So you’re ready to start marketing your product…or perhaps you’re ready to ramp things up and start spending more. Of course, you’ll need to put a complete budget together. Sounds pretty simple, right? Well, sort of.

Figuring out the typical line items that should go into your budget may not be too challenging. But building the budget alone is not enough. Without assessing spend efficiencies, and how your budget matches up with the likelihood of meeting business goals, you may be selling your go to market plan short.

These considerations should be your last line of defense when building marketing budgets. They let you “kick the tires” and determine if budgets and business goals are aligned, or if it’s time to reassess your approach.

Typical Marketing Budget Components

First things first, let’s start off with reviewing the typical marketing budget costs. After all, we shouldn’t take it for granted that these are all top of mind to begin with.

Media Fees If you plan to do any type of advertising at all—Google, Facebook, radio, TV—you’ll need to budget for actually getting your ads live on these channels. A big piece of this is determining which you’ll want to advertise, and how much to spend each month.

Contractors & Agencies Chances are, you won’t be ready to hire a bunch of full time talent. As a result, you’ll want to factor in fees associated with hiring agencies or freelancers for some, if not all, of the following areas:

- Creative development (e.g. ad creative, graphics, page layouts, etc.)

- Content development (e.g. blog posts, ebooks, white papers)

- Website developers and managers

- PR agencies

- Ad agencies

Software Fees & Licenses You’ll likely have to pay monthly or yearly fees for software or licenses to help run your marketing activities:

- Website Fees (e.g. hosting, website platforms, e-commerce platforms, etc.)

- Marketing Software (e.g. marketing automation, email, social media publishing)

- Domain licenses

Salaries & Benefits If you plan to have a robust marketing plan, you’ll likely need at least one full-time, experienced marketer on your team.

This is by no means an exhaustive list. Depending on your marketing plan, you may also need statisticians, front end developers, interactive designers, or other talent. Regardless, the list above will likely be a good starting point for what almost any business needs to get going.

The Critical Next Step After Building Your Marketing Budget

Once you’re budget is built, you’re not done! Now comes the ever-important task of validating that your budget actually makes sense. Most organizations have goals in place for new customer growth. With those goals in-place, we can gut-check if the budget will help support them…or if it’s an unreasonable expectation.

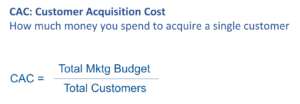

Calculate Customer Acquisition Cost

With a budget in-hand, one of the first key things to calculate is customer acquisition cost (CAC), a key marketing metric that shows the amount of money needed to acquire a new customer. The simplest way to calculate CAC is to take the entire marketing budget and divide it by the total number of new customers the organization expects to earn.

An ideal CAC is different for every company. Some businesses require more marketing to bring a new customer in. This will result in higher CACs. Some need little marketing. This results in smaller CACs. However, the best way to assess CAC viability is to measure customer Lifetime Value.

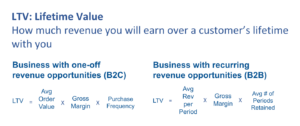

Calculate Customer Lifetime Value

Lifetime value (LTV) is how much profit you’ll earn from a customer during the duration of their time with your business. For businesses that require a customer to place an order, LTV is essentially the typical number of orders placed over time by a customer multiplied by the standard order gross margin value. For subscription businesses, it’s the revenue earned from the subscription multiplied by the average number of subscriptions made by a customer.

For companies with some history of being in-market, you can look at historical order values and re-purchase rates to measure LTV. For completely new businesses, take some conservative assessments (e.g. 2-3 average orders) to estimate your LTV.

With LTV in-hand, you can now look at your CAC and see if it makes sense. If LTV is greater than CAC, there’s a good chance you have a viable business. This would mean that the marketing budget will bring in valuable-enough customers to make up for the cost spent to acquire them. But, if LTV is lower than CAC, you should pause and assess if your marketing approach and customer acquisition goals need to be re-jiggered.

Using Budget Analysis To Set Business Goals

How does this all tie back to budgets and business strategy? We’ll go through some scenarios below that show how budgets and acquisition goals are a mix of art and science. While numbers can always be calculated to provide an attractive result, they should always be evaluated for reasonableness.

Scenario One: B2B Software Business With Annual Subscription

- Annual Marketing Budget: $1,000,000

- New Customer Goal: 30

- Average Order Value: $15,000

- Average Subscription Renewal Rate: 5 Times

The CAC is $33,333 and the LTV is $75,000. Under this scenario, CAC is lower than LTV. It passes the initial test.

However, if the organization has extremely long sales cycles, typical of businesses selling into large enterprises, the goal of 30 new customers may be unreasonable. If a more likely goal is 10 customers, then CAC becomes $100,000. CAC is now higher than LTV meaning we need to reassess things.

Perhaps we need to re-look at the budget and be more judicious with spend. It could be that the organization needs to re-set its customer goals numbers. Or, the team could decide to knowingly accept high CAC numbers in an effort to speed up (unprofitable) growth. Regardless of the option, this now becomes an opportunity to discuss acquisition goals, spend, and business objectives.

Scenario Two: B2C Business Selling Widgets

- Annual Budget: $250,000

- New Customer Goal: 300

- Average Order Gross Value: $175

- Average Re-purchase Rate: 3.5 Times

The CAC is $833 and the LTV is $612. Under this scenario, CAC is higher than LTV. It doesn’t pass the initial test.

However, it might force a reexamination of customer goals. Perhaps 300 is sandbagging and the organization should be more ambitious. Or, perhaps portions of the budget are being allocated in ways that have weak relationships to acquisition and can, therefore, be removed. Just as in scenario one, running these numbers become an opportunity to review budgets and goals, and assess if adjustments are needed.