Too often, customer personas get lost in the wind. Either they get considered and forgotten, or no one cares about them from the onset.

These common issues often stem from one core problem: Zero data was used to create those personas!

In order for team members to buy into personas, and for personas to have actionable business value, a group brainstorm session is not enough. You need real data, collected across a large number of customers, to identify discrete groups, assess their needs and pain points, and isolate how you can impact their journey. It’s this in-depth process that yields respected, legitimate personas that team members can use to drive material business growth.

What Is A Data Driven Persona

Data driven personas use statistical methods to identify unique groups or clusters within a broader population. They characterize discrete customer groups by demographic, psychographic, and product usage dimensions to generate clear insights into who your distinct customers are.

Depending on the type of business category you are in, these can include several types of dimensions:

1) Demographic Metrics: More common in B2C personas, demographics include things like home region or home type, race/ethnicity, income, age, and other straightforward data points.

2) Psychographic Metrics: Psychographic metrics are generally attitudinal in nature. They help capture perspectives or opinions. Psychographics tie very closely to the particular issue or category of interest. This can include attitudes about technology, opinions about the environment, political ideas, or much more.

3) Product Usage Metrics: This data group captures how people engage with, or use, your service. Again, this is highly tied to what you sell, and could include purchase frequency, services purchased, or features used.

By collecting these diverse data points across many, many customers, you capture a holistic view of who they are and what makes them tick. It offers insight into purchase or decision drivers as well as barriers to consideration. And, more importantly, how these elements vary by distinct personas.

How To Create Data Driven Personas

Producing data driven personas, sometimes called customer segmentation, hinges on a big data collection project. We typically start by surveying about 1,000 respondents, if not more. This survey captures the data points mentioned above, and homes in on those attitudes or purchase consideration factors we think influence different groups.

Once all of the data is in, the next step is to perform a factor analysis. This analysis helps us identify where there are overlaps across all respondents in how they answer certain questions. It’s a key step in synthesizing and simplifying the data we’re working with. From there, we move onto latent class analysis, an additional method that isolates distinct clusters within a unique population.

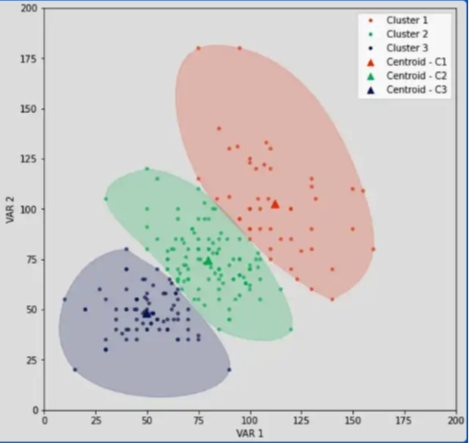

The end result is a set of unique clusters that show how groups of respondents band together based on demographics, psychographics, and product usage metrics.

The image on the right shows this final output in action. In this case, the data tells us that within the population we studied, there are actually 3 unique clusters or segments.

Business Implications Of Better Personas

As we always say, no one builds data driven personas just for the sake of it. They do it because of the strategic activities this type of work informs. In fact, there are many broader business and marketing areas this work frequently impacts.

- Customer Targeting – When we finalize the clusters, we see what percent each cluster represents within the broader population. This percentage, or share of population, tells us how big (or small) the group is. When we identify large groups not engaging with our product or service, we know there’s an opportunity.

- Product Roadmaps – Related to the topic above, this work identifies the barriers each cluster or segment faces when considering a product. By isolating those barriers, product and marketing teams glean key issues they must address to overcome those hurdles.

- Messaging & Positioning – By identifying what appeals or impedes each segment, we gain insights that inform product positioning and messaging. This is key for building products that must stand apart in crowded categories.

- Lifecycle Marketing – Another opportunity is targeted lifecycle marketing. Cluster work lets us see where each each segment is in their buyer or consideration journey. This lets marketers create plans to target each one in personalized ways to increase their engagement.

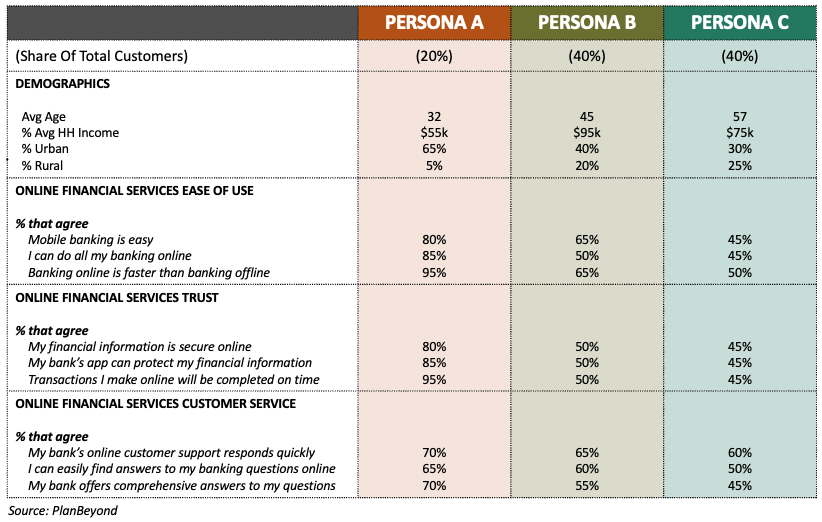

Let’s look at some pretend data we mocked up to see this all in action. In the example on the right, we pretended that we have a banking client. Their goal is to understand their customer segments, especially as they relate to using mobile banking services.

Out of the gate, we see there are three personas. While one is smaller at 20% of the total population, the other two are larger at 40% of the population. This offers an initial sense for where there are larger opportunities.

As we home in on Persona B and C, we see that they skew older but also better off financially. Also, the psychographic questions are very telling. By examining perceptions across each group, we see variances in ease of us, trust, and service.

As a result of this work, we’ve identified several key barriers to getting older but wealthier customers engaged in our online banking. In this case, our client would need to evaluate their service to improve perceptions of trust and positive customer service. Further, their marketing team would need messaging and advertising to support those service innovations. Lastly, at a more tactical level, marketing would want to consider targeted collateral or marketing campaigns to better engage Persona C and B.

How To Gauge If You’re Ready For This Work

Building data-informed personas yields powerful, valuable insights to fuel a host of business activities. However, it requires significant resources to complete.

As a result, you should ask yourself if you or your organization is ready for this kind of work before embarking on the project.

How should you determine if you’re ready or not?

We suggest asking yourself if you have the team or resources to take action on the persona findings. For instance, do you have product managers or brand managers to oversee the product innovations the research may suggest? Do you have brand strategy or visual design resources to update messaging, positioning, and the overall look of your product? Do you have marketers adept at targeted marketing programs and campaigns?

If you have the resources, you are likely ready to take this step. You’ll arm them with valuable insights to drive strategic activations. On the flip side, if you don’t have these resources either internally or externally, it’s likely too soon for this level of work.