How often have your rolled your eyes when hearing about a new product’s $1 billion market size potential? Yeah, us too.

It’s exciting to imagine hockey-stick style growth curves when launching a new product. But, the reality is often far different.

Flawed approaches to measuring market size lead businesses to overestimate demand for a product or service. These estimates lead to overinflated expectations and lackluster results. Thankfully, this can be mitigated.

By using more thoughtful approaches to measuring a product’s market size, businesses get a more realistic sense for its potential. This yields better-informed go / no-go decisions that correctly use a business’s limited resources.

Why Measuring Total Addressable Market Is Not Enough

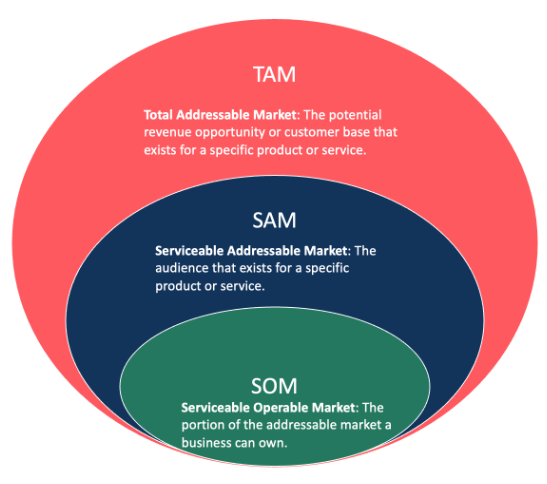

Those hyper-inflated $1 billion market size estimates often come when businesses just look at a product’s Total Addressable Market or TAM. It’s not that a TAM measurement is wrong. Rather, it’s just too simple.

Let’s pick apart what goes into a TAM measurement to understand why.

At its core, TAM looks at the absolute total revenue opportunity that exists for a product or service. That is, all the people that could ever possibly buy that item. It’s a good starting point. But, it’s too simple for several reasons:

- Price: It does not factor in price sensitivity or elasticity. Once you put a price on something, people are less willing to buy.

- Accessibility: TAM does not consider sales or distribution channels. If a person can’t access the product, they can’t buy it.

- Alternatives: TAM implicitly ignores the classic alternative of “do nothing” or “buy nothing.” People who choose not to opt-in will, again, not be part of the broader market size.

- Nuanced Needs: TAM fails to consider that people may want a product or service in a specific way. Just because you launch a product, that doesn’t mean people will want it how you deliver it.

In sum, TAM’s limited considerations yield market size projections that are (likely) too optimistic.

Using More Refined Approaches To Measure A Product's Market Size

If TAM isn’t sufficient, what is? We always suggest looking at two additional layers to correctly measure a product’s market size potential.

1. Serviceable Addressable Market (SAM)

SAM assesses the audience that would likely purchase your specific product or service. It factors in price, availability, features, and other factors that influence a customer’s purchase intent.

You can see this gets to a more realistic market size number. By taking into account customer decision drivers, SAM delivers smaller market size projections than TAM. However, it better captures market realities.

2. Serviceable Obtainable Market (SOM)

SOM goes one level deeper than SAM. It estimates the portion of the serviceable addressable market your company could realistically own.

SOM layers in additional factors like competition, distribution channels, and resource constraints that will impede owning the SAM. Once again, SOM will yield a smaller market size than SAM. However, these additional input considerations make for the most accurate market size measurement.

Collecting The Inputs Needed To Properly Estimate Market Size

At this point, you’re hopefully bought into the idea that TAM is a good starting point for measuring a product’s market size. But, you also understand that it isn’t sufficient. This leads to the logical next question: What process do I use to measure my product’s market size potential?

While we’ve gone into the nitty gritty details of this in a previous post, we’ll review the high-level steps below. And, we’ll use the example of a specialty water product to make things more tangible.

1. Measure Total Addressable Market (TAM)

When it comes to TAM, we suggest using pre-published secondary research for high-level market intel. This usually means finding a group that publishes market research about your broader industry or product category for a fixed fee.

Using our specialty water product example, this means looking for reports with data about bottled water, specialty water, and possibly functional beverages. While you could collect original, primary data, it’s usually not worth the price. Pre-published reports are more cost effective and you can have the data in-hand the moment you need it.

2. Measure Service Addressable Market (SAM)

When you’re ready to move down to measuring SAM, you’re likely ready to pursue primary research. This is because SAM measures product interest based on how you plan to take your product to market. Since it’s likely a unique product idea, no pre-published research will exist.

To get a sense for a product’s SAM, consider fielding a product concept test. Concept tests let you gauge the appeal for a given product based on its features, capabilities, pricing, and other key dimensions.

It starts by recruiting the right individuals into a study. In the case of our example, we likely want individuals who have purchased bottled water or functional beverages within a certain period of time. Further, we may want to put in other criteria based on findings from the pre-published reports. For instance, the reports might show that people of a certain age or income bracket are more likely to purchase them. If that’s the case, we’d want to only include these individuals in our study.

From there, we share the concept idea with our respondents and collect key information like purchase interest, relevance, willingness to pay, and other factors that gauge market appeal. With these data points in-hand, we start understanding what segment of the TAM wants our potential product.

3. Measure Service Obtainable Market (SOM)

At the SOM level, it’s time to factor in how the competitive landscape, distribution model, and other broader factors may impact your market size. Some of these inputs can be driven by data in those pre-published reports you bought. Other inputs may be driven by estimates you have to make.

At this stage, we suggest building models with expected, conservative, and optimistic views. You can factor in more or less competition, better or worse than expected sales channel distribution, or other levers that have material market size impacts.

Gut Checking Your Market Sizing Approach

We’ll be the first to admit that market sizing is a mix of art and science. It helps drive informed decisions making, but it is by no means perfect.

Knowing this, it’s important to ask oneself how confident you are in your market sizing exercise. Here are a couple quick gut-check questions to assess where you confidence level should be:

- Did we use data points collected by reputable third parties?

- Did we take time to objectively measure the appeal of our particular product or service?

- Did we fully capture the market conditions that impact purchase likelihood?

- Did we create different market size views based on more positive or negative inputs?

There will always be uncertainty when you measure a product’s market size. However, the more you can say “yes” to all of these questions, the more confidence you can have in your estimates.