What happens when you spend time, money, and energy on marketing and customer acquisition…only to fall short of your goals?

Naturally, you ask, “What happened?”

The answer could be one thing, or a medley of things. From product-market fit to pricing to customer targeting, companies could have some or all of these things wrong. But, you don’t have to be left guessing. With straightforward, objective research approaches, organizations can quickly pinpoint what went wrong and properly evaluate how to fix the problem.

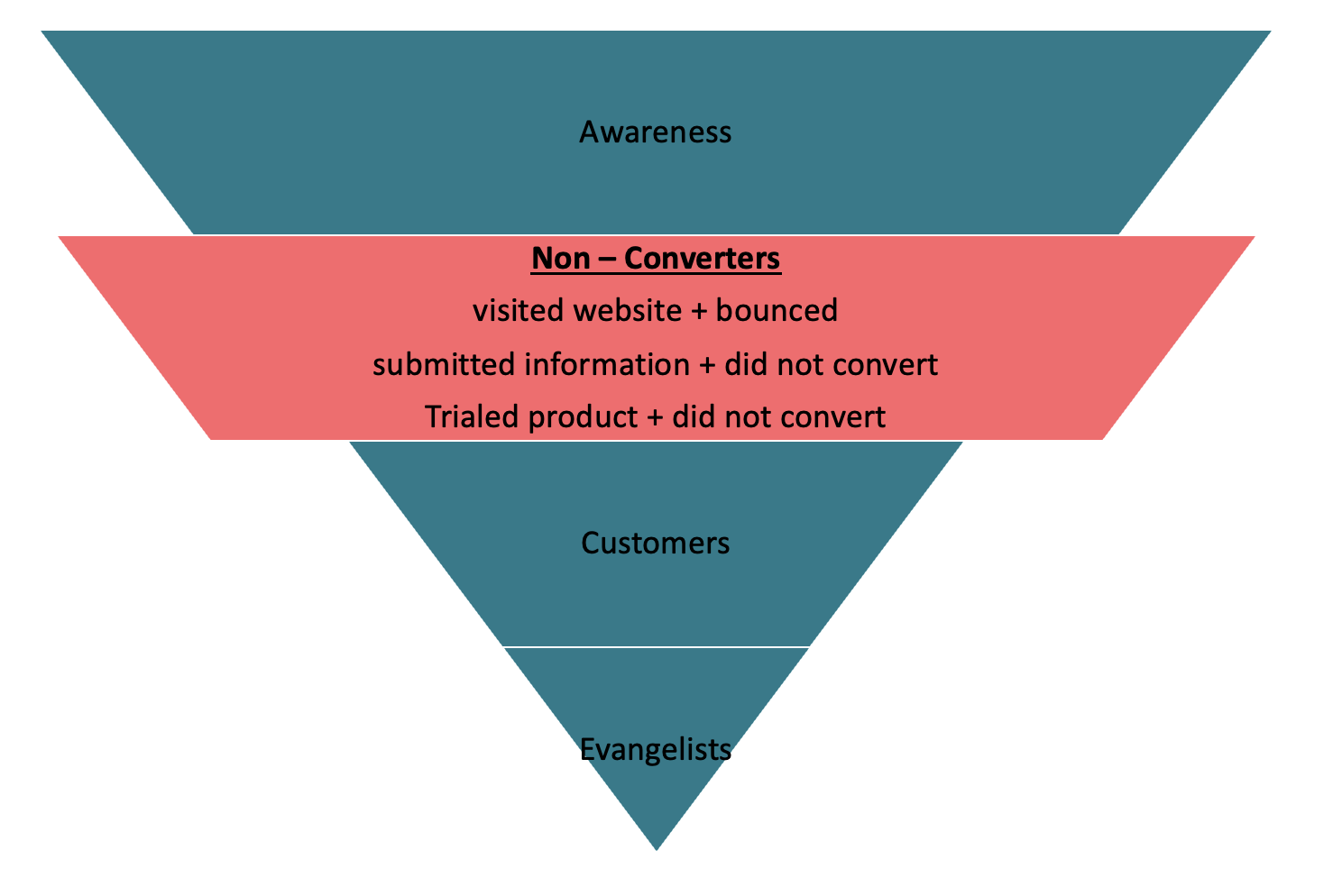

What Is A Non Buying Customer

Obviously, a non-buying customer is someone that does not buy. But, this high-level category includes individuals at all different places in the buyer journey. At the very least, they have engaged with the brand. For instance, they may have visited the website. However, from there, these people could be:

– Website Bouncers: This includes anyone that comes to the website and does not convert.

– Lapsed Leads: This includes anyone that has entered their information at some point in time, but never became a customer.

– Lapsed Inbounds / Trialists: This includes individuals that actively requested information from a sales team or actually tried the product. However, they never ultimately purchased.

The last category is often the most valuable focus area. This includes individuals that showed genuine interest. But, due to some reason, they never got to the finish line.

Likely Reasons Customers Are Not Buying

Before you jump into any research to explore why a customer is not buying, you need to start with a series of hypothesis. It’s only once you have hypotheses that you know what to test in your research. Let’s break down the typical issues we see when there are non converting customer issues.

Customers Are Not Buying Due To…Product-Market Fit

One of the most common reasons customers do not buy is due to product-market fit. This means that the product does not align with an existing market need. Or, that the market does not perceive it to align with an existing need.

In essence, the product’s positioning, value propositions, or benefits do not resonate with customers. Something may have initially piqued their interest. But, upon some further exploration, they do not see it as meeting a sought-out need.

Customers Are Not Buying Due To…Poor Targeting

Some products are better for small businesses rather than mid-sized organizations. Meanwhile, some are better for super tech-oriented people than more latent adopters. When companies don’t target their product to the right audience, its message and benefits fall flat. This doesn’t mean the right audience isn’t out there. Rather, it means the current audience isn’t the right one.

Customers Are Not Buying Due To…Product Uncertainty

Another common issue is the classic, “I don’t understand how it works.” With this problem, customers like the general idea of what the product says it does. But, they may not understand the actual way that it functions. And, without this insight, they are not willing to invest more time exploring the product or service.

Customers Are Not Buying Due To…Price

Even the biggest of enterprise customers have some level of price sensitivity. That is, no matter how attractive a product might be, the price may not be right. Pricing issues encompass a range of things including, individual price points, term or contract commitments, and even how charging is done.

Customers Are Not Buying Due To…Trust

Products or services may sound great. The price may even be just right. But, if customers don’t know anyone using it or don’t see any proof points, they may not trust it. This is especially true when customers cannot try a product before they buy it. Or, if there is serious onboarding process that makes getting started daunting. Without that trust, customers may be wary of getting started.

Find Out Why Customers Are Not Converting

When entering into a situation with a lot of hypotheses and a lot of unknowns, we typically suggest performing one-on-one, in depth interviews. While you can only do so many interviews due to their time intensiveness, they are a fantastic way to get a broad lay of the land.

Let’s look at the types of questions we suggest using when exploring any of the hypotheses above.

Product-Market Fit

- Tell me about some of the biggest challenges you face in your everyday tasks.

- I’ll read you a description of a product and I’d like to hear your initial impression. [READ DESCRIPTION]. What are your initial impressions?

- What is one thing you really like about this product?

- What is one thing you really dislike about this product?

- How well do you think this would solve those challenges you mentioned earlier? Why?

Poor Targeting

- How relevant is this product for you? Why?

- Which of your day-to-day challenges does this address? Why?

- How do you think this would be received in your organization/household/friend group? Why?

- What would be the #1 thing that would prevent you from using this?

- Is there someone else you think this would be a better fit for? Why/why not?

Product Uncertainty

- Do any questions or concerns come up as you think about this product?

- Would this replace something you use today? If so, what would that be?

- As you look at the [PRODUCT / SCREEN / INTERFACE], what draws your attention? Why?

- If it could include 1 other thing, what would that be?

- What would be the #1 thing that would prevent you from using this?

Price

- Think about other products like this that you’ve used or explored. What do you think would be a reasonable price for this?

- How would you want to pay for this? For instance, a monthly credit card charge, an annual invoice, or something else?

- How quickly could you make a purchase decision? For instance, is this something you’d have to budget for, or would you be able to purchase it when you want?

- Who else would be involved in making this decision? What would they have to say about price?

- Let’s say the price were [INSERT DESIRED PRICE]. What are your impressions of that price?

Trust

- What would need to be true about the product for you to pay for it today?

- Have you tried products like this before that did NOT live up to expectations? If so, what happened?

- What additional materials or information would you need to see to be confident it does what it says?

- Who would you like to hear from to see if this would be a good fit for you?

- What resources, online or offline, do you turn to to learn more about products like these?

How To Talk To Non Buying Customers

One of the best parts of research on non-buying customers is that you already have their contact information. In fact, most organizations in this position have a wealth of people they could speak to. But, they just haven’t done so. Yet.

When it comes to sourcing non buying customer research participants, we suggest looking at your existing CRM or contact database. First, consider who you want to speak with. This could be based on where they are in the sales or consideration funnel. In the case of B2B products, perhaps the type of company they work for, job title, or other relevant segments. If it’s B2C, it could be based on the products they browsed or demographic information you have.

Once you know who you want to talk to, ask them to connect! Invite these individuals to an interview. Let them know how long it will take, what the goal of the interview is, and what they’ll get in return for participation. We typically suggest interviews in the 45-60 minute range. And, be sure to match incentives or payments to what they would normally earn in that span of time. This process yields strong rates of people opting in, letting you collect the data you need to see what’s stopping customers from buying.