How strong is your brand? How effective are your marketing and sales activities (relative to the competition)? If you care about any of these things, you need to care about customer lifecycle stages, and how efficiently customers move across those stages.

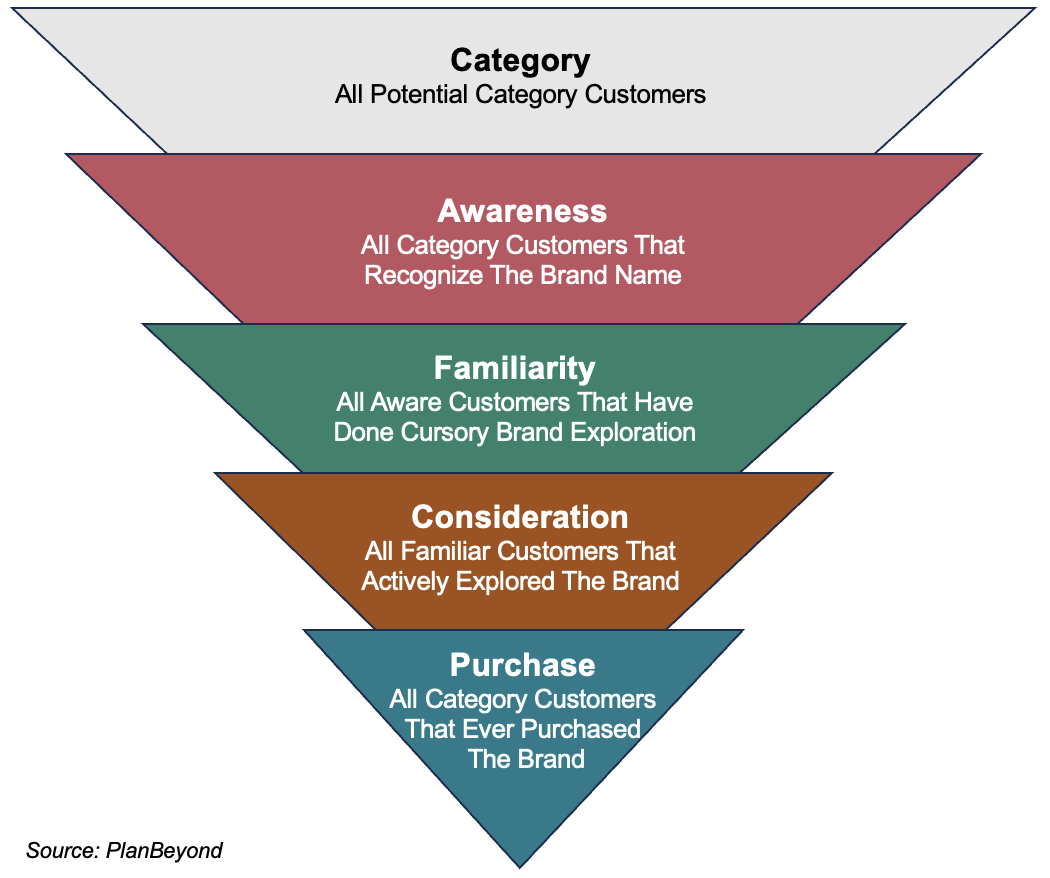

As prospective customers transition from early brand awareness to making a final purchase, they pass through key steps or lifecycle stages. Knowing where customers are in each stage, and how many actually move to the next step, provides incredible visibility into your branding and marketing spend efficiencies.

The better your conversions, the better your branding and marketing activations. But, the weaker your conversions, the more you need to zero-in on improvement opportunities.

The Strategic Intel You Get From Customer Lifecycle Stages

Why should you even care about lifecycle stages, let alone how well customers convert across those stages? Simple…

– Know your market penetration. Without knowing the lifecycle stages for your brand, you’ll never fully understand how much of the category or market you own.

– Know how effective your branding / marketing / sales activities are. It takes time to get a customer to buy, which is where branding, marketing, and sales come in. If you want to know how effective your activities are, or where they most need improvement, you need to understand lifecycle stages.

– Know how effective your competitors’ marketing / sales activities are. When you measure your brand’s market penetration and marketing / sales efficacy, you can measure these same dimensions for competitors. This gives you at-a-glance details about how you really stack up in your broader category.

Key Customer Lifecycle Stages

Let’s look at the actual stages any business, B2B or B2C, would likely have. And yes, this is the classic funnel. But, even if you’ve seen it a million times, it bears reviewing again. After all, it’s a good reminder that you’ll need to take the stages listed below and determine if they are the right ones for your business. Or, if you need to make some adjustments to adapt to your business conditions.

– Awareness: In this stage, we measure all of the people who have any awareness of a brand whatsoever. They could be avid customers or just people who have heard of the brand somewhere. If they recognize the brand, they have awareness.

– Familiarity: Familiarity takes awareness to the next stage. This may include people who have done some minor exploration like visiting a website or checking out a product in person.

– Consideration: The consideration stage indicates an individual made an active commitment to learn more. For a consumer product, this could be trying a product on or reading its label. For a B2B business, this could mean requesting more information.

– Purchase: The last and final stage includes anyone that has purchased the product at any time. Given the lack of time span indicated in this stage, some organizations may break this into two stages: Recent Purchase and Non-Recent Purchase.

Measure Customer Lifecycle Stages & Lifecycle Stage Conversions

With the actual life stages defined, it’s time to know how many customers are in each stage. And, with that, how many actually move to the next phase in the purchase funnel.

This is a three-step process that starts with gathering survey-based data to collect clean information about category buyers.

1. Assess Each Category’s Shoppers Life Stage

We first need to know where customers are in a particular stage for each brand we care about. This means using surveys to ask individuals how engaged, or not, they are with particular brands. Let’s use the ketchup category as an example. We’d want to survey individuals who are primary household shoppers and first ask them a brand awareness question. It would look something like:

Please look at the list of ketchup brands below. Which ones have you heard of? Select all that apply.

• Heinz

• Hunt’s

• Newman’s Own

• Muir Glen

• Store Brand

• None of the above

This gets us one key piece of information out of the gate, which is aided brand awareness.

Once we know aided brand awareness, we ask a brand engagement question like the one below. You’ll see that each answer choice tracks back to a specific lifecycle stage.

You mentioned you were aware of [BRAND]. Which of the following best describes how familiar you are with the brand?

• Heard of them [AWARENESS]

• Looked at them once or twice [FAMILIARITY]

• Checked out their product on shelf [CONSIDERATION]

• Purchased their product in the past year [PURCHASE]

• Purchased their product, more than one year ago [PURCHASE]

Once we do this for every respondent, we are ready to jump into step 2.

2. Measure Customer Lifecycle Penetration & Conversions

With the data in-hand, it’s time to build out the lifecycles and funnels for each brand.

We’ll use some completely made up numbers for a Store Brand as our example. Let’s say after running our numbers, we back into the following rates of customers at each life stage for our Store brand:

• 50% aware of the brand

• 10% glanced at the brand

• 8% checked out the product on shelf

• 5% purchased the brand at any time

• 4% purchased the brand in the past year

3. Evaluate Weak Conversion Points

As we look at the numbers above, two key opportunity areas pop out at the top of the funnel. Only half of category customers know the brand exists at all. And, among those, very few bother to even look at the brand. Meanwhile, if they do look, they are very likely to actively explore it and buy it.

This quick analysis tells us that the Store Brand would most benefit from marketing and branding activities to improve awareness. And, following that, just winning some glances. This might mean awareness advertising to get people to the category. After focused work to drive awareness, the brand could consider improved package design and on-shelf placement to increase shoppers actually checking it out.

Additional Measures To Capture In Customer Lifestage Research

As you saw in the example above, mapping customer life stages all starts with doing survey work. This means we can also include other relevant questions in survey to collect additional information. For this reason, we frequently suggest three additional evaluation areas.

• Purchase Consideration: Regardless of whether someone has purchased or not, it’s great to know if they would be open to purchasing. By asking category customers what brands they would be open to purchasing next, organizations get insight into brand perceptions and willingness to consider.

• Purchase NON-Consideration: Also of value is measuring if there are brands customers would not consider, independent of whether they know them or not. This shows if awareness is in the neutral-to-positive spectrum or if it’s a negative type of awareness.

• Favorite Brand: Another dimension to consider asking is which brand is the respondent’s favorite. Being a favorite brand comes with the likelihood of strong repurchase. Brands that have high “favorite” ratings likely have high loyalty and will “win” the category.

These aren’t exhaustive options. Consider additional questions that build further understanding of the brand category, perceptions, and penetration.