You can’t build great products or services without knowing what your customer actually wants. And you can’t know what they want if you don’t take the time to even understand who they are in the first place. This is where market research becomes so vital: It affords teams the actionable insights they need to inform early product ideation, product or service development, go-to-market planning, and even marketing campaign messaging.

But, where do you begin? With so many research options available, you want to make sure you’re selecting methods that will address your short- and possibly long-term business objectives. After all, no single method is a market research silver bullet.

We’ll review four common market research approaches, and bring to life to what makes each one so powerful…but also the inherent limitations that prevent any single method from being the answer to all your research needs.

Diary Or Observation Research

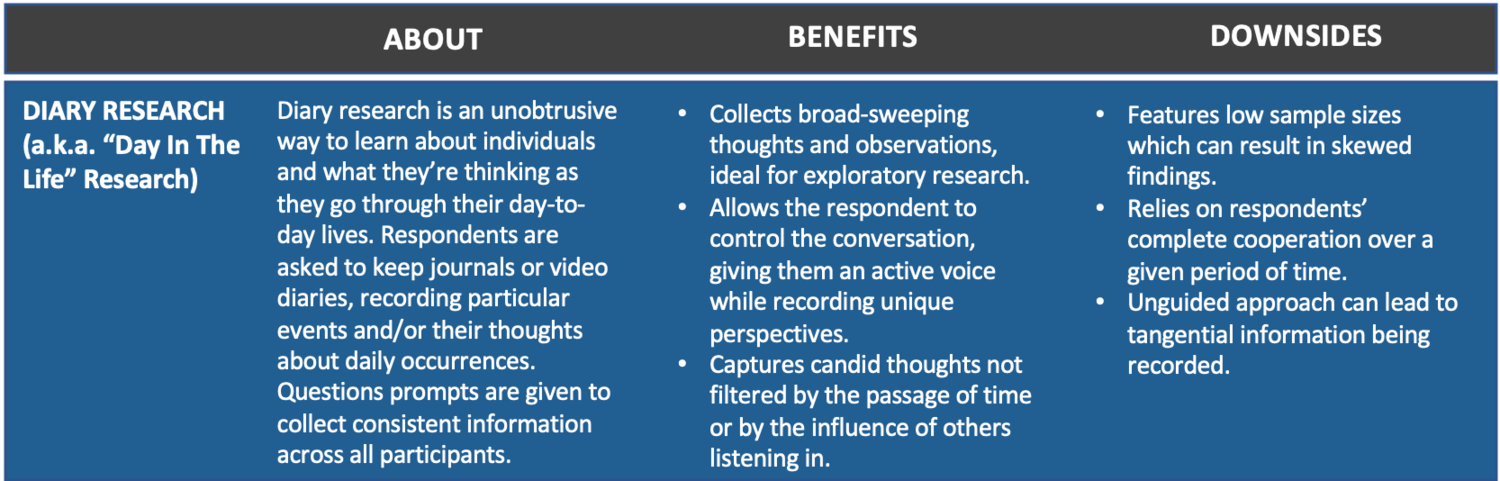

While it goes by many names (e.g. diary research, ethnographies, research communities, etc.), observational research is one of the richest ways to gather unfiltered information about a population or customer set you want to learn more about.

As the name implies, it’s an excellent way to observe a group with limited intervention, meaning you get real, unadulterated insights. While historically this meant physically following individuals around and observing them in certain situations or asking them to record thoughts in a journal, the advent of digital marketing research methods has broadened the types of observations available. Individuals can now be asked to record video diaries, video vignettes, or off-the-cuff audio recordings. This lets researchers record more real-time information while allowing respondents to more freely express themselves in natural situations.

Observational research is ideal when you know next-to-nothing about a group or population. Its open format lets you learn a wide range of details about individuals, letting you really “see inside their heads.†On the flip side, its open-ended nature and low sample sizes makes it extremely limiting when trying to hone in on specific details, or when you need statistically significant inputs to make informed, data-driven decisions.

Focus Groups

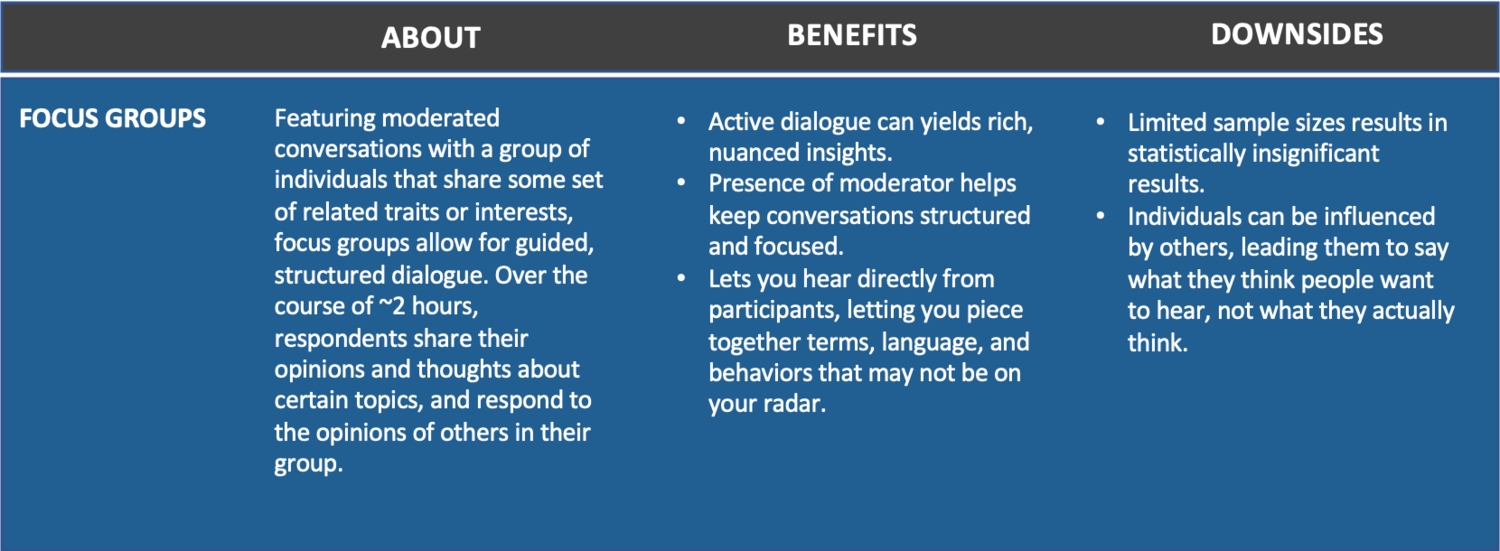

Featuring moderated conversations with specific customer sets or populations, focus groups allow for open, dynamic conversation while keeping to a specific conversation focus. Traditional offline focus groups generally include 8-10 individuals plus moderator, though the digital variety while likely feature closer to 4-6 individuals to better manage a group when using a digital portal.

Similar to observational research, focus groups can result in unexpected insights as participants engage in conversations with each other and the moderator. It lets you hear directly from respondents’ own mouths…while creating a bit more structure around what you hear. However, like observational research, focus groups are limited by naturally smaller sample sizes. Also, they can be more challenging with sensitive topics as participants may be less likely to share candid thoughts in the presence of others.

Population Or Customer Surveys

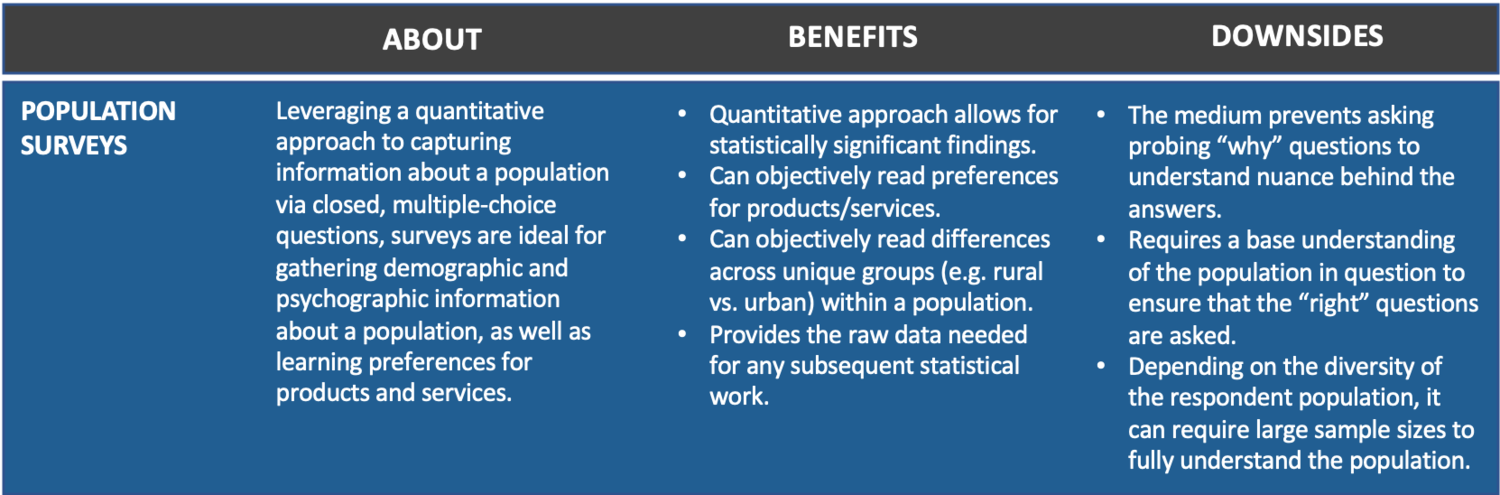

Taking a divergent path from the qualitative approach of observations and focus groups, survey research captures information about customers or populations in quantitative ways. By asking a variety of questions (e.g. single-select, multiple-choice, rank-order, etc.) to a large number of respondents, you can capture tangible, statistically significant trends.

Said another way, if you really want to know that you’re making concrete assertions about what individuals are like, how they perceive their environments, their perceptions of products or services, or anything else, surveys are the way to go. Large sample sizes can give you the confidence that you’re drawing the right conclusions, and let you explore the ways in which unique subgroups (e.g. different ages, sexes, racial or ethnic categories) behave.

However, the output is only as good as the questions you ask. As a result, this is an extremely weak research method when you know very little about a population to begin with.

Segmentation Analysis

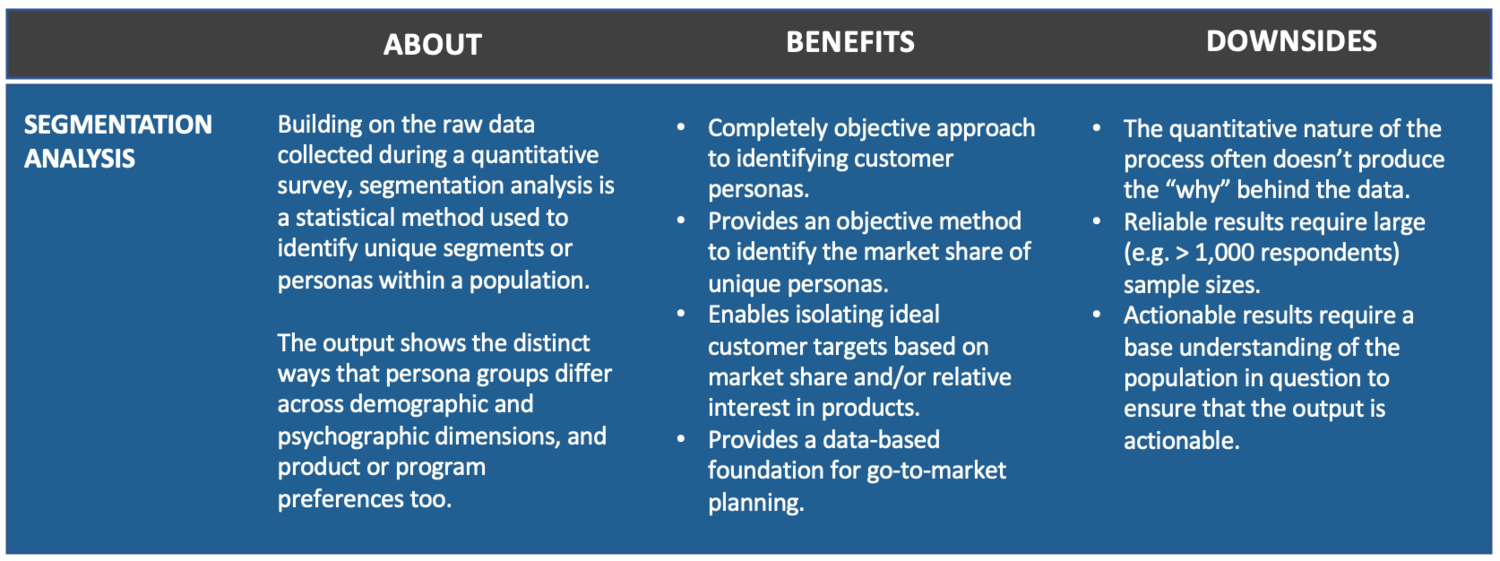

Technically a statistical analysis and not a standalone research method, we’re including this on the list since segmentation analysis does an exceptional job of letting you objectively hone in on unique segments or personas within a population. Performed via a statistical model called cluster analysis, segmentations lets you visualize what discrete group, differentiated by demographics and psychographics, make up a customer base or population.

It’s an extraordinarily objective way to zero-in on ideal customer targets and understand their market shares as well as preferences for unique products or services. Yet, the raw data for segmentation studies come from a broader population survey being conducted first. As a result, it falls prey to the same weakness: if the right questions weren’t asked initially, due to limited exploratory research, the raw data won’t be strong and neither will the unique segments uncovered.

Selecting Research Methods Based on Business Objectives

While we’ve spent time reviewing the pros and cons of different research methods, what we’ve really done is focus on tactics, and not strategy. After all, no one is doing research just for the sake of doing research. We’re doing it to address very definite questions or business needs. As a result, before you decide on a research method, a better starting point is isolating your research goals. They tend to fall into one of two categories:

-

Broad, Exploratory Understanding: When you’re completely new to a topic, be it a product category, customer group, or general population, you’ll likely need some foundational understanding of how and what they are all about. This means performing exploratory research to begin getting a general picture and understanding.

-

Data-Driven Decision-Making: When it comes time to make business decisions, you’ll usually want to make informed, data-based decisions. This means performing more data-based research that will give you high levels of confidence that a particular path will likely resonate with your prospective customers.

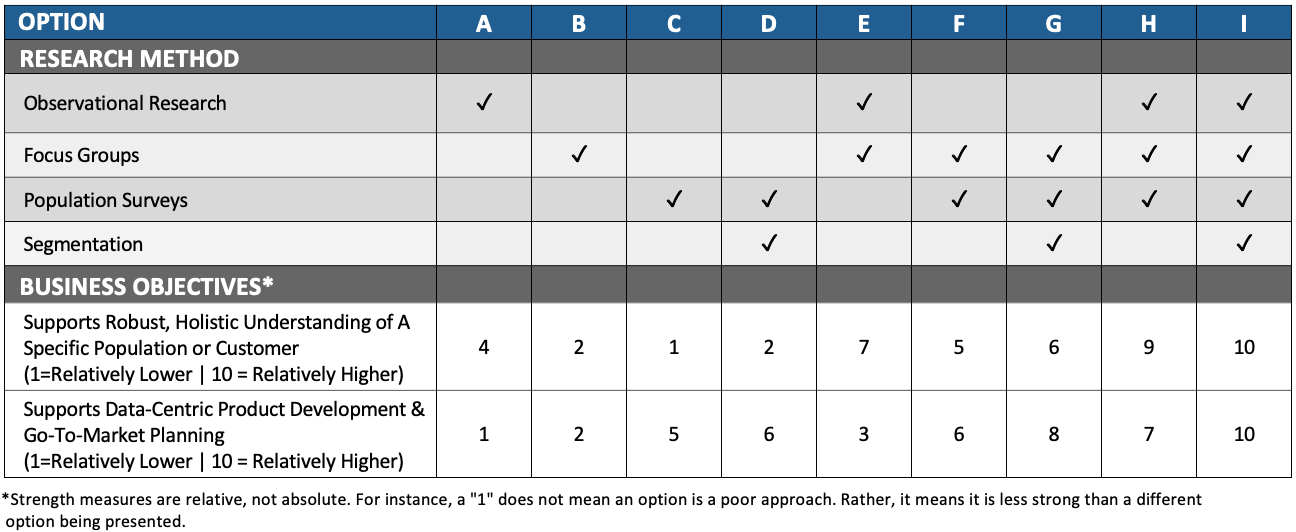

Of course, you might have both objectives in mind! If that’s the case, take a look at the table below to see how to best line up different methods based on your objectives. Unsurprisingly, if your objectives are more exploratory in nature, opting for observational or focus group research is best. In contrast, if your goals are to leverage data-driven decision making, then surveys and segmentation are ideal.

However, take note of Option I which includes both qualitative observational and focus group methods coupled with quantitative population surveys and segmentation. This comes out as the strongest option when wanting to optimize either exploratory understanding or data-centric decisions. This is not a fluke!

Running robust exploratory research gives you the foundations you need to ask the right questions in your surveys and therefore get actionable data to work on. Relatedly, spending time on survey and segmentation work gives you an objective level of detail into customers groups or populations that qualitative research alone does not provide.

As a result, we say start with your goals and objectives first. With those in-hand, you’ll be better equipped to hone in on just the right research methods.