The foundation of every insightful thought leadership report is the quality of the questions you ask. Stunning statistics and fresh insights don’t come from generic or surface-level queries. They result from questions designed to dig deeper, challenge assumptions, and reveal real stories within your industry.

That means asking about evolving trends, homing in on concrete actions or tools, and getting a clear sense for both what’s happening now and what’s likely to happen next. When done correctly, the right questions turn into the rich data you need for content that will matter to your audience.

Understanding Thought Leadership Research

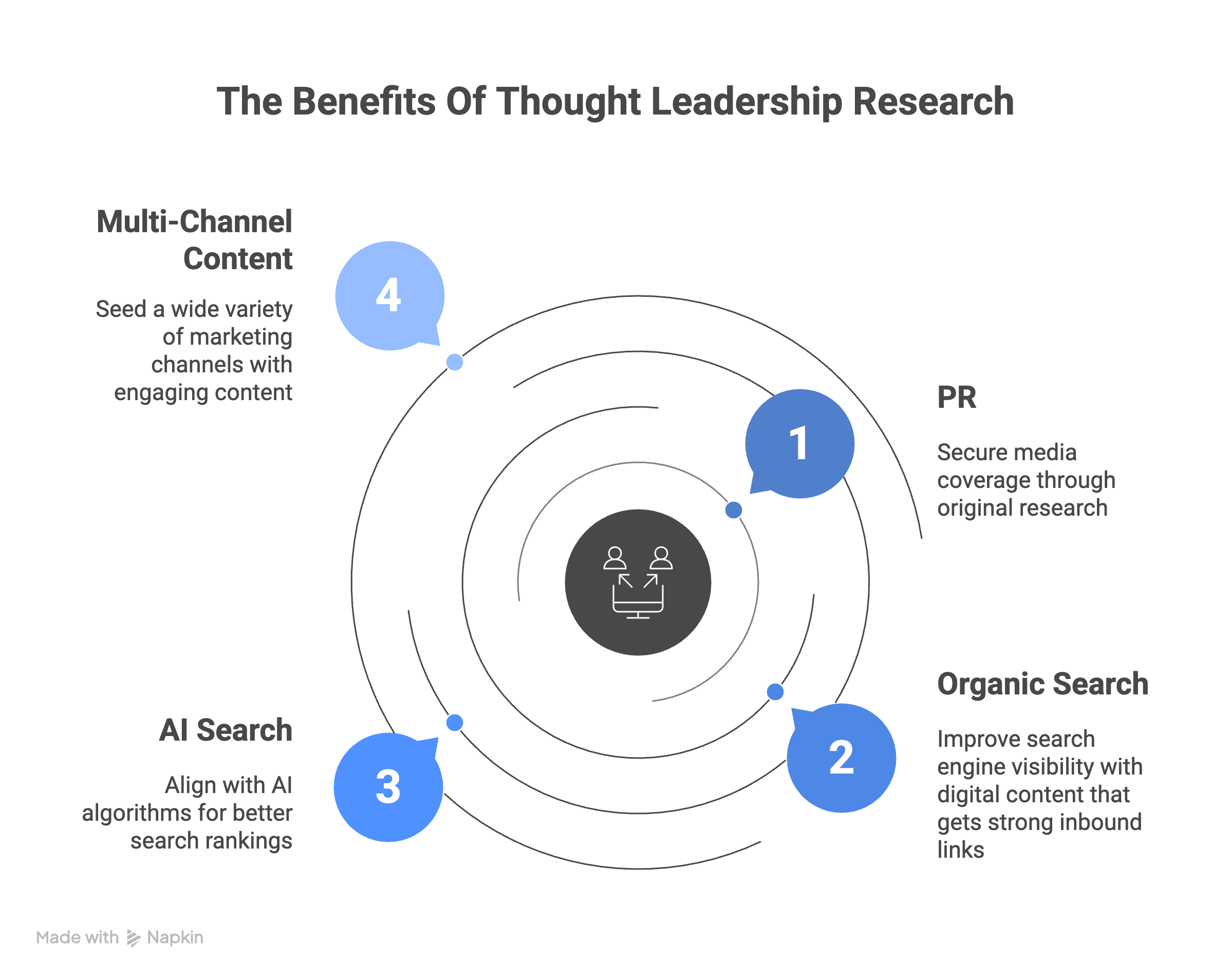

Thought leadership research is when a company funds original research to spotlight new trends, industry insights, or evolving customer perceptions.

But, this is not about producing a research report. It’s about grabbing attention, building your reputation, and turning heads in the media. When you publish unique data, you give journalists fresh stories to cover, earn links back to your site, and fill your content channels with information no one else has.

This work is the backbone of standout marketing. It powers your SEO, fuels lead generation, and fills your marketing calendar for months. Because the data is truly original, your brand stands out from the sea of generic content online. By sharing your findings across blogs, social, and email, you meet your audience where they are while boosting your credibility and visibility.

How To Avoid Generic Thought Leadership

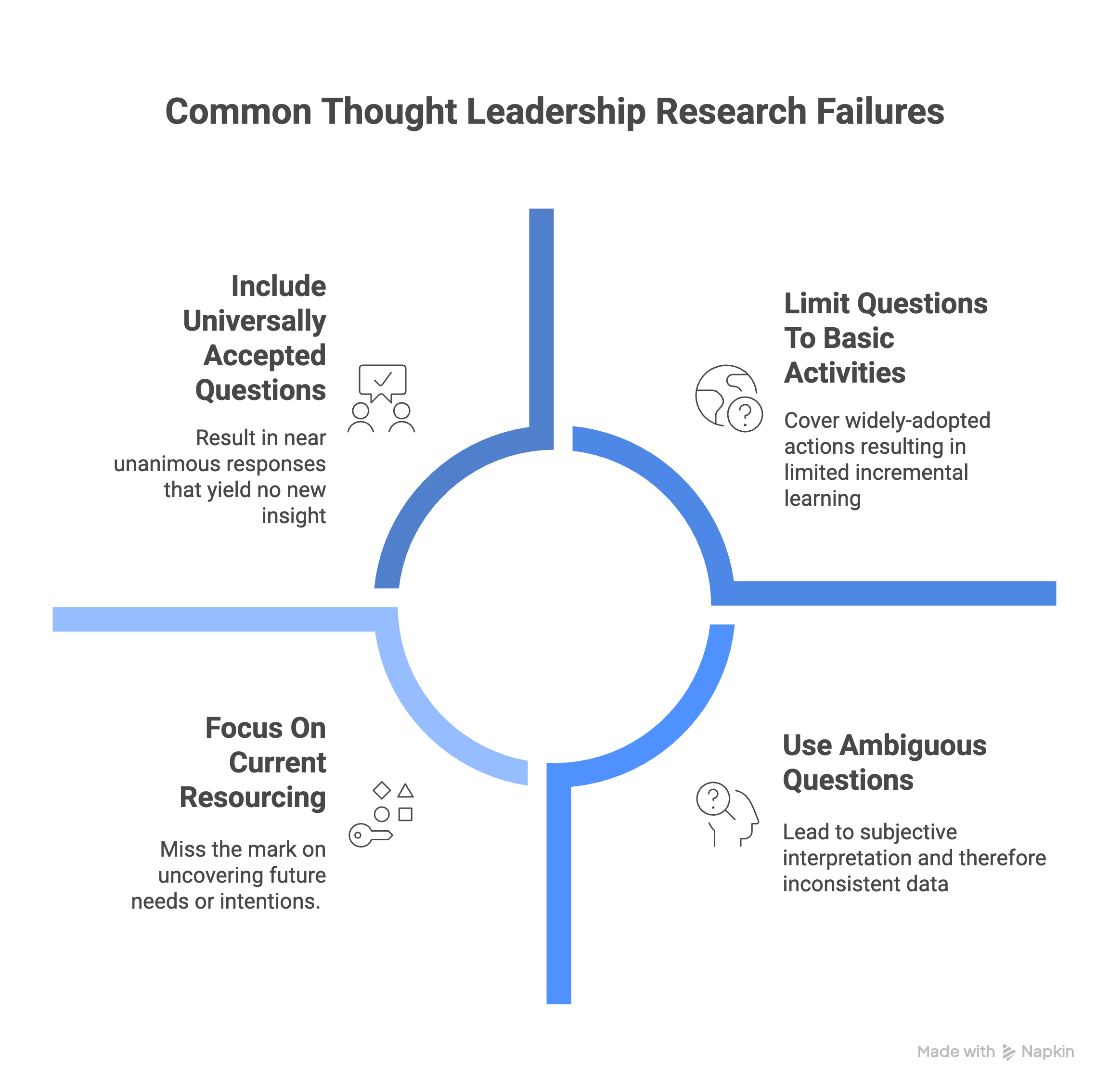

To get real value from thought leadership research, you need carefully crafted questions that dig beneath the surface. It’s easy to fall into the trap of asking questions that only confirm the obvious or capture what’s already known. But that won’t set your insights apart or illuminate where the industry is headed.

Let’s pick apart the common question pitfalls. And, we’ll use the example of doing thought leadership research for a cybersecurity company to help bring this to life.

Including Obvious / Universally Accepted Questions

These types of questions probe on universally accepted values. They lead to near unanimous responses that yield no new insight.

➡ EXAMPLE: Does your organization care about cybersecurity. Yes or No.

In our example above, we can expect everyone to agree that their organization cares about this topic. The result isn’t insightful; it’s just a confirmation of what’s already assumed to be true in the industry. You aren’t uncovering any real trends, challenges, or priorities, which defeats the purpose of using research to advance thinking for your audience.

Asking Ambiguous Questions

Ambiguous questions include language or terms that are up for interpretation. How one respondent thinks about the answer is fully subjective. As a result, respondents interpret it differently and therefore the data is inconsistent.

➡ Example: Does your organization have a state-of-the-art cybersecurity infrastructure? Yes or No.

In this case, “state-of-the-art” is ambiguous. What one respondent sees as world-class may be outdated to another. The results won’t lead to any definite conclusions.

Asking About Basic Actions

Questions about everyday actions or activities also generate fairly obvious responses. These activities are, to some degree, widely adopted meaning they yield no depth of insight.

➡ Example: Do you use automation in you cybersecurity monitoring? Yes or No.

Automation is such a standard practice in IT operations and cybersecurity that we expect high numbers of people saying “Yes.” Failing to probe on specific types of automation means we’re left with very basic and non-helpful intel.

Asking About Only Current Approaches

Questions that focus solely on current spending or resources miss the mark on uncovering future needs or intentions. They offer a snapshot of today, not a window into what’s changing, what’s lacking, or where priorities are shifting.

➡ Example: Do you spend money on cybersecurity? Yes or No.

This question just confirms the status quo. It doesn’t reveal whether organizations expect their needs to grow, if they’re satisfied with their current tools, or if they’re planning to implement new solutions. As a result, it fails to provide insight into emerging trends, future investments, or strategic intent.

How To Ask High Quality Thought Leadership Research Questions

If bad thought leadership research comes from asking fairly obvious, shallow prompts, good research incorporates nuanced questions. By introducing specificity while evaluating specific behaviors and future plans, good thought leadership research questions yield fresh, compelling insights.

Include Concrete Ways To Measure Attitudes

Incorporate tangible or concrete counterpoints when asking about a specific activity. By giving respondents a comparison set, you build insight into how much an activity or behavior is in play.

➡ BEFORE: Does your organization care about cybersecurity? Yes or No.

➡ NOW: How has your organization’s investment in cybersecurity software changed relative to other IT operations software in the past 12 months?”

- Increased a lot compared to other IT Ops areas

- Increased a little compared to other IT Ops areas

- Stayed about the same as other IT Ops areas

- Decreased a little compared to other IT Ops areas

- Decreased a lot compared to other IT Ops areas

The second question digs into real changes and priorities, while the first just gets a predictable yes or no. We went from vague interest into clear insights on how investment is shifting.

Ask Questions With Precise Probe Points

When you use concrete terms and clearly define what you’re asking, there’s no guesswork for respondents. Everyone is answering the same question the same way. This sharpens insight quality and lets you pinpoint how organizations align with industry standards or emerging tools.

➡ BEFORE: Does your organization have a state-of-the-art cybersecurity infrastructure? Yes or No.

➡ NOW: Which of the following cybersecurity tools or resources does your organization use today? Select all that apply.

- AI-Powered Threat Detection

- Dynamic Zero Trust Automation

- Robotic Process Automation

- AI-Driven Phishing and Social Engineering Detection

- None of the above

Rather than letting respondents self-define “state-of-the-art,” the second question does it for them. By including specific examples of leading-edge technologies and asking for adoption, we can now actually interpret how organizations are evolving.

Include Ways To Evaluate Nuanced Behaviors

It’s important to probe beyond basic actions to explore how certain activities or behaviors are carried out. Nuanced questions offer a richer picture of how organizations engage in specific behaviors. This helps you go from surface-level data to a detailed, actionable view of what’s happening on the ground.

➡ BEFORE: Do you use automation in your cybersecurity monitoring? Yes or No.

➡ NOW: Look at the cybersecurity activities below. Which of the following, if any, are places where your organization currently uses automation to streamline those activities.

- Asset Inventory Management

- Backup Monitoring

- Compliance Reporting

- User Account Management

- Certificate & Key Management

- None of the above

This question evolution takes us from a basic understanding of how organizations behave to a more thoughtful, nuanced understanding of how they embrace certain activities.

Structure Questions To Understand Current & Future Approaches

Questions that offer multiple options tied to current and future use offer a crisper read on where organizations sit in the adoption funnel.

➡ BEFORE: Do you spend money on cybersecurity monitoring software?

➡ NOW: Which of the following statements best applies to your organization’s investment in Vulnerability Management Software:

- We do not use vulnerability management software today and have no plans to invest

- We do not use it today, but are considering investing in the future

- We currently use it and expect our investment to stay about the same

- We currently use it and plan to increase our investment

While the initial question only gauges a point-in-time investment, this revised question provides critical intel about future market demand and organizational priorities.

Structure Research Questions Around Key Stories

As you start crafting your survey questions, don’t forget to see the forest from the trees. Develop clear narratives up front or ideas for stories you want to tell with your data. For instance, maybe you want to tell an IT automation story. Or, maybe it’s a story about how Gen Z has a fresh take on ready-to-eat meals.

Once you have these core stories in mind, then design your questions. This approach ensures your data collection is purpose-driven and aligned with your content goals, making every response a potential building block for a compelling, insight-rich report.