenging stories about the founder experience while wondering if the stories we hear are anecdotes…or part of broader trends impacting founders in general.

After publishing our Bias In Venture Capital Report, an analysis of how founder sex and race impact venture captial funding across the US, we wondered if the national-level trends we saw would repeat within Seattle. Being a data-oriented team, we set off to find out. We took our broader data set and honed-in on the Seattle market, examining every Seattle-area venture backed company that received funding in 2019. This means examining companies hoping to be fast-growth, fast-paced billion dollar businesses. Our data set includes 182 companies with 363 founders raising everything from seed funding to late-stage investments.

The findings, and what they tell us about trying to raise venture funds as a woman or racial minority in the Seattle area, were startling.

KEY FINDINGS

- Venture Backed Founders In Seattle All Look The Same

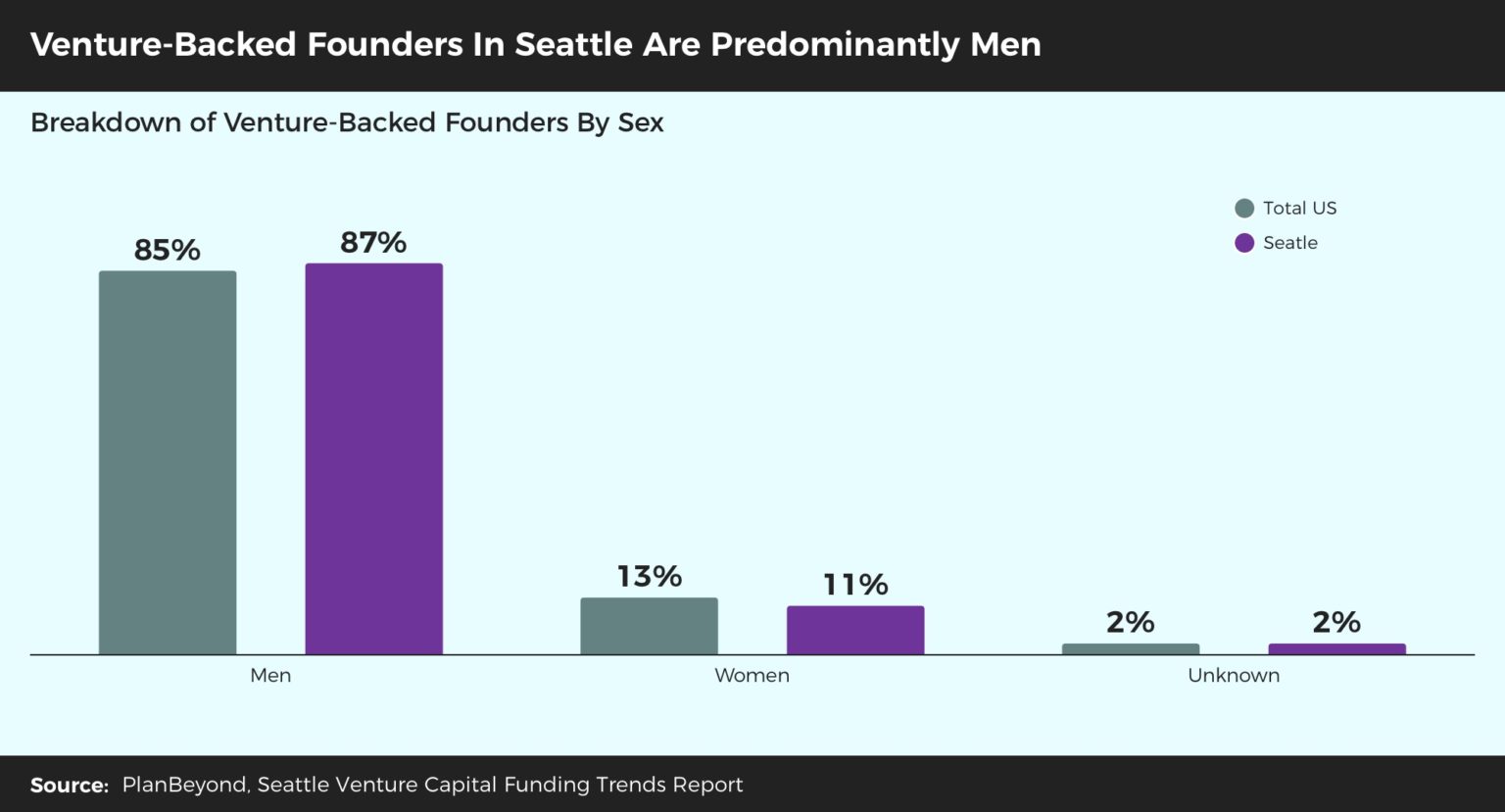

- 87% of venture-backed founders in Seattle are Men.

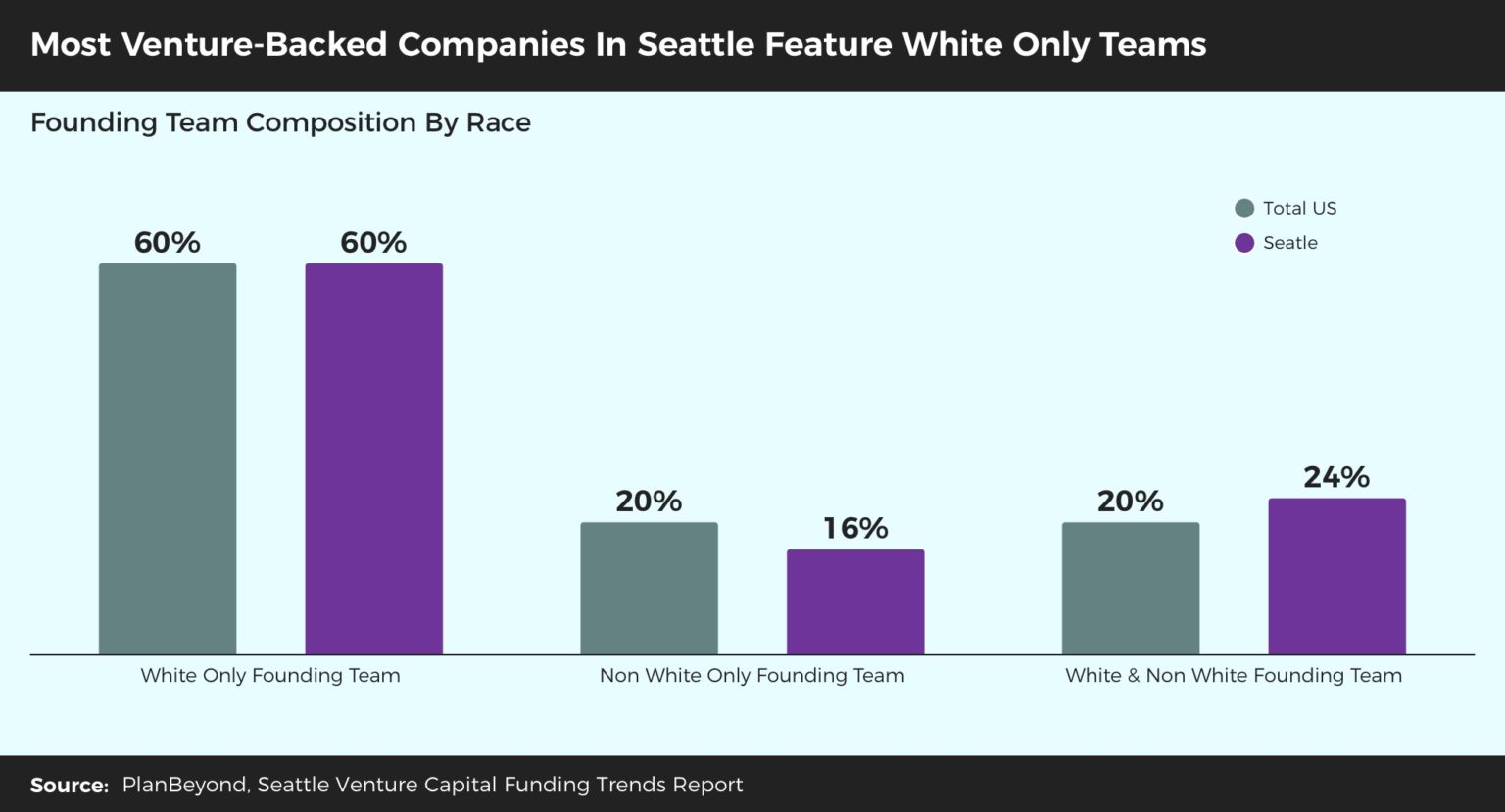

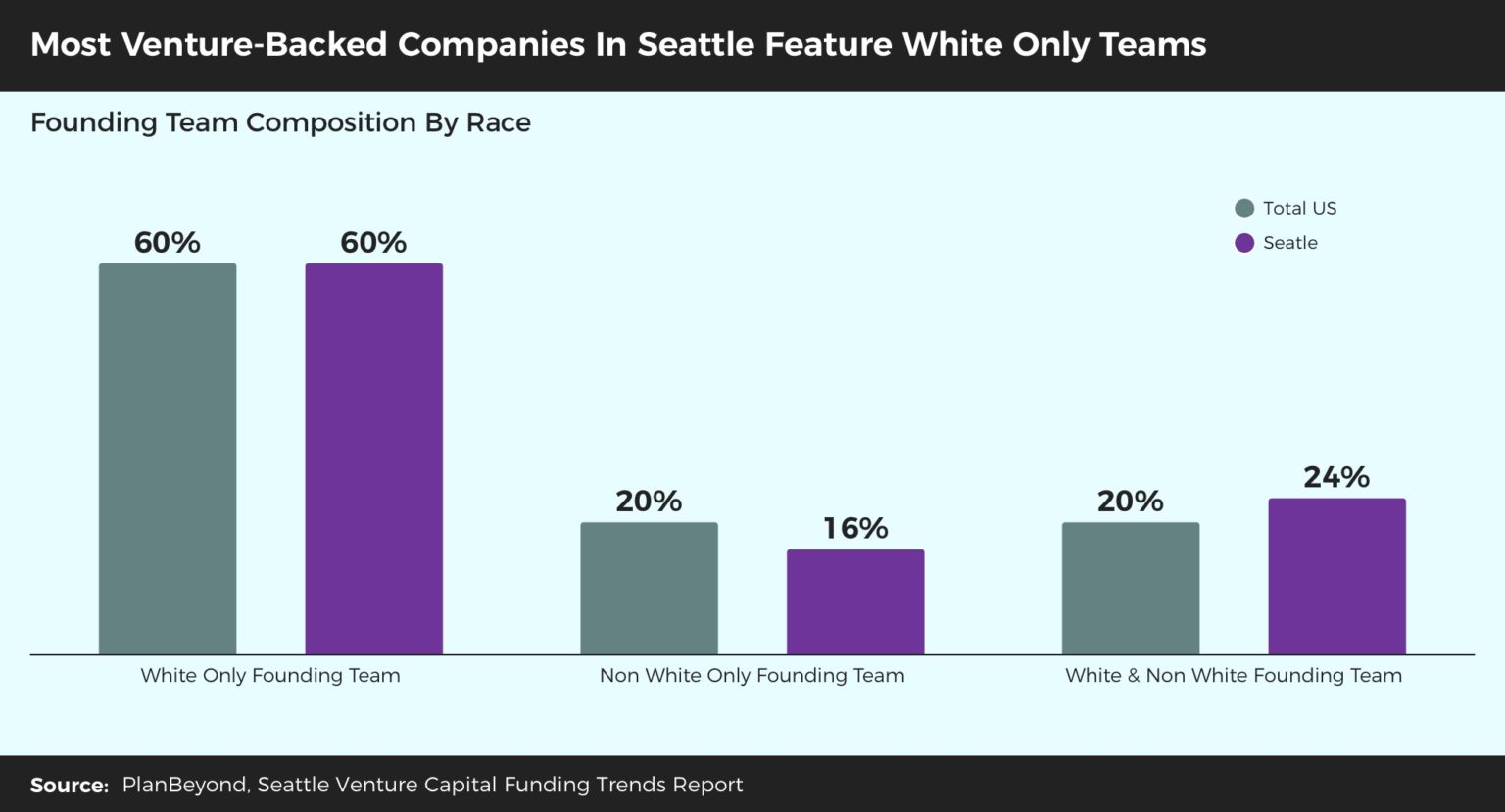

- 60% of all venture-backed founding teams in Seattle are composed exclusively of White team members.

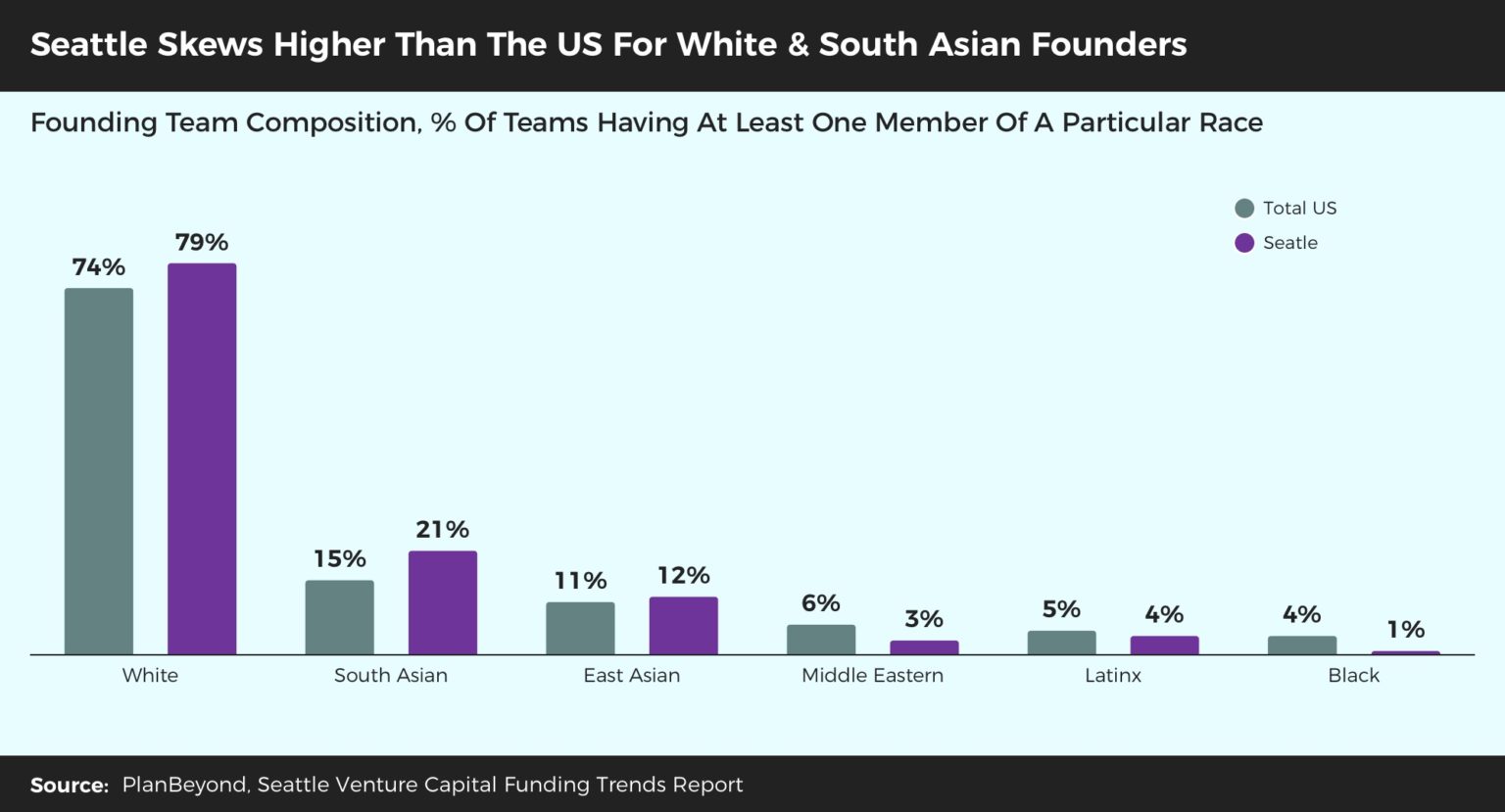

- Only 4% of all Seattle venture-backed founding teams have a Latinx member. Only 1% have a Black member.

Venture Capitalists Prefer To Fund White Men

- Teams with at least one White member average 5.81 investors. Teams with at least one Black founder average 2.00 investors.

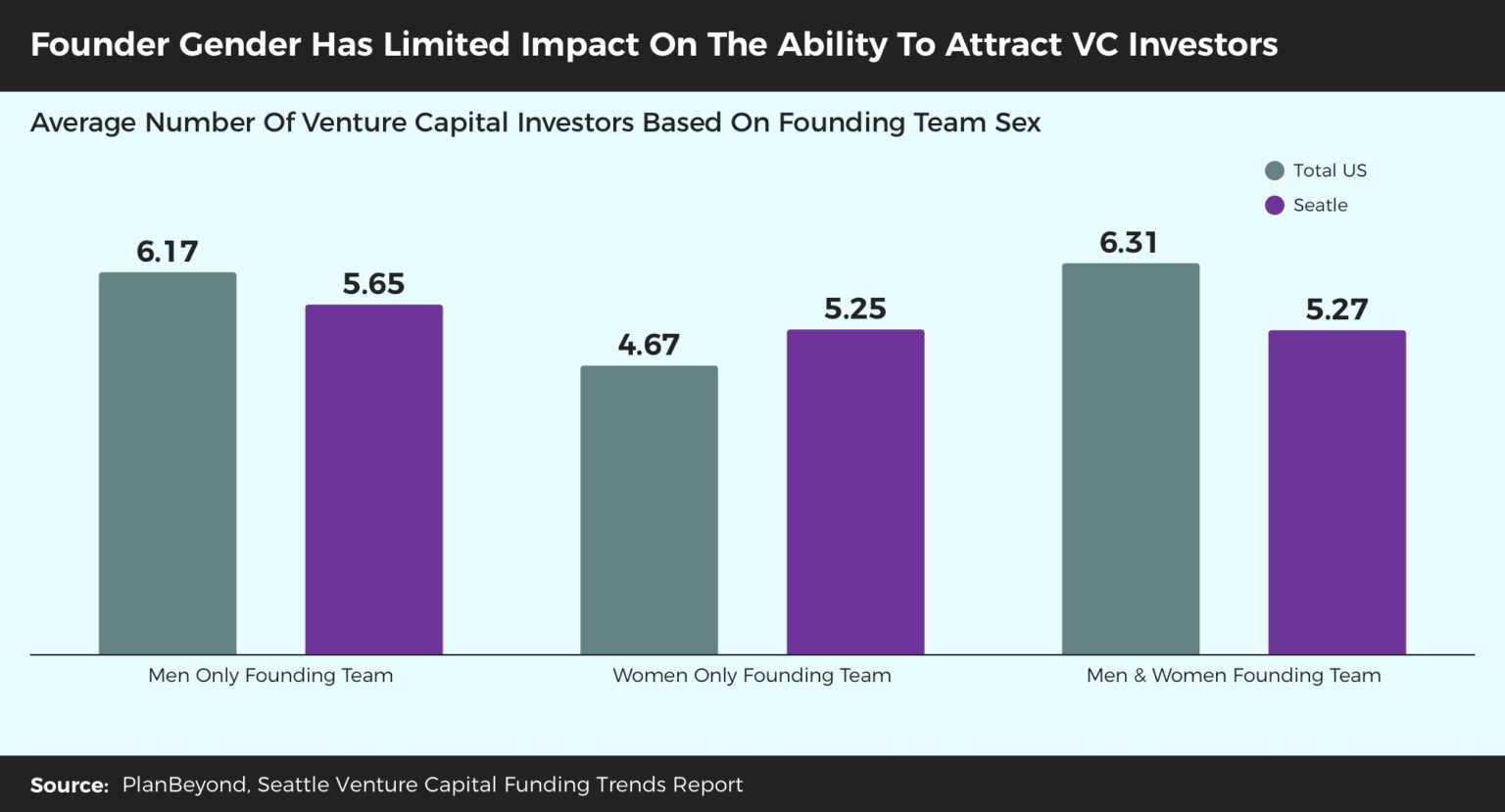

- Venture-backed teams that include Women attract fewer investors, on average, than Men-only teams.

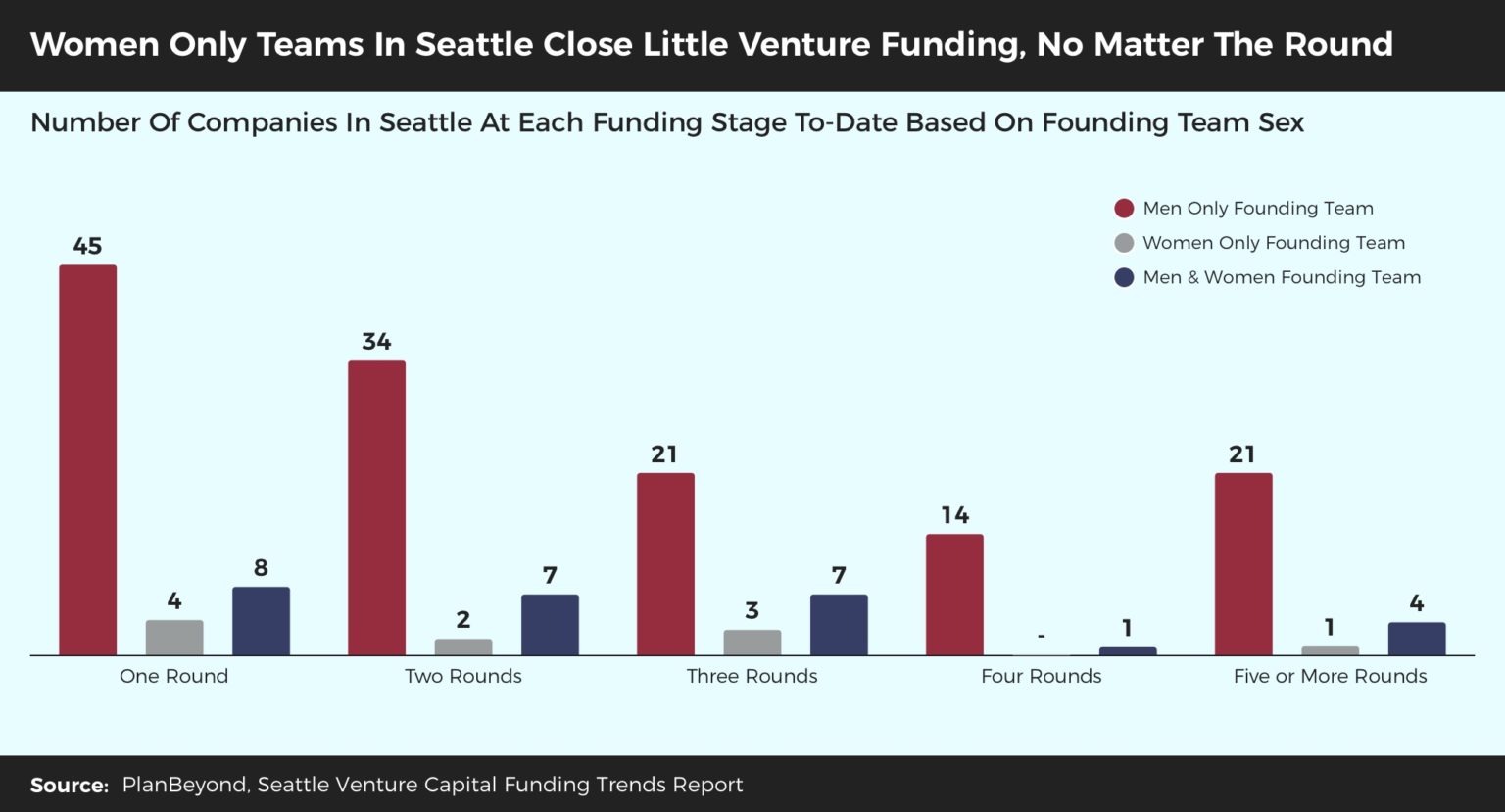

- Four Seattle-based teams led by Women raised their first round of venture funding in 2019. In contrast, forty-five Seattle-based teams led by Men raised their first round.

Want To Raise The Really Big Bucks in Seattle? It Helps To Be A Man, It Hurts To Be Black or Latinx

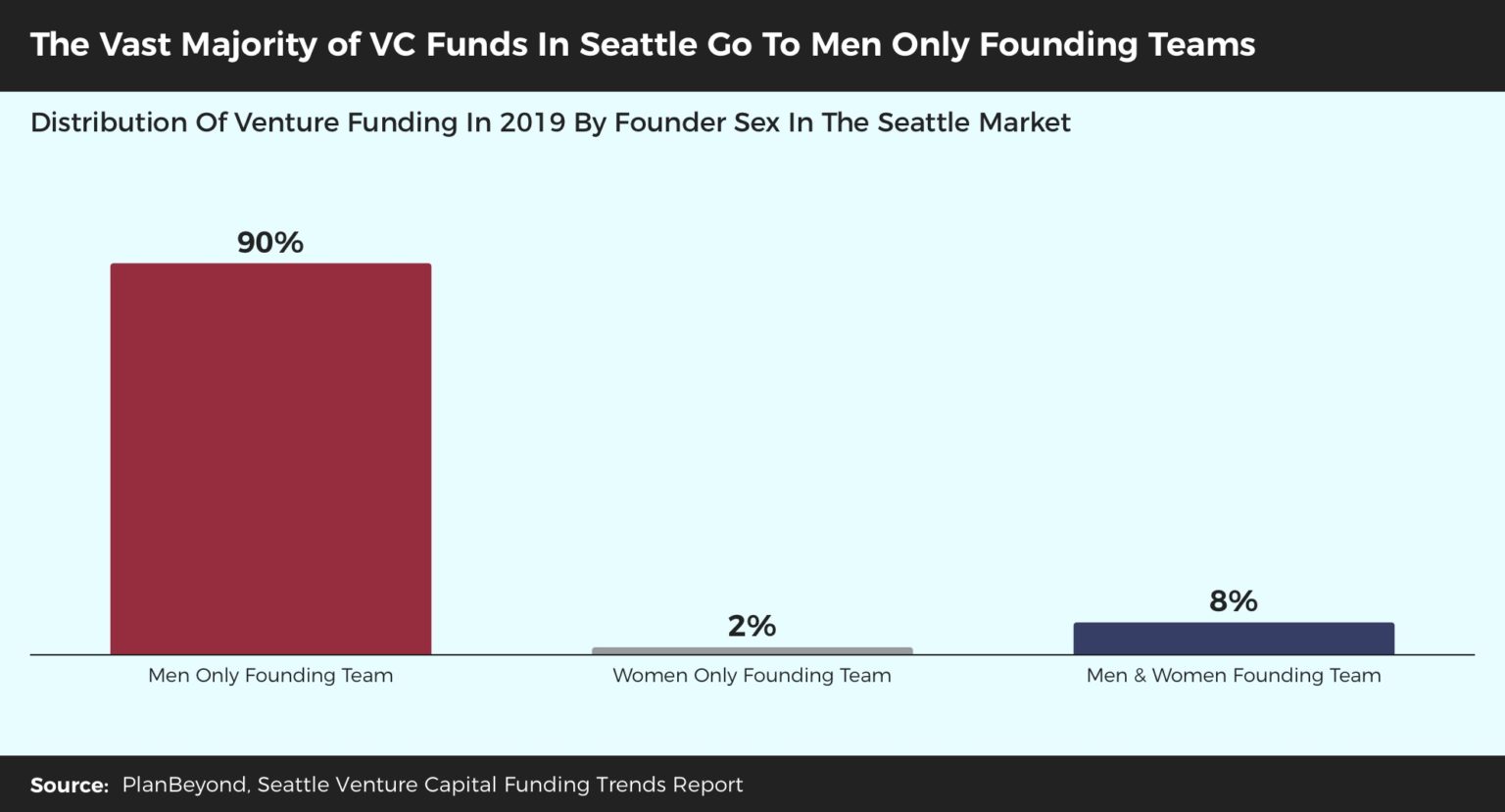

- 91% of all venture funding in Seattle went to Men only founding teams. 2% went to Women only team.

- Not a single company with a Black or Latinx founder received seed or late stage funding in 2019.

Venture Backed Founders In Seattle All Look The Same

Our data showed that Seattle matches the US when it comes to who venture capitalists actually fund. 87% of venture-backed founders in Seattle are Men, a relatively similar rate found across the US.

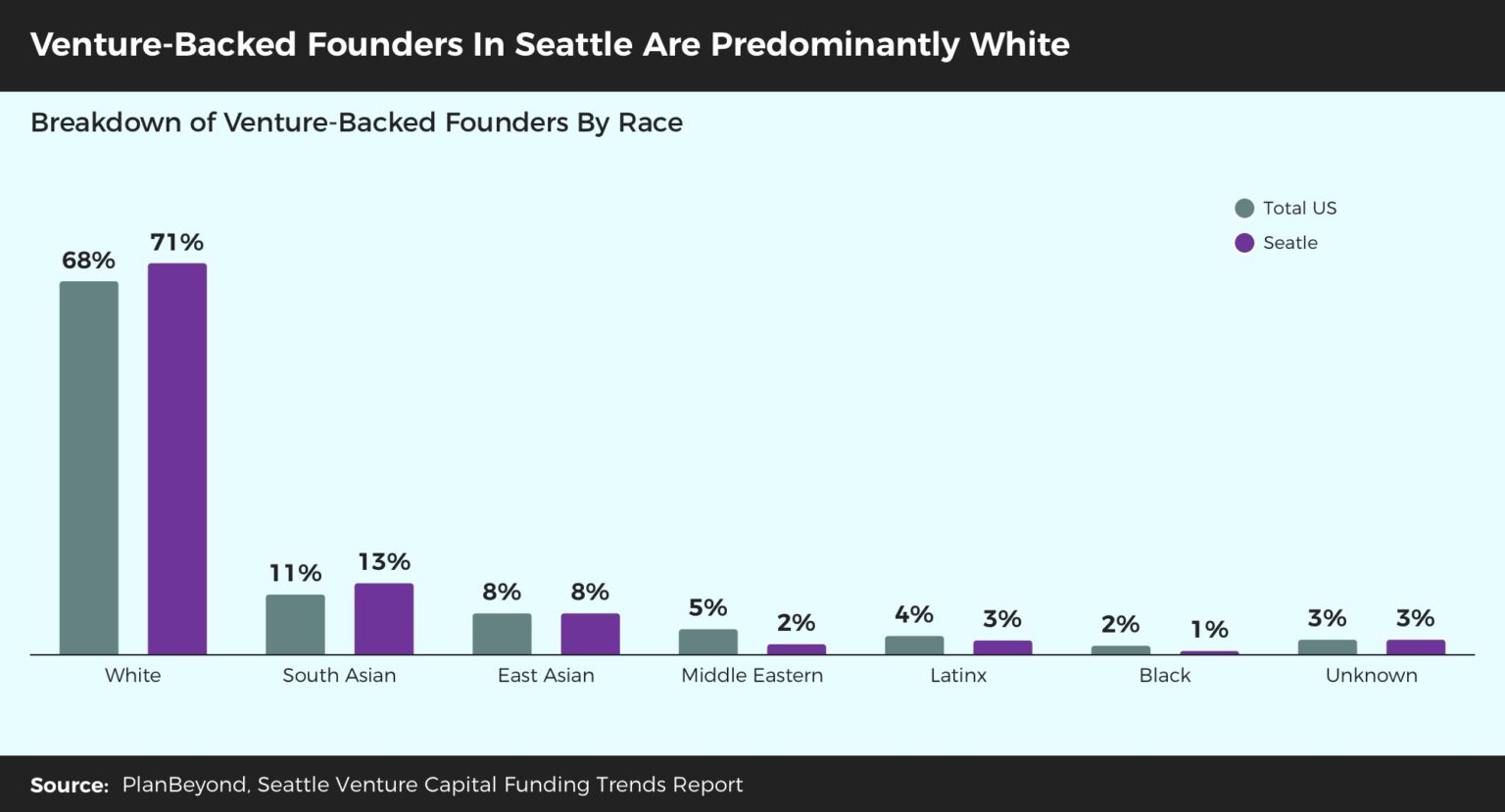

When it comes to the racial makeup of founders, Seattle tends to match US averages once again. At 71%, White founders comprise the bulk of all founders in our region, followed distantly by South Asian founders at 13%. Meanwhile, Latinx and Black founders make up only 3% and 4%, respectively, of founders in our region.

This homogeneity becomes extremely obvious when we start to look at the actual individuals that comprise founding teams.

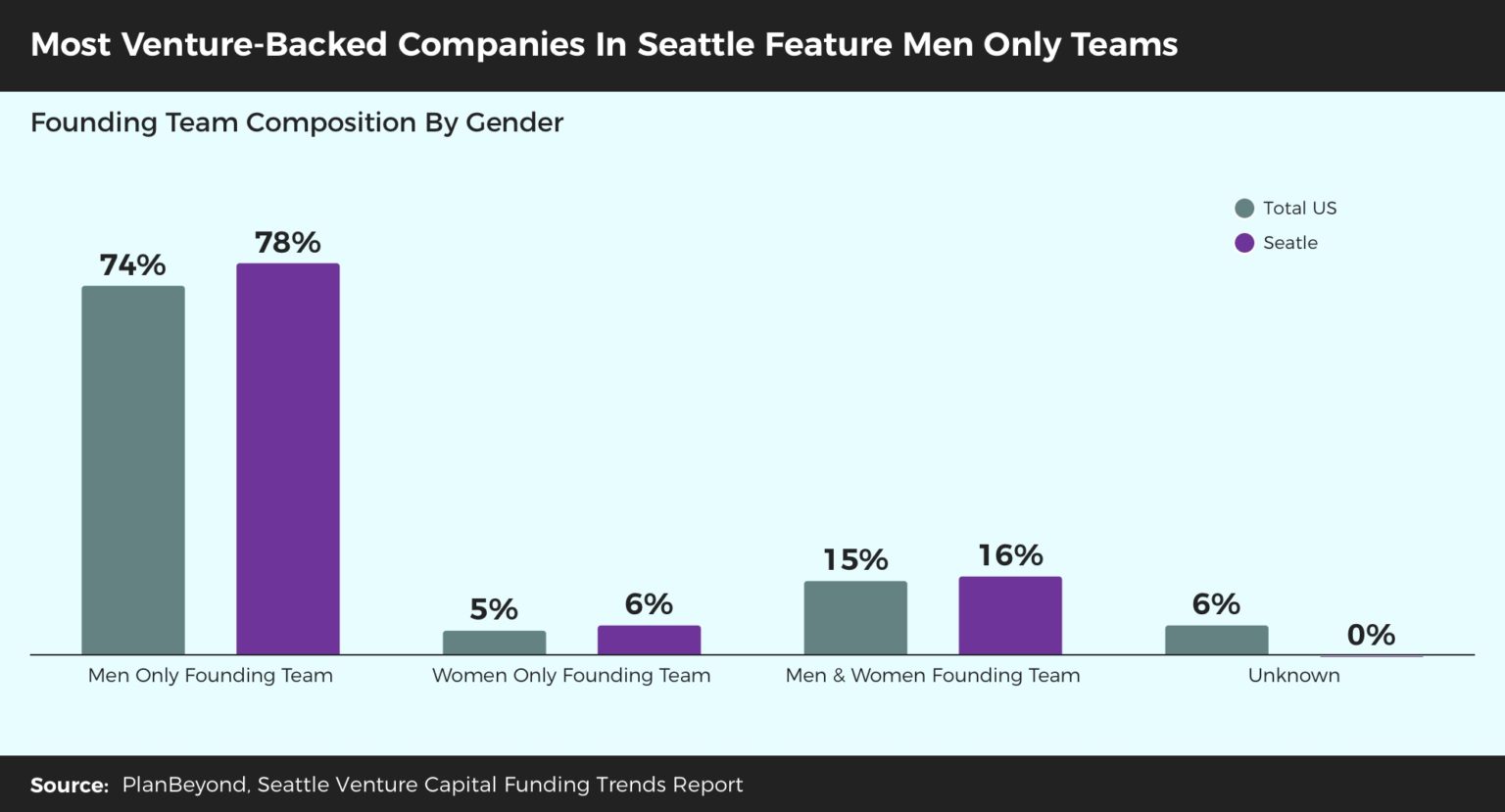

Only 16% of Seattle-based founding teams include both Men and Women. 78% feature exclusively Men only teams, an unsurprising sum considering the disproportionate number of Men founders in general.

Relatedly, only 16% of founding teams in Seattle include both White and Non White members. The bulk of all founding teams, at 60%, is exclusively White.

The initial data showed us that venture-backed teams in Seattle are typically led by White Men. That finding begs a different question: Are founding teams led by White Men given preferences not affording to teams with Women or minorities?

We found the answer to that question to be: yes.

Seattle-based founding teams composed exclusively of Women, regardless of business life stage, have 5.25 investors. Meanwhile, Men only teams have an average 5.65 investors. The only upside is that while Women only teams in Seattle tend to attract fewer investors, it is at a much smaller rate gap than seen across the US.

When we made men and women pick the #1 thing that had them concerned about 2019 business performance, limited access to funds was the top reason chosen by women. In contrast, the top reason chose by men was not having enough employees or the right employees on-hand. Men may have the financial resources they need to hire employees but are challenged with finding the right people. Meanwhile, it appears that women haven’t yet overcome the funding hurdle itself.

Venture Capitalists Prefer White Men

What we were surprised to see was the divide in skills sets men and women SMB owners said were missing from their organizations. 39% of women pointed to marketing as a core skill area their organizations were missing, which was 24% higher than men.

In contrast, 32% of men said sales expertise was missing from their organizations, which was 24% higher than women commenting on the same missing skill.

However, the Seattle market is falling behind the US when it comes to reaching any kind of racial parity in venture funding. Non White Only teams in Seattle average 4.46 investors, down from the 5.72 averaged by White Only teams. Teams composed of White and Non White founders do enjoy the highest number of investors at 6.00, though this is a much lower improvement than the benefit minorities bring to White founders in the US market as a whole.

The starkest data point pertains to Seattle companies with at least one Black founder. These organizations average 2.00 investors, the fewest number of investors based on any team’s racial composition.

Further, we see that the funding pipeline is not a pipeline at all. At least, not for companies founded by Women & Non White only teams.

Barely any Seattle-based companies led by women received even their first round of funding last year. Said another way, Women only teams are not poised to raise a second, third, fourth, or fifth round of funding since very few close even a single funding round.

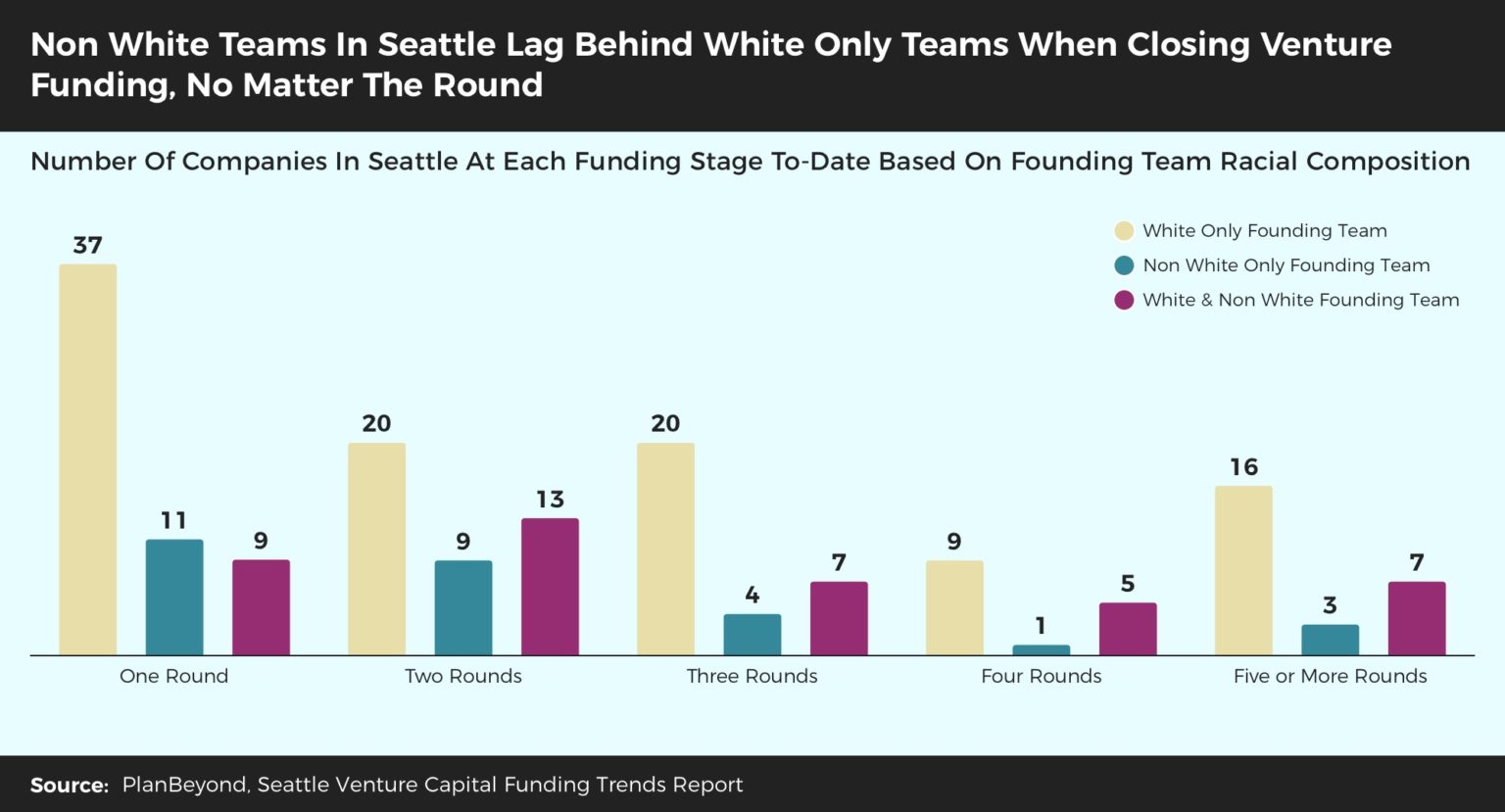

A similar dynamic is playing out across Non White Seattle founding teams, though not to the same extreme we see on the gender side. We see that a disproportionate number of White only teams are in the “Round One†stage of the funding pipeline. This affords White only teams the chance to raise additional rounds in the future. Meanwhile, a much smaller number of Non White teams have even reached the “Round One†stage, making it less likely to see any Non White teams progress into future funding rounds.

Want To Raise The Really Big Bucks? It Helps To Be A Man, It Hurts To Be Black Or Latinx

With so many Men, and White Men at that, receiving the bulk of investor interest, it would stand to reason that the bulk of venture capital money is allocated to companies with these types of founders.

Of the approximately $30 billion of venture capital funding allocated to Seattle-based start-ups in 2019, 91% of that went to Men only founding teams. A paltry 2% went to Women only team.

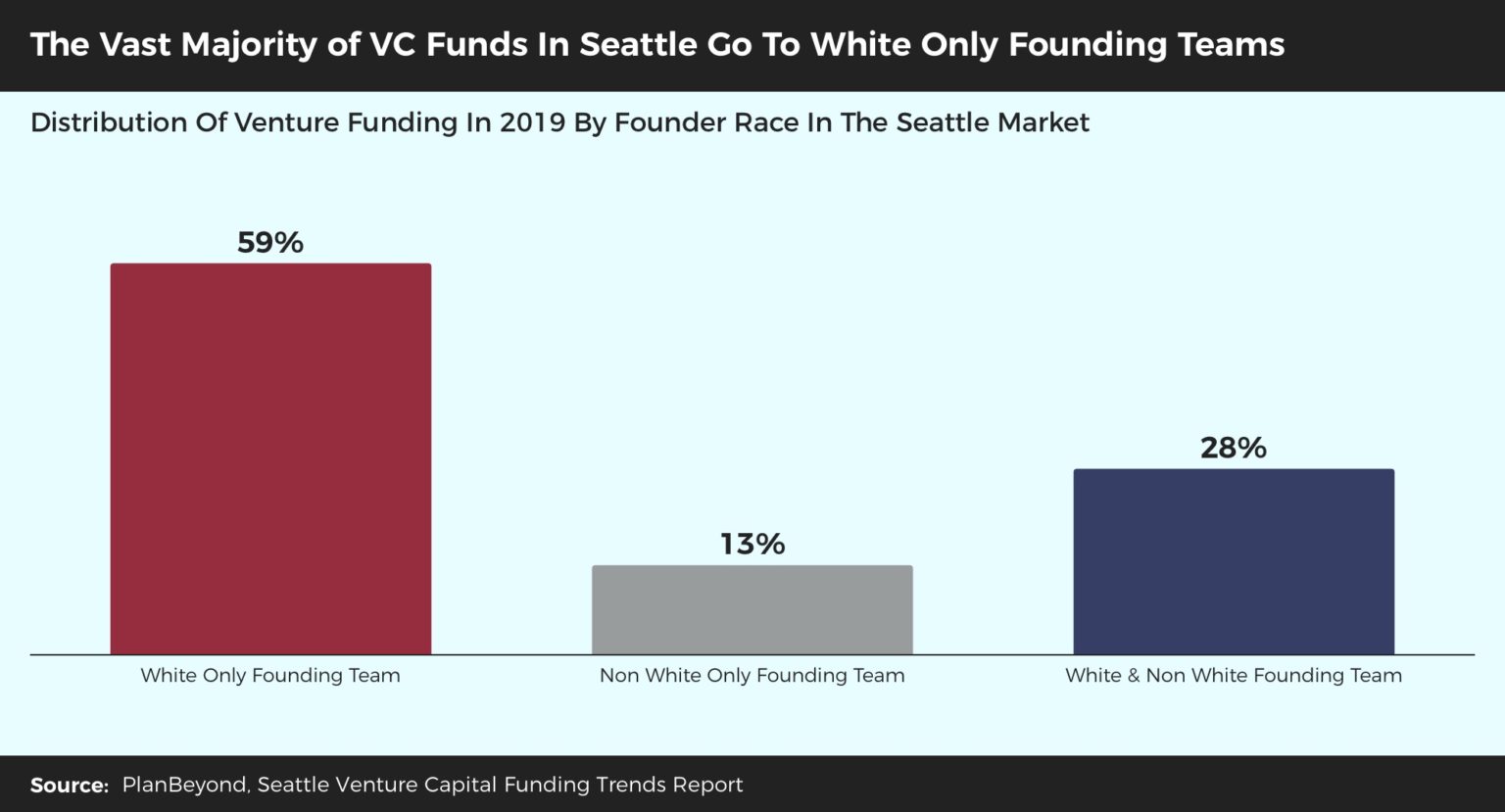

Nearly 60% of those same funds went to exclusively White only founding teams while 13% went to exclusively Non White founding teams.

These trends become readily apparent as we look at individual funding rounds, and especially later rounds which tend to skew towards larger investment sums.

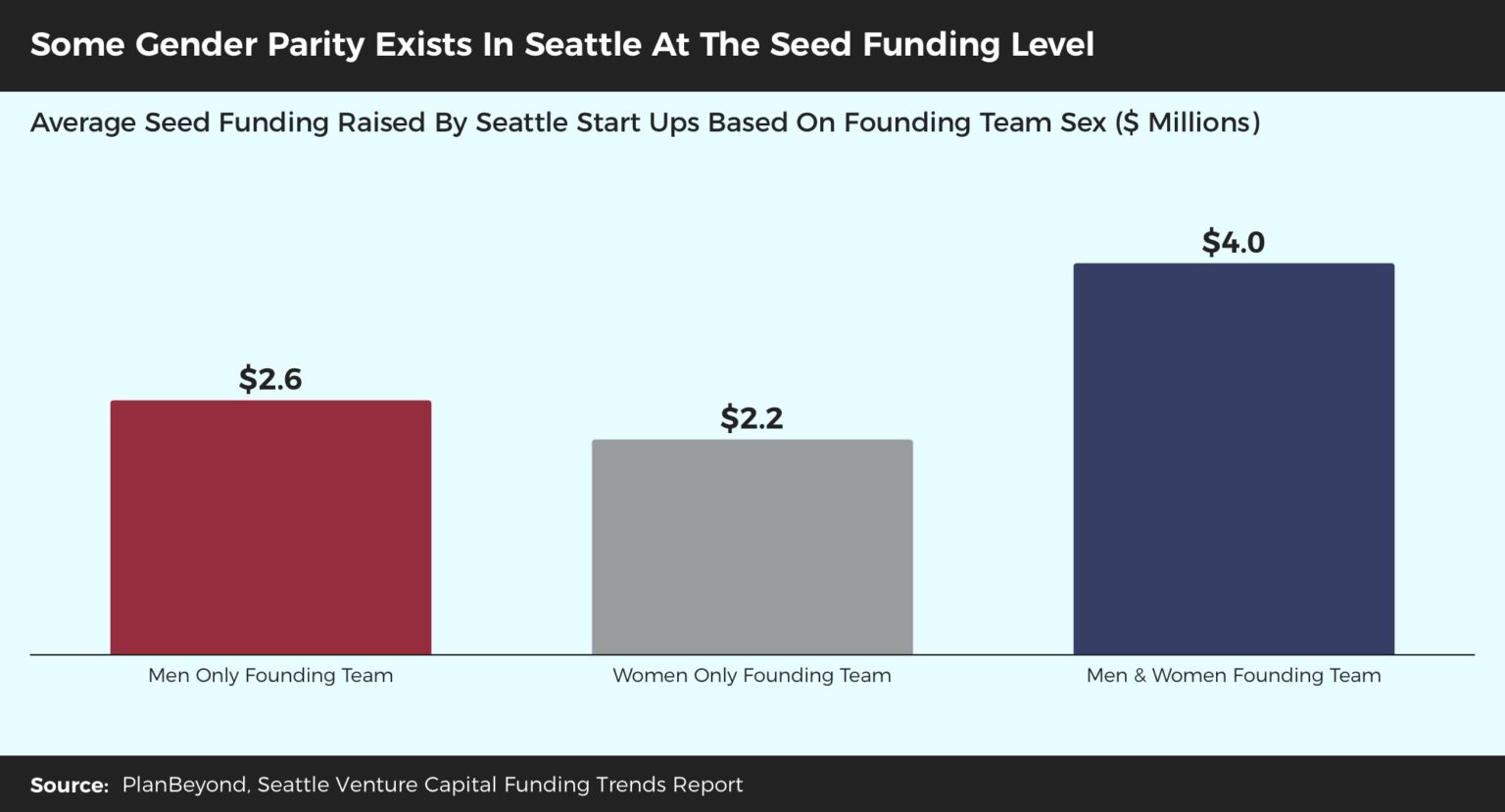

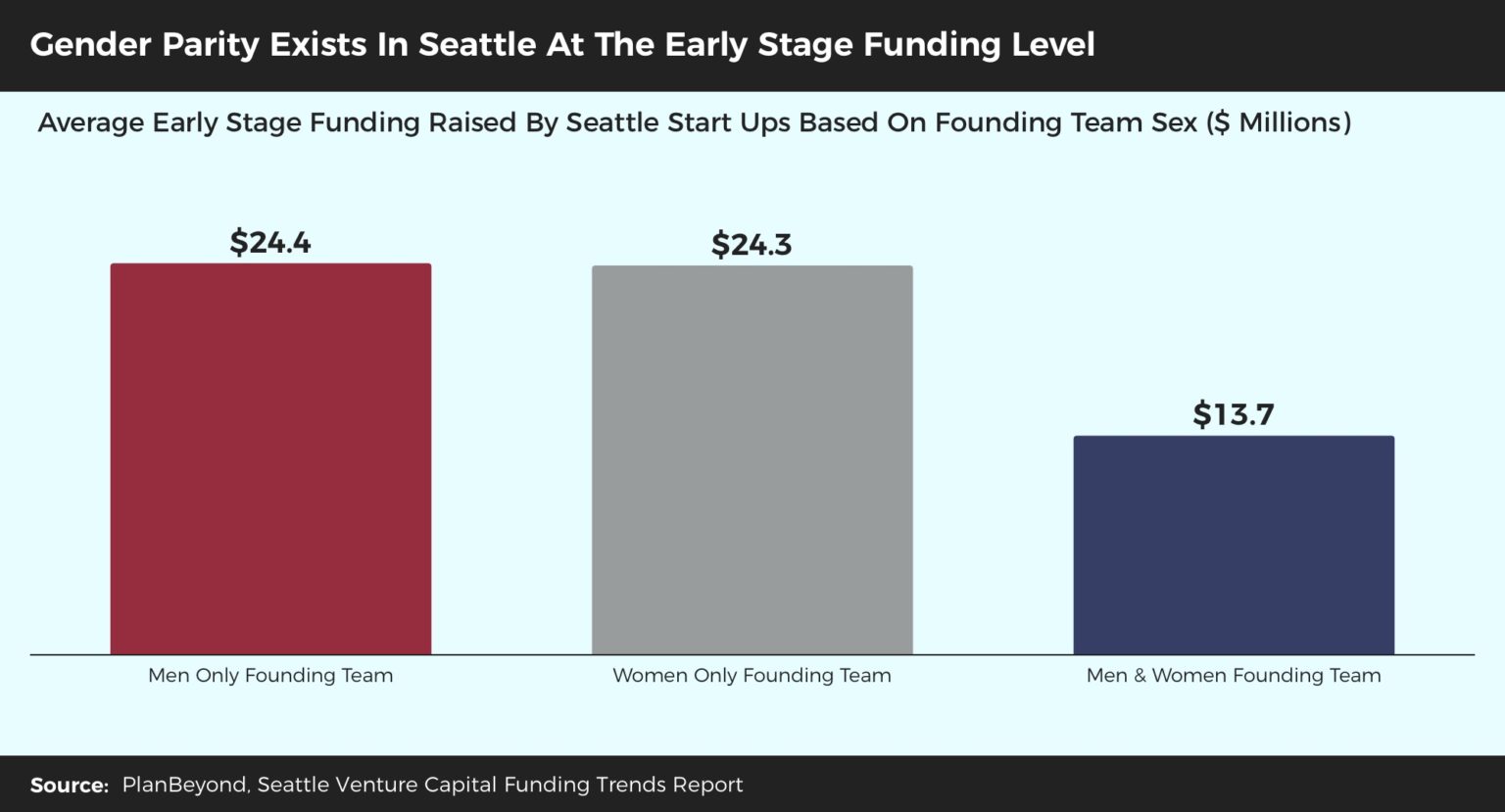

During early seed funding rounds, Men only teams do out-raise Women only teams by about $400,000, on average. Though, it must be noted that mixed-sex teams raise the highest seed rounds.

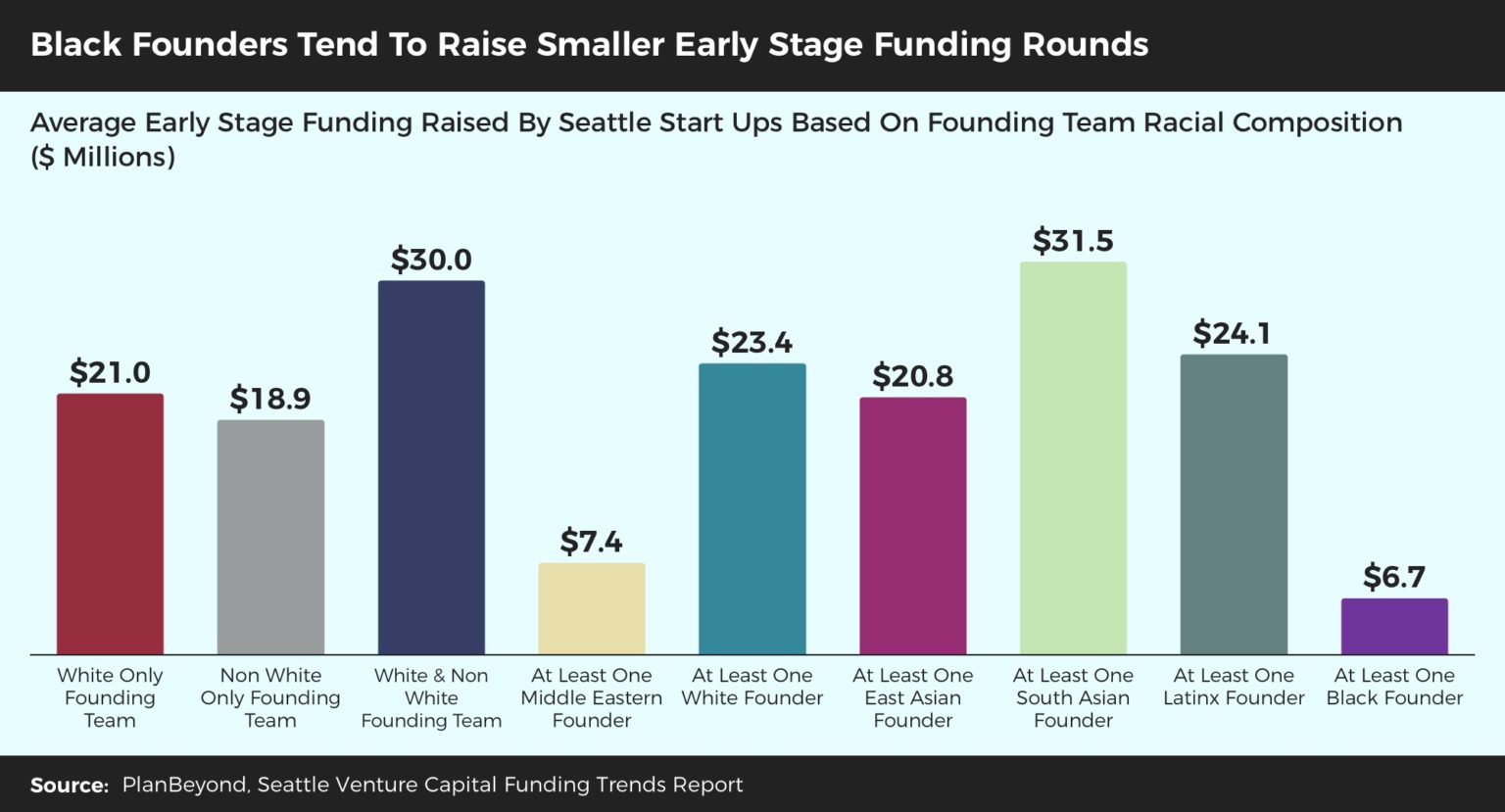

Seed funding disparities are extremely pronounced when we review the data by founder race. Exclusively White teams raise, on average, $700,000 more in their seed funds than exclusively Non White teams. However, the glaring absence is in seed funding for Black and Latinx founders. Not a single company with a Black or Latinx founder received seed funding in 2019.

Interestingly, as Seattle-based organizations move into Series A and Series B rounds, Men only and Women only teams tend to raise the same amount of early stage funding.

However, this parity doesn’t translate at the race level. There is a slight advantage to having an all White team ($12.0 Million) compared to an all Non White team ($18.9 Million) when it comes to raising early stage funding. Though, it must be noted that White & Non White teams tend to raise the most ($30.0 Million) early funding. While White founders get a boost from having Non White co-founders, Non White founders receive an even larger financial benefit from partnering with White co-founders.

Nevertheless, companies with at least one Black founder continue to fall behind, raising only $6.7 Million, on average, during early stage rounds, the lowest of any racial group.

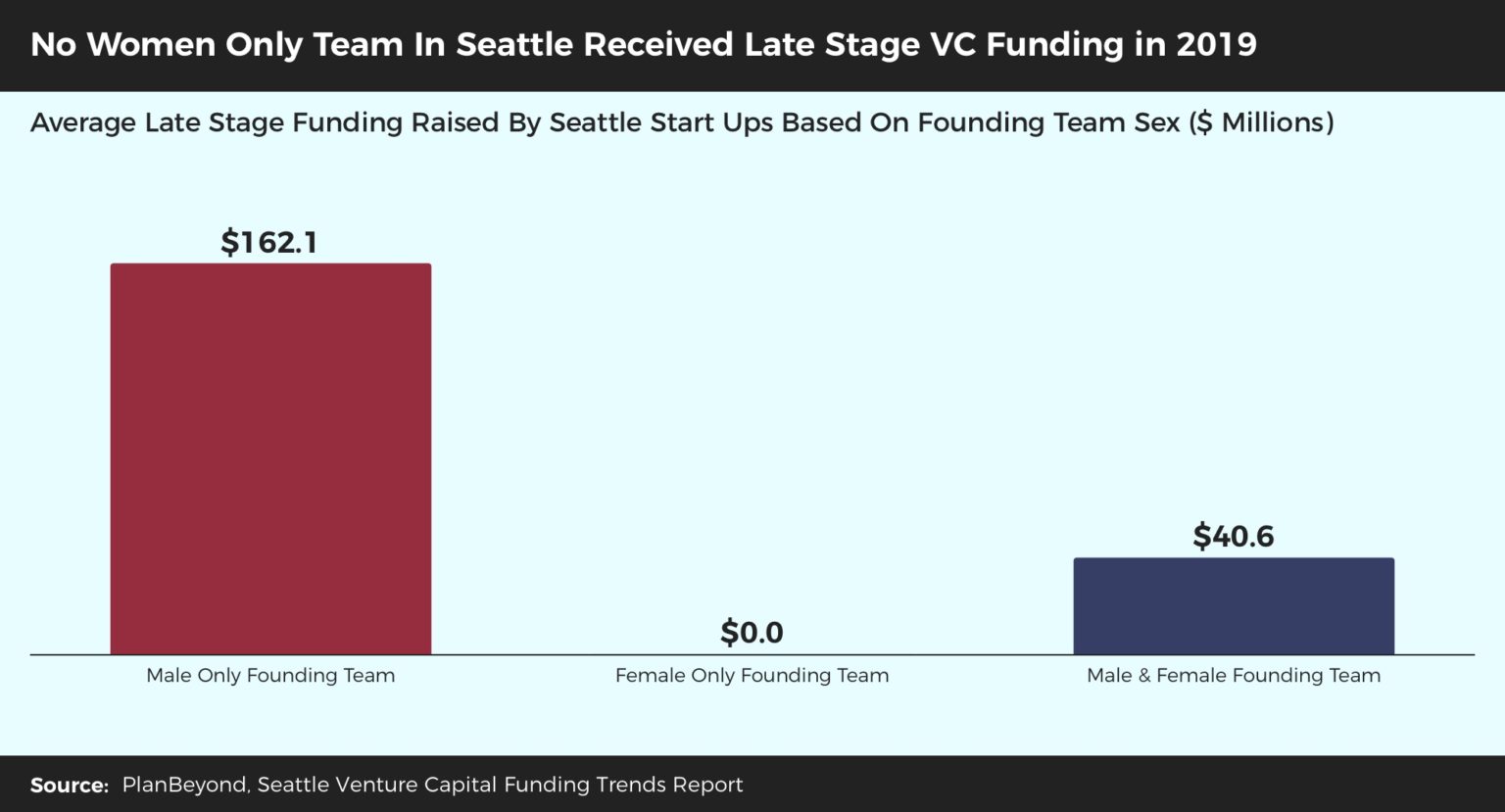

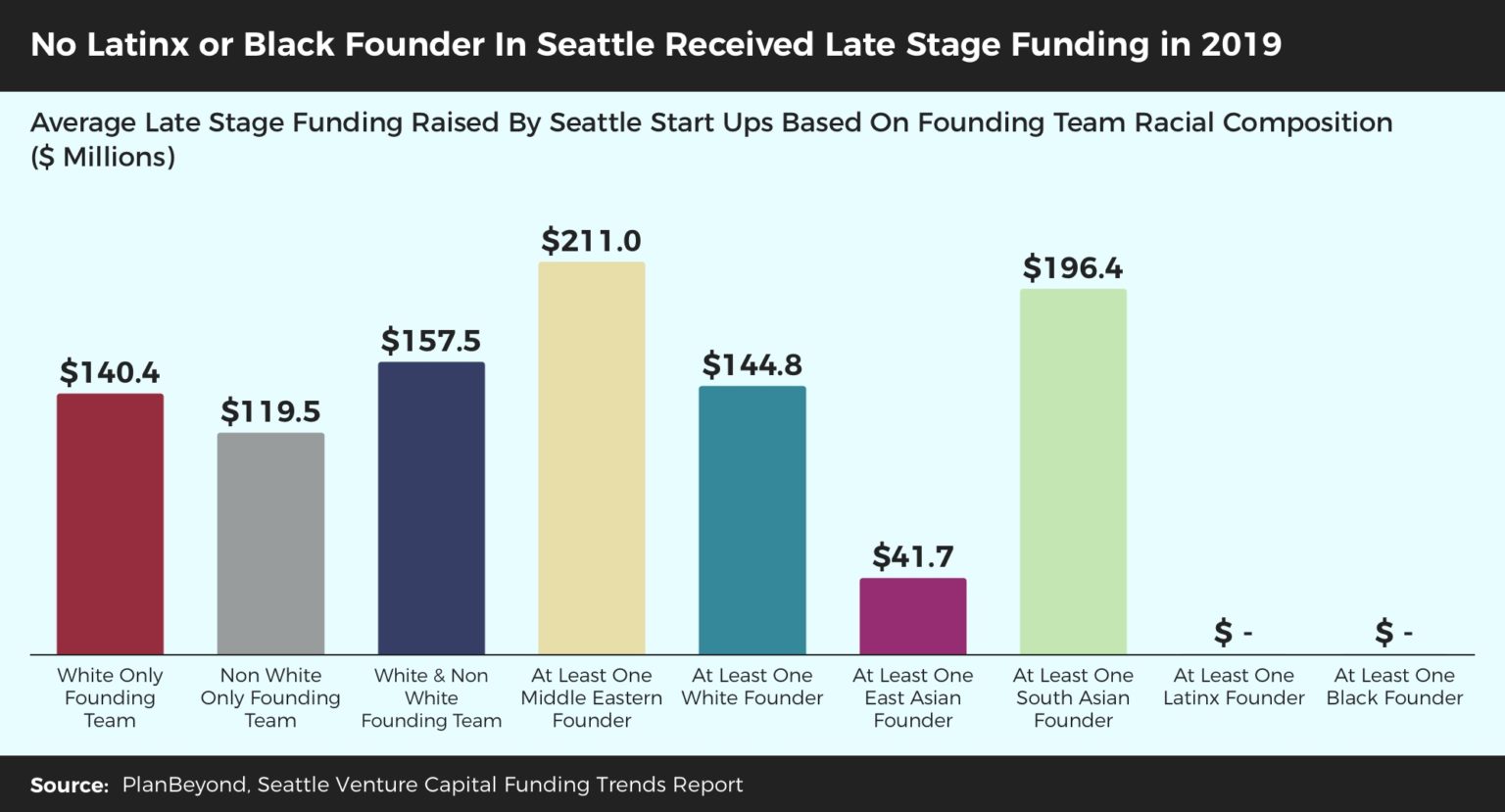

As we examine how founder race and sex impacts venture funding during late stage rounds, we see the true cause behind funding disparities.

Not only did zero Women only teams in Seattle raise late stage funds, teams composed of Men & Women raised $40.6 Million, a far cry from the average $162.1 Million raised by Men only teams.

At the same time, not a single company with at least one Black or Latinx founder raised late stage funding.

Conclusion

A common rationale used to explain the lack of investment in Women founders or Non White founders is the lack of talent in the pipeline. That is, it’s not that venture capitalists don’t want to invest big in these founders but rather that aren’t enough talented individuals in these groups to invest in.

Our data is telling a very different story in the Seattle market.

Even when venture capitalists invest in Women and Non-White founders, less of them tend to invest and they invest at lower amounts. With so few of these founders even getting a chance at funding, the fact that they raise less than their White and Male counterparts puts their organizations at a disadvantage from the get-go.

Not only does this lead to perpetuating unequal investment funding but it could lead to missing opportunities to improve our society in general. After all, our original research on the subject showed that organizations founded by Women and Non White teams are more likely than those founded by White Men to develop products and services that support improved health outcomes, better access to education, promoting safe communities, designing more flexible public transportation, and ensuring equitable resource access to traditionally underserved communities.

If venture capitalists truly want to bring investment equity to the Seattle market, they must review not just who they invest in but also how much they invest in them. Of course, this need not be in isolation of seeking strong returns. These are risky investments after all, and only robust results could justify such funding. However, there’s no reason to believe VC firms can’t have strong returns and play a role in bringing equitable funding outcomes to our region.

Methodology

Starting with publicly-available data published by Crunchbase, a platform for finding business information about private and public companies, we compiled a list of all companies receiving venture funding in 2019, including seed, early, and late stage funding. Organizations receiving venture funds for IPOs or mergers and acquisitions were excluded.

Again, using Crunchbase, we gathered the names of every founder associated with these organizations. Using a host of public, digital sources (e.g. LinkedIn, Google Image Searches), we gathered information on each founder including sex, race, education, and professional background. To determine race and sex, data coders were asked to select the race and sex they believed most closely described each founder, using cues like physical traits and first and last name. While not a wholly perfect approach, it attaches labels to founders based on easily-visible traits and therefore mimics how founders are likely initially perceived when interacting with investors.

Upon collecting all raw data, Seattle-area companies, and their founders, were isolated to allow for market-level analysis. We reviewed demographic trends in founder team composition as well as the way race and sex of founders and founding teams impacts investment rounds and money raised.