You’d be hard pressed to find a single category with only one brand. That means from day one, you’ll always be asking, “Do we have a strong brand?”

Brand health tracking studies answer this very question. By uncovering a variety of dimensions—awareness, perceptions, and usage—these studies give you an objective view of how you stack up against the competition.

Why Track Brand Health

When you track brand health, you gauge not just where your brand stands today but also where you may stand in the future. Because brand health is a leading indicator of future performance, it tells organizations if they should stay the course or develop new approaches.

In particular, brand health tracking tells you:

– How well people know your brand

– How relevant your brand is

– How your brand is perceived

– When and why people use your brand

When you include other brands in your brand health tracking, you learn:

– If competitors are gaining / losing advantages

– How campaign or advertising spend impacts market behavior

– If there are evolutions in product or brand use cases

Top Metrics To Capture In A Brand Health Study

There is no one size fits all approach to brand health tracking studies. After all, what’s relevant for a consumer good brand is very different than what’s relevant for an enterprise software brand. As a result, studies must have some customization to adapt to the business context.

Nevertheless, there are a series of metrics that tend to be in all brand health studies.

Brand Awareness

Brand awareness is a major driver of purchase consideration. As a result, it’s a metric we usually capture in brand health tracking. This typically includes two types of measures: unaided and aided awareness. Unaided captures top-of-mind recall while aided explores general brand name recognition.

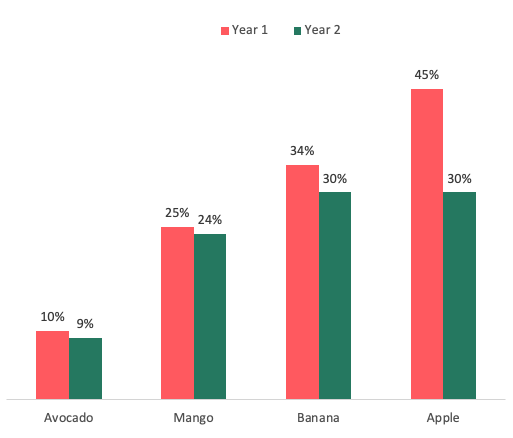

On the right, we see a mockup for different fruit brands. By tracking awareness over two different time periods, we see that awareness plummeted for Apple. Of course, we need to understand why this decline happened. Nevertheless, it’s through brand tracking that brand managers recognize this decline in the first place, a necessary step in any subsequent exploration.

Brand Perception

Brands, by their very definition, are meant to stand for something. After all, that is what allows brands to charge a premium over store brands or private labels. As a result, brand health tracking studies often include measurements of brand perceptions.

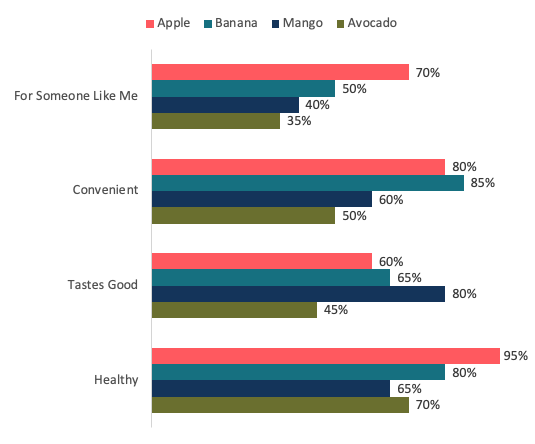

For many brands, this includes basic characteristics like trust and relevance. However, you likely want to delve deeper depending on your specific category. Using our example of fruit brands, we surmise we’d want to know how buyers perceive each fruit for things like taste, health, and convenience. By mapping out perceptions by fruit brand, we see which fruits are strong or weak across key perceptions.

Brand Usage

Products are used in a variety of ways, even if the original intent was for one single use case. Understanding brand usage identifies a brand’s versatility and resilience, as well as its ability to own unique market needs.

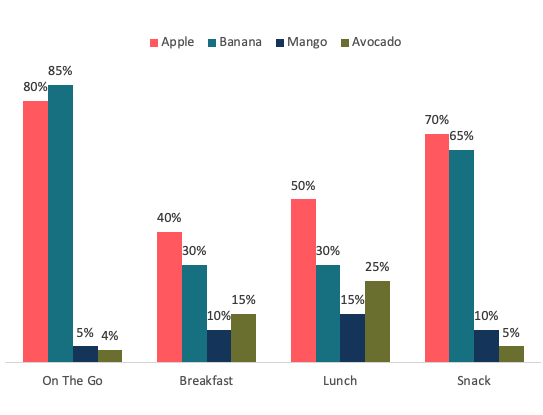

Once again, we mapped our fruit brands against the different ways they could be used. By looking at them side-by-side, we quickly see which fruits are considered more versatile and which ones skew to more limited use cases.

Brand Health Score

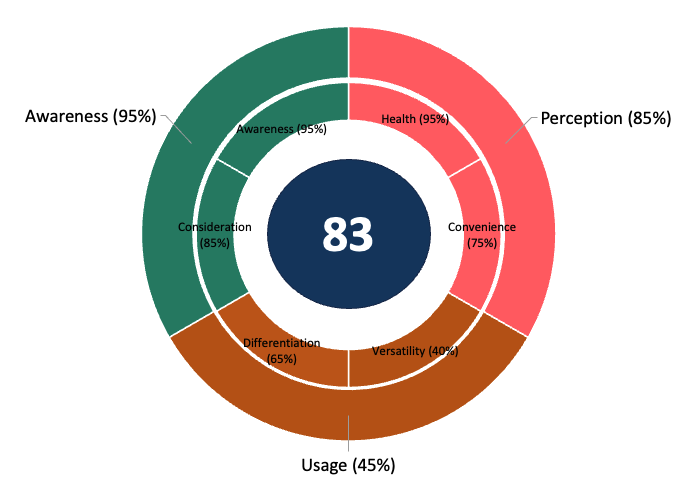

One potential culminating element of a brand health tracker is a health score. This is a single score that serves as a composite of different measures collected through the entire brand health study.

Notably, there is no single way to build a brand health score. Work is needed in advance to determine the different measures that go into the score. Additionally, we need to know how much to weigh each measure. For instance, we may want to give more weight to brand awareness and less weight to product usage. Or, vice versa. Once the approach is reached, the end result is a simple, at-a-glance way to see how brands stack against each other.

Who To Survey In Your Brand Health & Awareness Tracking

Once you know what to include in your brand health and awareness tracking, it’s time to begin collecting data to see how you stack up. This means collecting responses from relevant individuals.

What does that look like in practice? We suggest keeping in mind two things when moving into data collection:

1. Surveying The Right People. You only want to survey people who would have a chance of actually knowing about you or competitors. As a result, consider the demographic, psychographic, and product usage criteria that make someone a viable customer. And, in the case of B2B brands, include firmographics too. Only people with those backgrounds should be in your study.

2. Respondent Sample Size: Brand tracking measures changes in health and perceptions over time. This means you want confidence that changes are due to actual market or customer evolutions. Getting enough people in your study builds this confidence by minimizing the natural sampling error that comes from surveying a portion of a given population.

In essence, plan your data collection to get enough of the right people in your study to be confident about point-in-time and longitudinal data.

What To Do With Brand Health Data

Think of brand health data as the launchpad for your subsequent product, marketing, and business strategy. The information you uncover is foundational for understanding your brand strength and product relevance, and therefore what needs to change to build or maintain momentum.

For instance, if you find that brand awareness lags behind the competition, it’s possibly time to consider marketing and advertising campaigns. Meanwhile, if you find that product use cases do not align with your product’s full potential, there’s likely a product marketing opportunity at play.

In essence, brand health studies don’t just give you a point-in-time read on your brand’s strength. They also guide business and product roadmap planning so you allocate your resources to the right activities.