Let’s say you’re ready to launch marketing programs and spend money to build awareness for your brand. Will it work?

A classic approach to answer this question is launching a brand awareness study. This is a survey that polls relevant individuals before and after the campaign to see if you’re moving the needle. It’s an extraordinarily effective approach…if you can do it.

Sometimes, market or brand conditions just don’t allow it. Thankfully, that doesn’t mean you’re out of luck! Leveraging alternative approaches to measure awareness are effective indicators of marketing campaign efficacy. You get the data you need sooner to know if things are working, or if things need to be adjusted.

When Classic Awareness Surveys Don’t Work

We are absolutely big fans of the classic awareness survey. That is, ask a whole bunch of people to name the brands or companies that come to mind within a specific product or service category. We’ve been doing them for years and will keep on doing them.

But, here’s the thing. They aren’t always the right way to gauge awareness. In fact, there are two key situations when the classic approach to measuring awareness isn’t quite right.

- Unable To Find or Afford Survey Participants: If you’re in a niche category or industry, it’s often extremely challenging or cost prohibitive to find enough people to interview. Consider it in these terms. It can cost $50 or $60 to recruit just one senior-level individual for a B2B survey. At a minimum of 200 participants, you’re spending $12,000…and that’s just to recruit people to your study. That may be too much for some companies. Also, it assumes you can even find the right person. For more obscure categories there simply may not be enough people to survey to begin with.

- Is Too Much of a Lagging Indicator: The idea of surveying awareness makes a big assumption: that individuals are able to recall the name of a business either on their own or after seeing a list of names. This is a really safe assumption for long established brands and categories. But, what if you’re too new? People may have a sense for your name or category, but the actual name may allude them. When this is the case, awareness studies will show a big ol’ zero for awareness when the reality is a bit more nuanced.

If these are the issues you face, you need to look elsewhere to gauge how effective your marketing campaigns are at building interest and awareness.

Ways To Measure Awareness Beyond Just Surveys

There are a lot of proxy approaches for measuring brand awareness. As with all research methods, no single approach is perfect. In fact, they each have their own sets of pros and cons. Regardless, understanding what each one offers (or doesn’t) goes a long way to pointing you towards how best to go about measuring awareness when the classic approach won’t work.

Traffic To Your Website

Measuring the amount of traffic to your website, usually using Google Analytics, is a straightforward (and free!) way to begin assessing awareness. After all, they are landing on a digital site with your name all over it. Tracking changes in on-site traffic over time, and where that traffic originates, lets you keep tabs on how much awareness, exploration, and interest is hitting your brand.

Pros:

- Is a clean measure of awareness since it shows explicitly the number of people checking out your brand and what you have to offer.

- Easily measurable over longer periods of time.

Cons:

- Does not give you visibility into competitor traffic or changes in their website traffic volume.

- People can click on search engine listing without fully seeing the brand’s name. This can lead to traffic volume numbers outweighing actual awareness.

- Paid marketing activities can artificially drive up website visits without actually improving awareness metrics.

Branded Organic Search

Another approach looks at how many people are actively searching for your brand name online. We like Google Keyword Planner for this. By looking at month-over-month changes in search volume, you can see if there are any increases in searches following campaigns. Relatedly, you can also see if there are decreases following pull backs in marketing spend or marketing activities.

Pros:

- You can track both your brand name and competitor brand names.

- You can track search volume over long periods of time, letting you visualize long-term improvements

Cons:Â

- It can take a while for people to explicitly remember the name of a brand. As a result, you may not see improvements in brand even though category awareness may be growing.

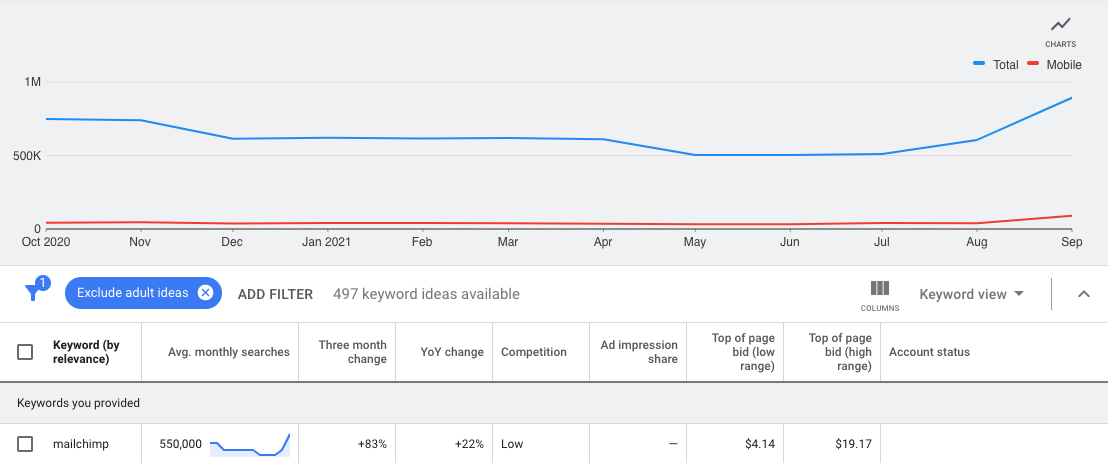

Let’s take a look at the image below so you can see this in action. We used Google Keyword Planner to see how branded search volume for Mailchimp, an email marketing software tool, trended over the past year. While we don’t know what they did in August and September, it’s pretty clear that it results in some very big shifts in awareness as evidenced by a jump in their branded search volume.

Unbranded Organic Search

Brand awareness often comes after category awareness. That is, people usually know about a general set of products before they know about specific brands that fall within it. That’s why sometimes it’s valuable to look at the search volume for the category rather than a single brand. You can see if any marketing activities, whether they be yours or your competitors’, are improving overall category awareness.

Pros:

- Strong leading indicator of changes in a category awareness when brand awareness hasn’t yet taken hold.

- Great for emerging categories where there is still room for building awareness and exploration.

Cons:

- Legacy categories generally see limited changes in search volume, no matter the active marketing campaigns.

- Does not offer visibility into which brands or products are driving volume changes.

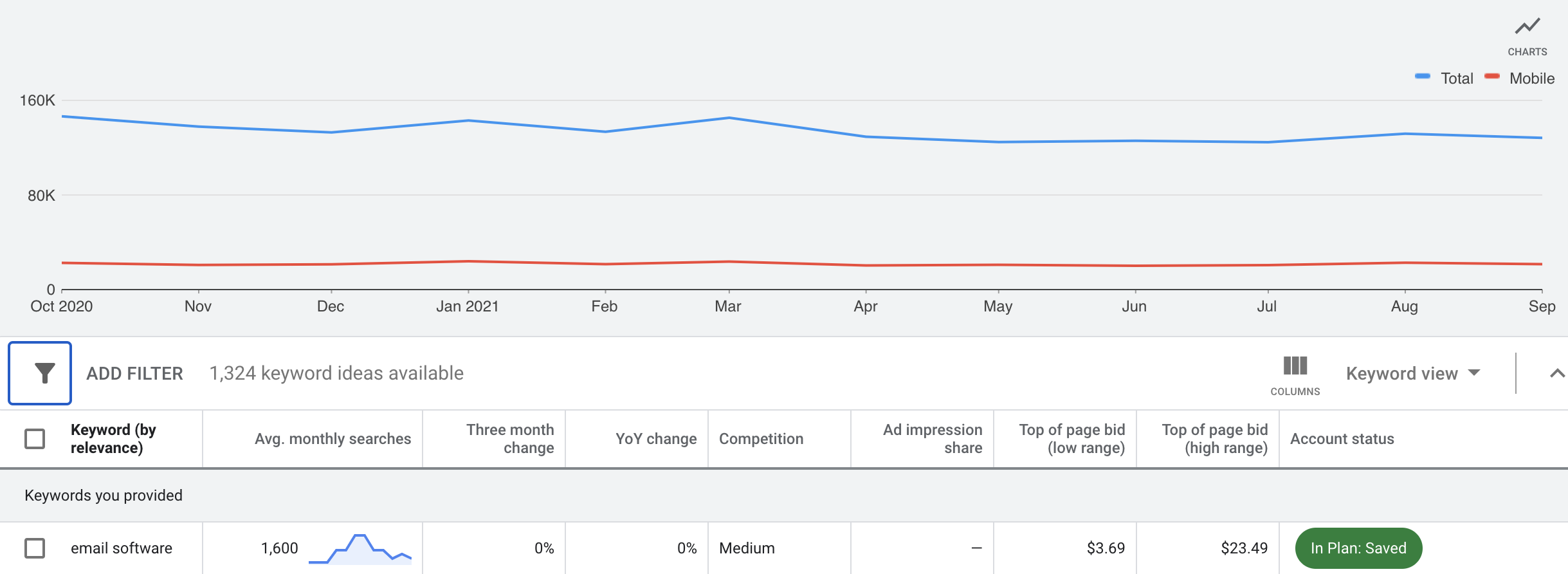

Let’s take our earlier example, but this time search for the generic category of “Email Software.” The graph below shows some declining interest in the second half of the year. While we don’t know exactly what to attribute this to, it’s showing an interesting macro-level trend in category interest and awareness that could impact longer term sales.

Social Media Share Of Voice

Another approach is tracking how people are talking about you and your competition online via social media platforms. This is often called “share of voice,” which is a measure of what percentage of digital chatter your brand owns versus other brands. By recording the mentions of social media comments that reference certain words or themes, it’s possible to see how your brand is doing at a point in time relative to competitors.

Pros:

- Let’s you capture sentiment in a very natural, organic way.

- Enables tracking of “share of voice,” which is a proxy for word of mouth advertising.

- Allows for longitudinal measures so you can track changes over time.

Cons:

- Assumes there is enough branded social media chatter that you can measure share of voice. This is a problematic assumption, especially with B2B companies.

- Large, global brands can dwarf smaller players. This can make share of voice tracking very challenges for newer or niche brands.

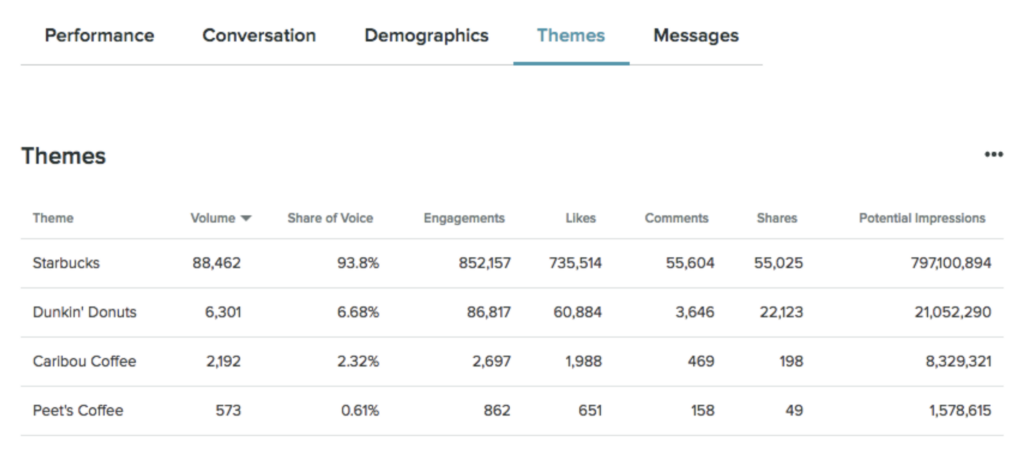

Take a look at the image below from the team at Sprout Social, a social listening platform. This lets us see how different coffee retailers compare for online share of voice. We see Starbucks is dominating for share of voice, a not very surprising finding given the company’s global presence. In other categories where there is greater share of voice parity, we’d be able to better track changes in share of voice with the launch of different marketing campaigns.

One Brand Awareness Measurement Is Never Enough

Let’s say you’ve begun measuring brand awareness, either through the traditional survey route or some of these alternative approaches. That’s great. Keep measuring it!

We often assume that after recurring months (or years) of regular marketing activity, awareness numbers will go up. However, if those activities aren’t very effective, or there are changes in competitor activity or new market entrants, that assumption may not hold true.

Regularly measuring brand awareness at regular cadences keeps you ahead of these ebbs and flows. You’ll get a gut check that things are running smoothly, or a “canary in the coal mine” alert that tells you it’s time to change things up to retain or build your awareness numbers.