Introduction

At PlanBeyond, we do a lot of market research work, and frequently collaborate with start-ups as they journey through customer intelligence and business strategy challenges. It puts us at an interesting cross-section: we’re data people that also get to hear anecdotal stories about the startup founder and entrepreneur experience.

After a while, you hear enough stories that it begs the question: are the challenges we’re hearing one-off events, or are they part of a more pervasive problem? We had a unique opportunity to explore this further thanks to the team at Underwire, a content and media company that educates, inspires, and encourages women founders. Part of Underwire’s efforts include building a database of woman-led businesses receiving venture-backed funding, recognizing these founders and demonstrating the breadth of businesses created by women business leaders.

When we were given an opportunity to review the database and see if clear patterns could be rought between venture funding and women-led businesses, new ideas sprung up. Could we broaden the study purview and therefore identify patterns in venture funding across men and women-led businesses? If we included race, would we see other patterns there? And, if we explored funding at different life stages, would additional patterns appear? With so many interesting questions, and the knowledge that the raw data was out there, we went off to find out.

We examined every venture backed company that received funding in 2019. This means examining companies hoping to be fast-growth, fast-paced billion-dollar businesses. Our data set includes 6,045 companies with 11,672 founders raising everything from seed funding to late-stage investments.

The findings, and what they tell us about trying to raise venture funds as a woman or racial minority, were certainly illuminating.

KEY FINDINGS

-

Companies Led By Women & Black Founders More Often Help Society

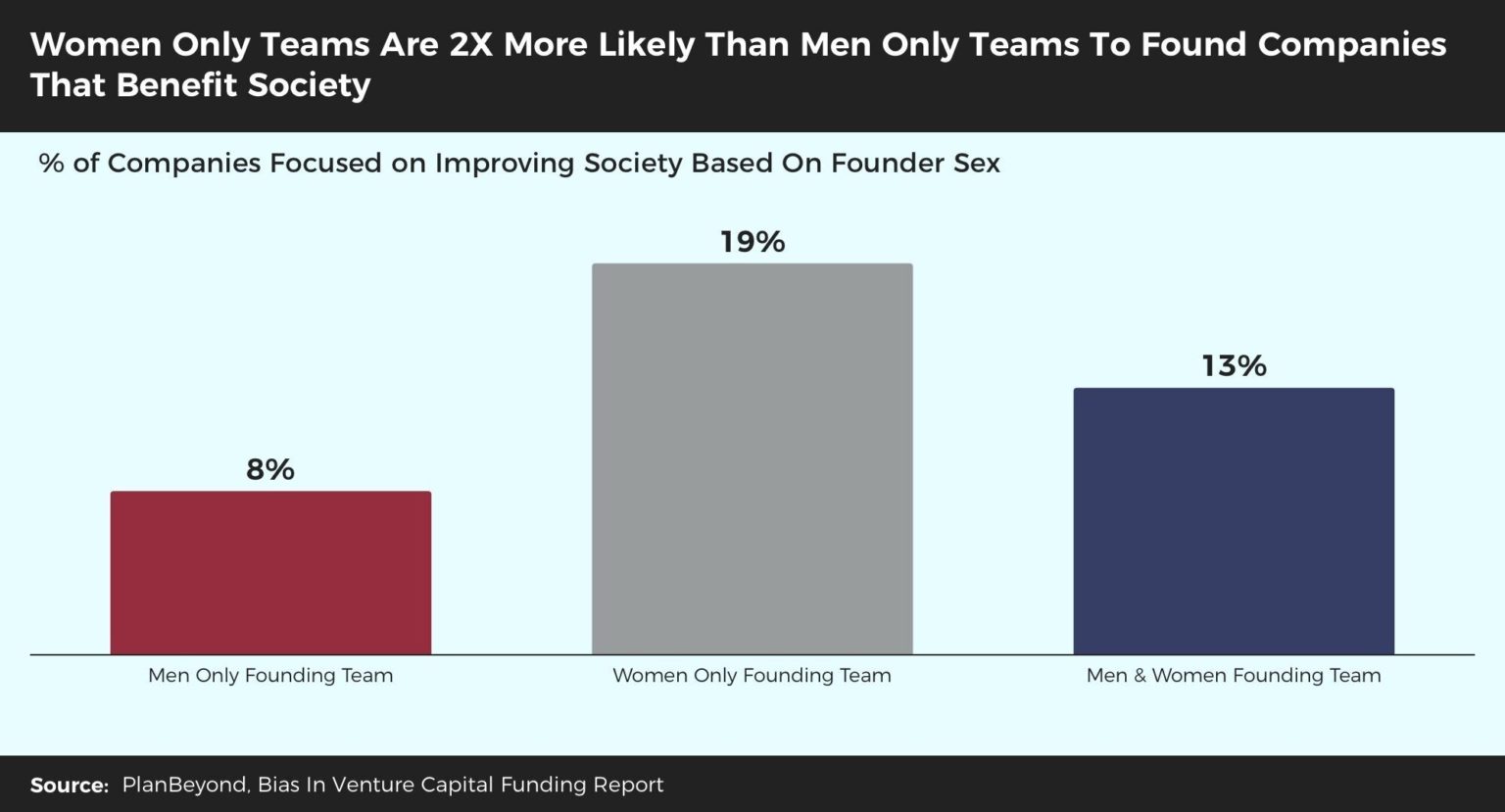

- Companies with women only founders are more than twice as likely than men only teams to develop companies that improve society.

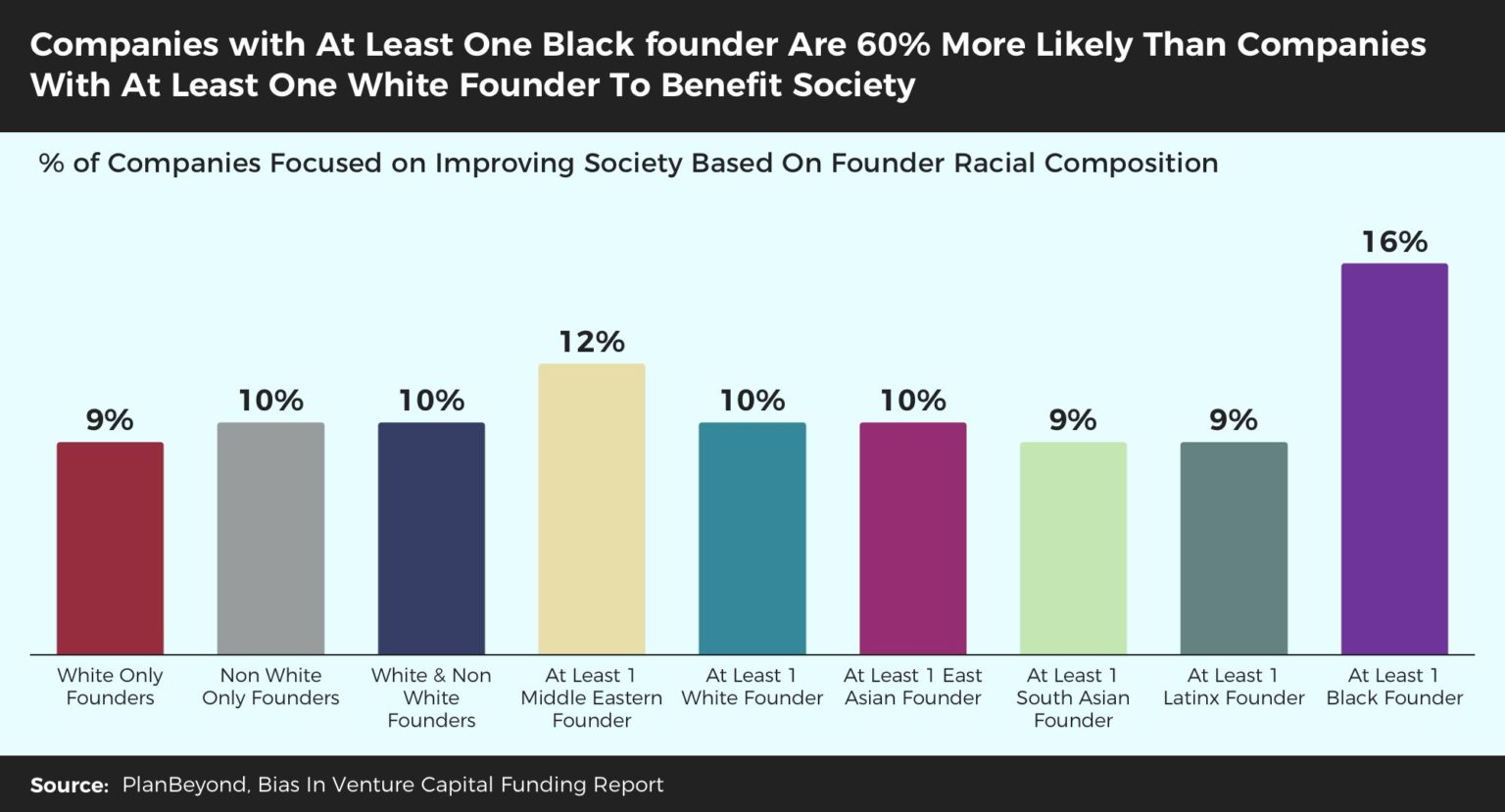

- Organizations with at least one Black founder are 60% more likely than organizations with at least one White founder to work to benefit society.

Venture-Backed Founders All Look The Same

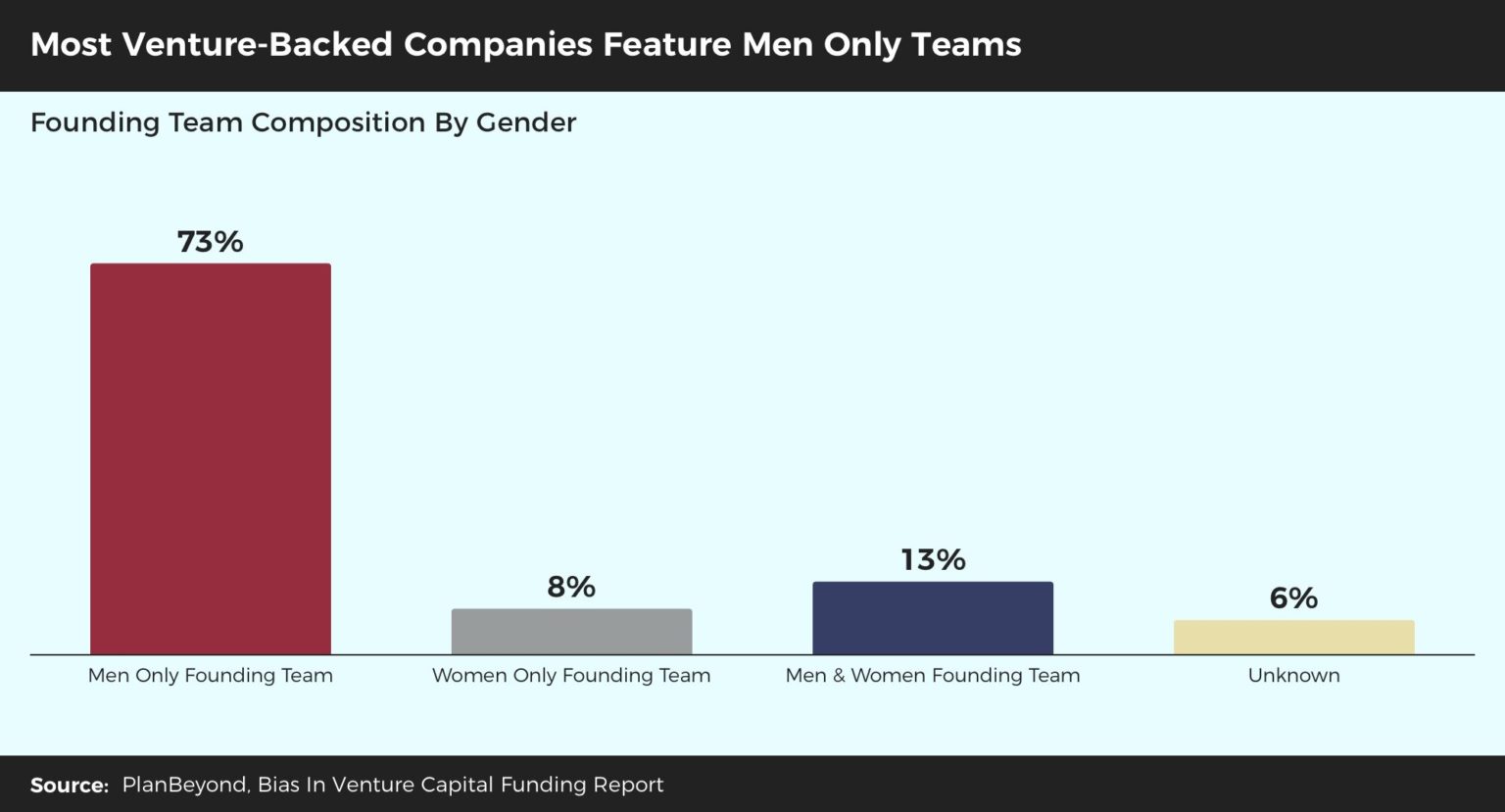

- 73% of all venture-backed founding teams are composed exclusively of men

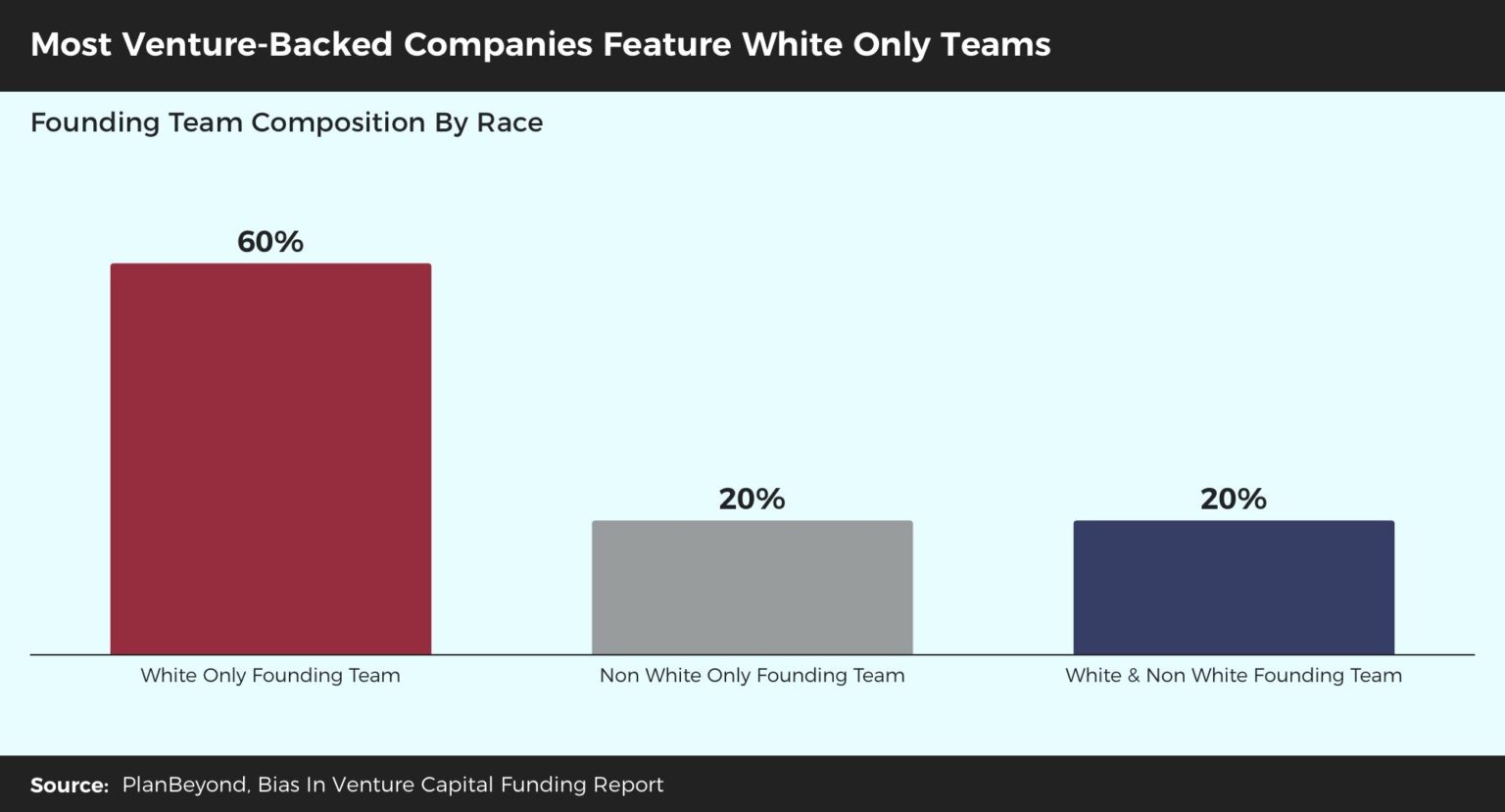

- 60% of founding teams are exclusively White.

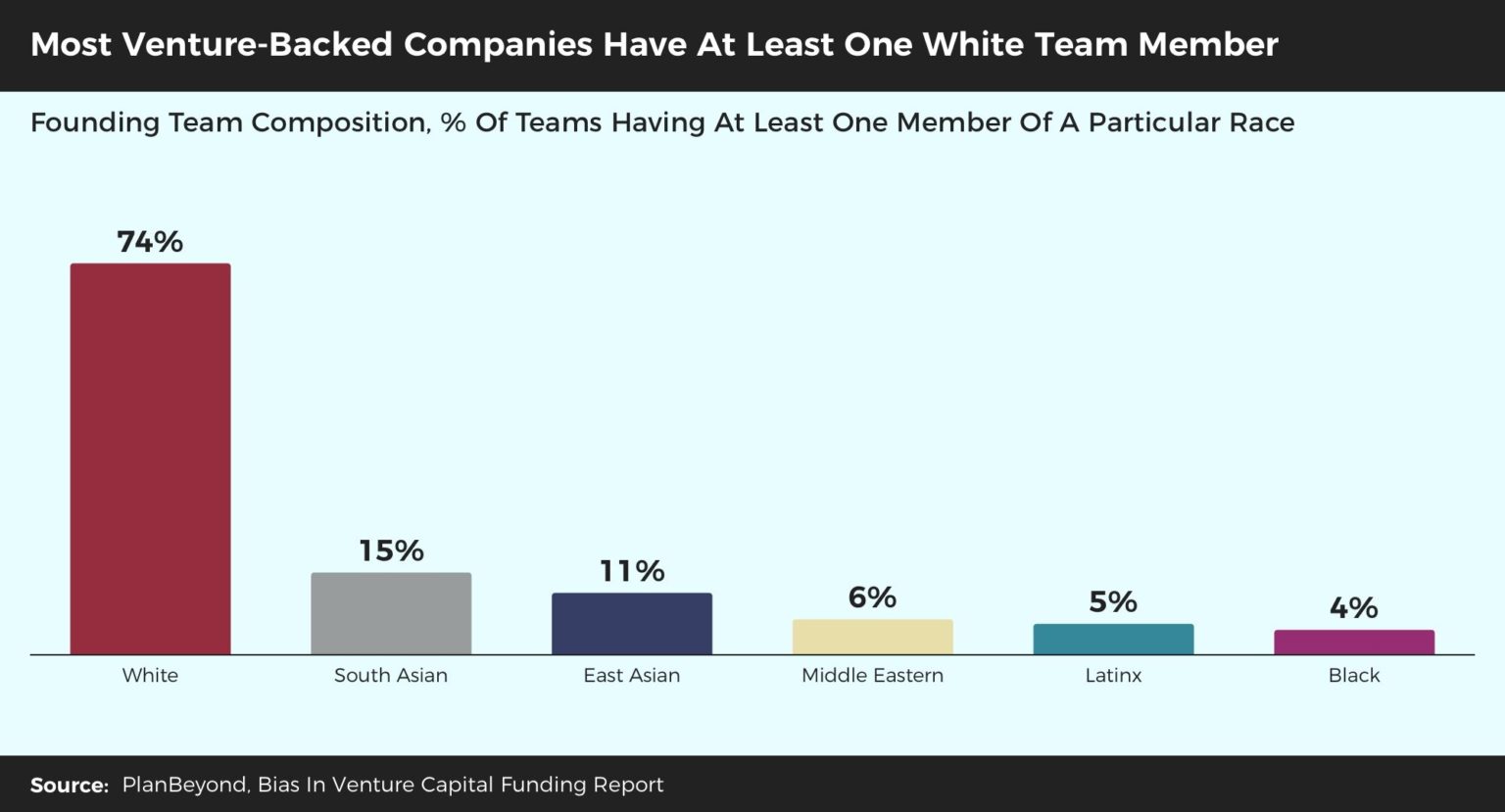

- Only 5% of all founding teams include a Latinx founder and only 4% include a Black founder

Want To Raise The Big Bucks? It Helps to Be A Man, It Hurts To Be Black

- Men only teams receive 3 times more funding than women only teams, independent of company stage.

- Founding teams made exclusively of White founders raise nearly 35% more money over their life than teams composed exclusively of Non White founders.

- Companies with at least one Black founder raise, on average, about one quarter of what teams with at least one White founder raise.

Venture Capitalists Prefer White Men

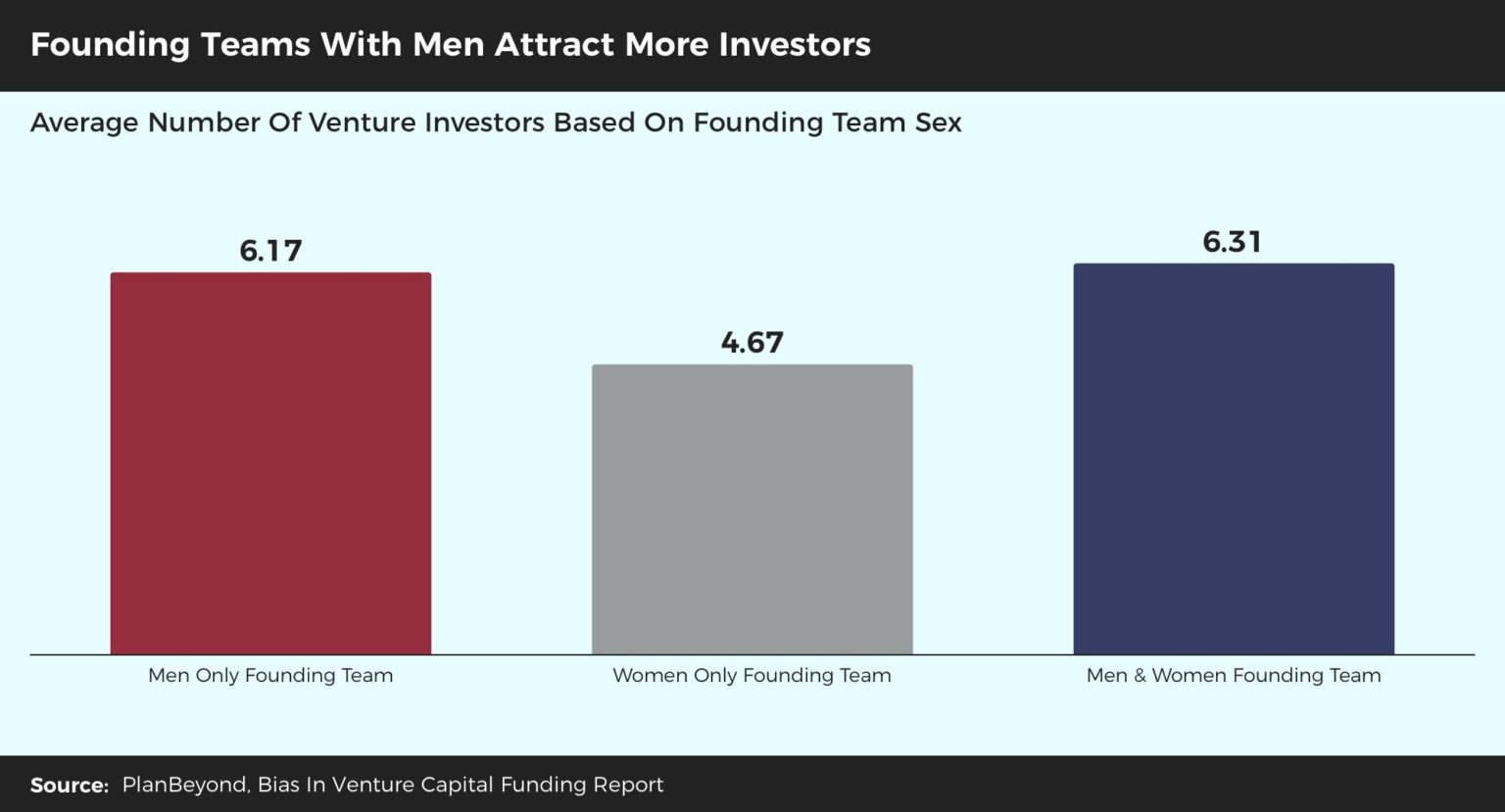

- Founding teams composed exclusively of women average 4.67 investors while teams composed exclusively of men attract 6.17 investors.

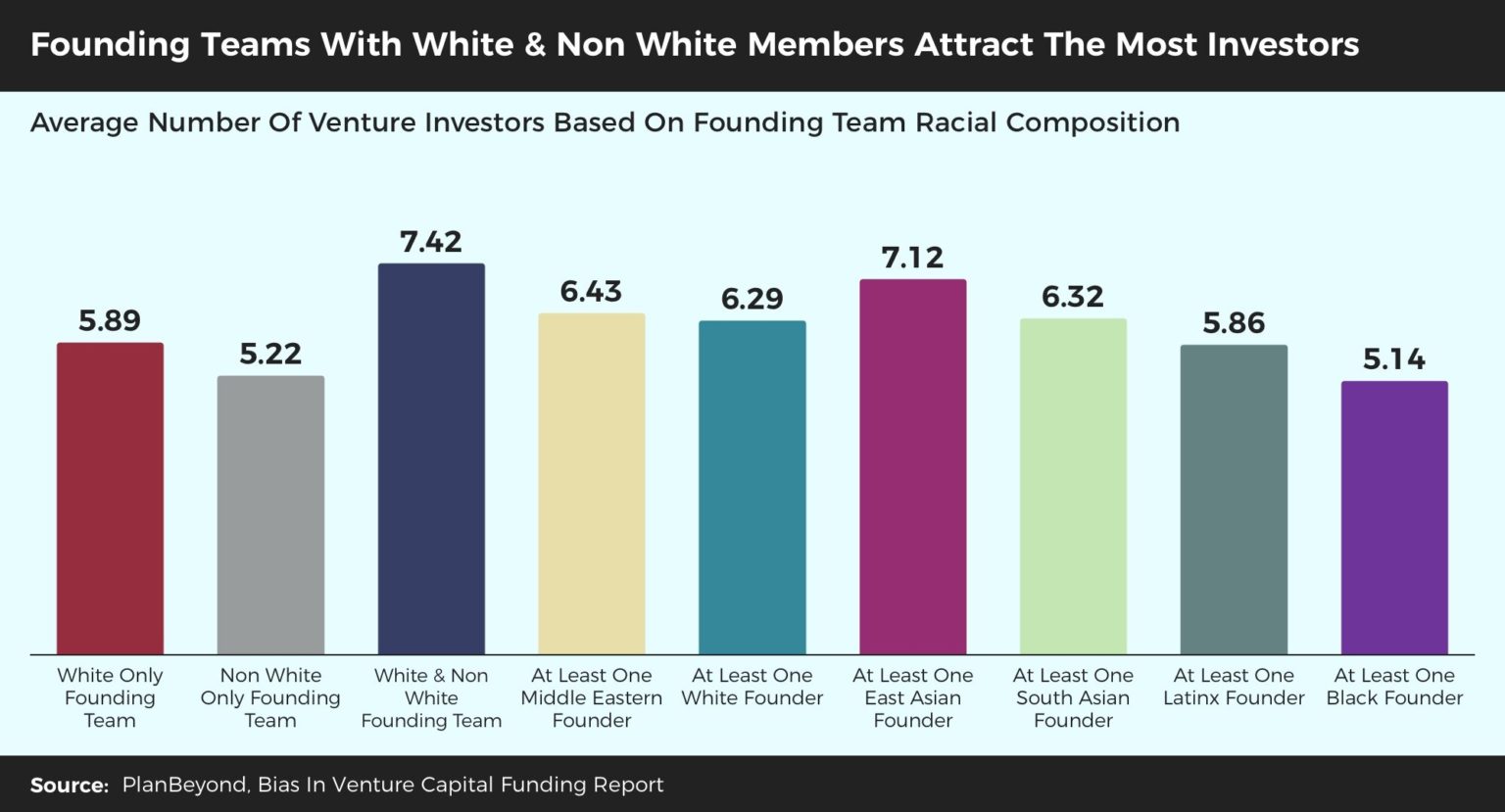

- Teams with at least one Black founder average 5.14 investors, the fewest number of investors based on any founding team racial composition.

Companies Led By Women & Black Founders Are More Likely To Help Society

-

What makes for healthy societies and populations? Research on this topic shows that it covers many areas including diet and exercise, education, safe communities, clean environments, public transit, basic health, and that traditionally underserved communities are being given equitable resource access. As a result, we were curious to learn the extent to which venture-backed companies were supporting these areas, and what types of founders were creating them.

We found an incredible wealth of for-profit organizations doing just that: organizations focused on sustainable food surplus management, digital programs to alleviate depression, aquaculture technology aimed at improving the ecological impact of fish farming, transportation management platforms aimed at helping cities design improved public transit, edtech platforms to personalize educational experiences around childrens’ unique learning needs, and materials developers finding novel ways to reduce the harmful chemicals used in indigo dying to develop “clean jeans.â€

It’s remarkable to see so many organizations working to improve society as a whole. Yet it’s not being done equally by all founders. In fact, women and Black led organizations are more likely to build these types of companies.

Women only founding teams are more than twice as likely as Men only teams to develop companies that improve society. In fact, even mixed-sex teams are 62% more likely than all men teams to found companies with societal benefits.

Meanwhile, organizations with at least one Black founder are 60% more likely than organizations with at least one White founder to work to benefit society. Yet, as we’ll show later in this report, organizations with women Black founders are receiving disproportionately less funding throughout their life stages.

Venture Backed Teams All Look the Same

With data showing that Women and Black-led businesses are doing more work to improve our societies than those organizations built by White men, it of course begs one question out of the gate: are there many women and Black founders?

No, no there are not.

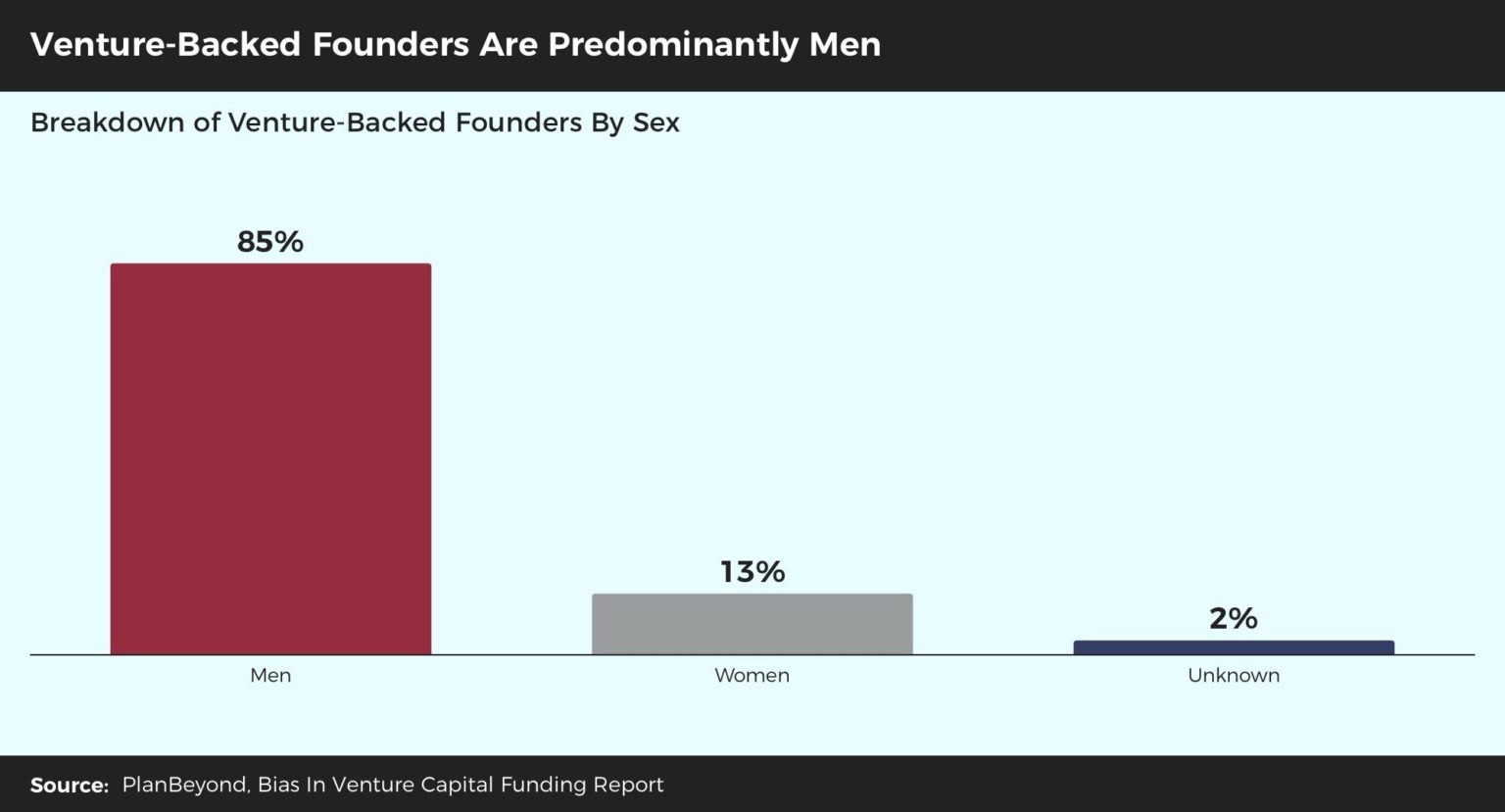

Venture-backed founders are disproportionately men, representing 85% of all startup founders.

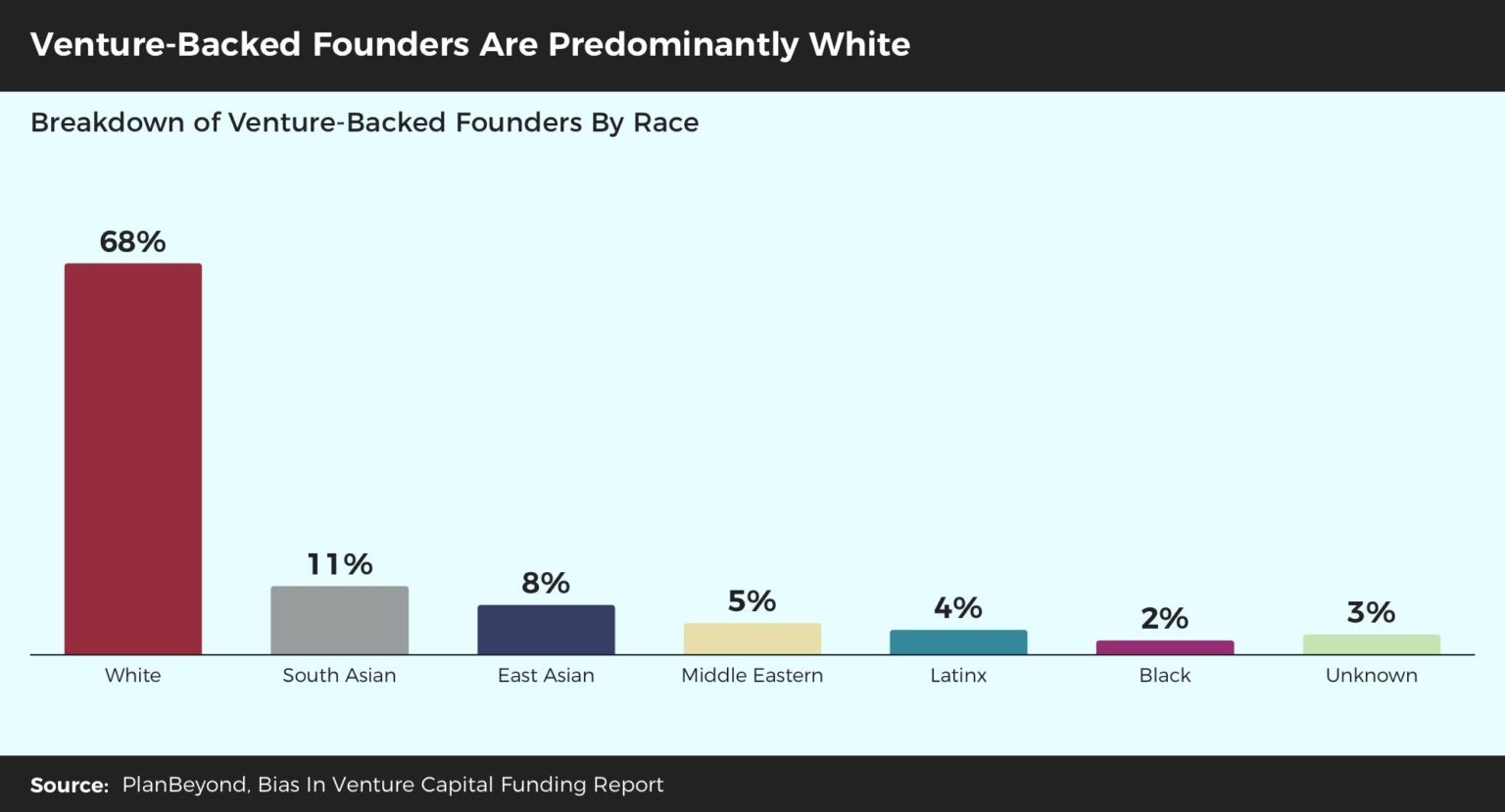

Additionally, more than two out of every three founders is White while only 2% of founders are Black and only 4% are Latinx, extremely low numbers considering the latest census data showing these groups represent nearly 13% and 17% of the US population, respectively.

This homogeneity becomes extremely obvious when we start to look at the actual individuals that comprise founding teams.

Only 13% of founding teams have both men and women co-founders. Meanwhile, nearly three in four founding teams are men only, not a surprising percentage given the disproportionate number of men founders in general.

Relatedly, only 20% of founding teams include both white and non-white members. The bulk of all founding teams, at 60%, is exclusively white.

When we break down the non-white founder category a bit more, we see that 15% of companies have at least on South Asian founder while 11% have at least one East Asian founder. However, only 5% of all founding teams have a Latinx member and only 4% have a Black member, not surprising given how few venture-backed founders come from either of these racial groups.

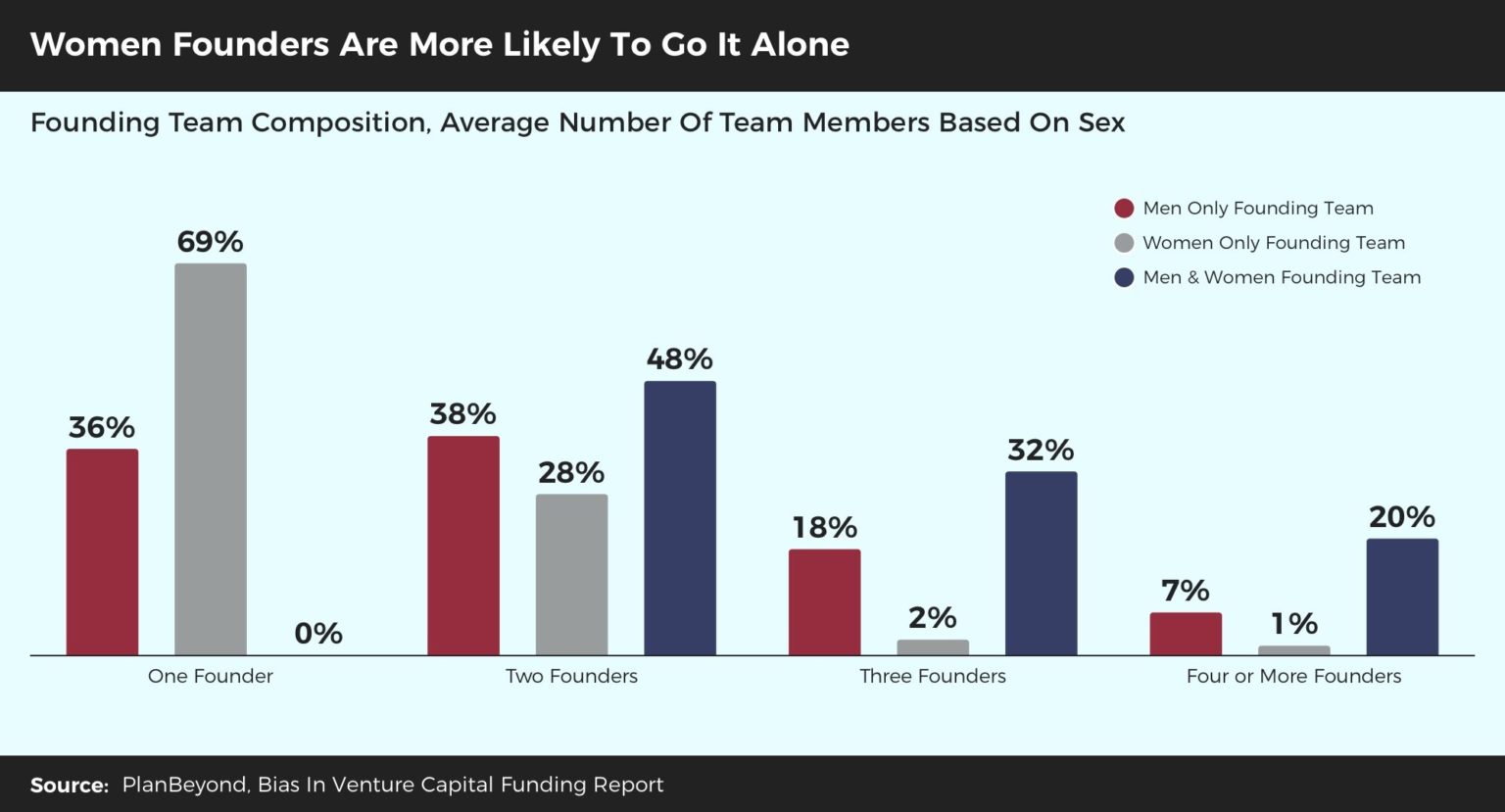

What about founding team size? Turns out women are much more likely than men to go it alone, with 69% of all women only founding teams having just one member as compared to 36% of men only founding teams. In contrast, men only teams are much more likely to have three or more members.

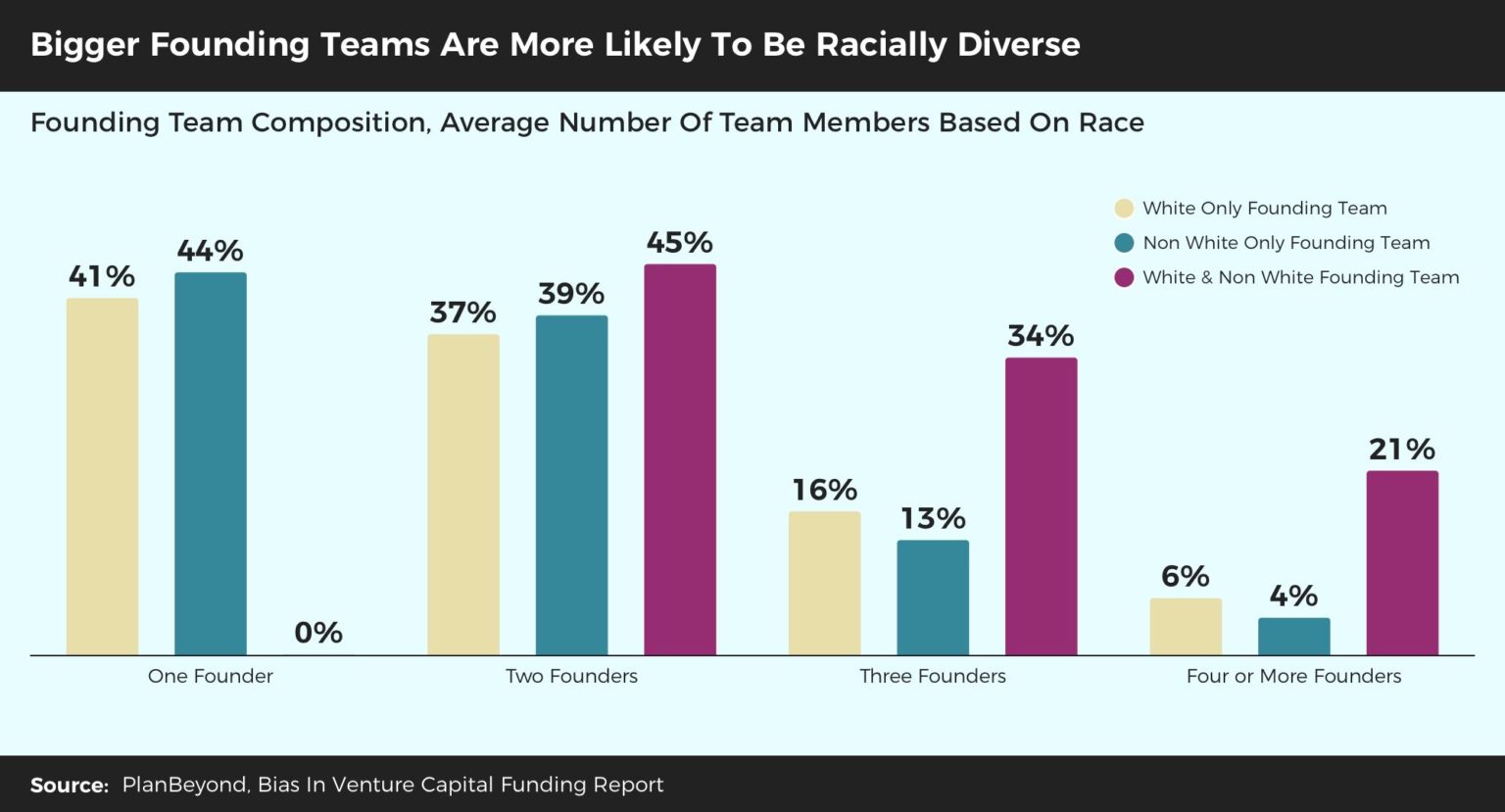

There is a bit more similarity when it comes to race. Whether teams are white only or non white only, they tend to have teams composed of either one or two members. No surprise, teams that cross racial lines are more likely to be larger.

Venture Capitalists Prefer White Men

We now know that most venture-funded teams are led by White Men. Knowing that this is true, we have a new question to ask: Are teams that feature White men being given preference by investors?

Yes, yes they are. By a lot.

On average, founding teams composed exclusively of women, regardless of business life stage, have 4.67 investors. In contrast, men only founding teams have 6.17 investors. Interestingly, teams with both men and women average 6.31 investors. It seems that having women on your team helps with investment…so long as there are men on the team too.

Notably, founding teams composed of white and non white founders enjoy the highest number of investors at 7.42, well above the average number of investors for a solely white team, 5.89, or solely non white team, 5.22. This tells a unique story. As a white founder, it’s helpful to have members of other racial groups on your founding team to get investors. At the same time, non white founders get an added boost by having white founders on their team.

In stark contrast to this are founding teams with at least one Black founder. These organizations average 5.14 investors, the fewest number of investors based on any founding team racial composition.

While some of this is explained by the life stages of companies with women only teams, we can’t explain it when it comes to the racial composition of founding teams.

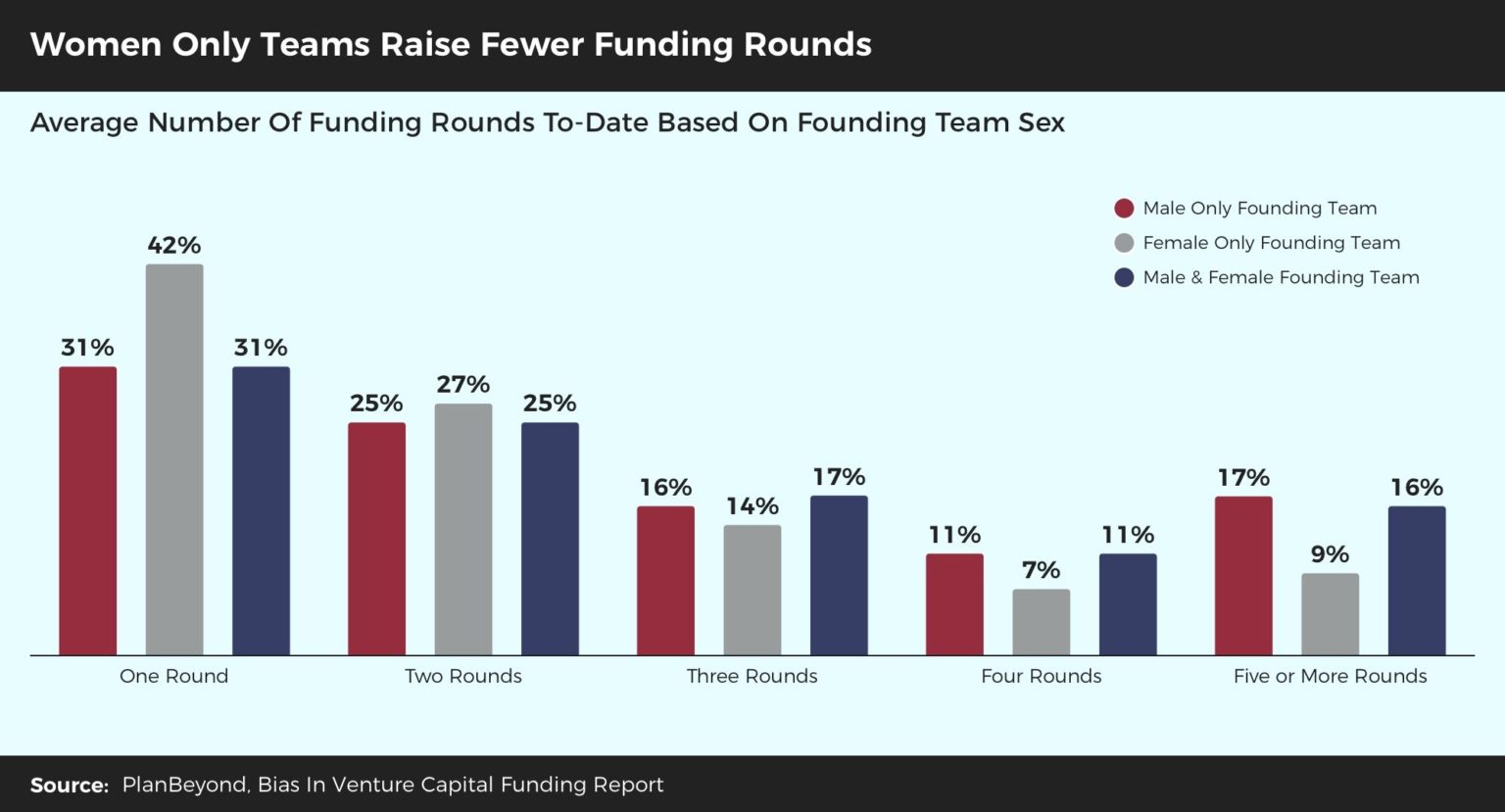

Amongst companies that received funding, 42% of those with women only teams received money to fund their first investment round. A sharp difference from the 31% of those with men only teams or mixed-sex teams who received money for their first round. Teams with men were more likely to be getting investments for later rounds of funding, helping explain their greater number of investors.

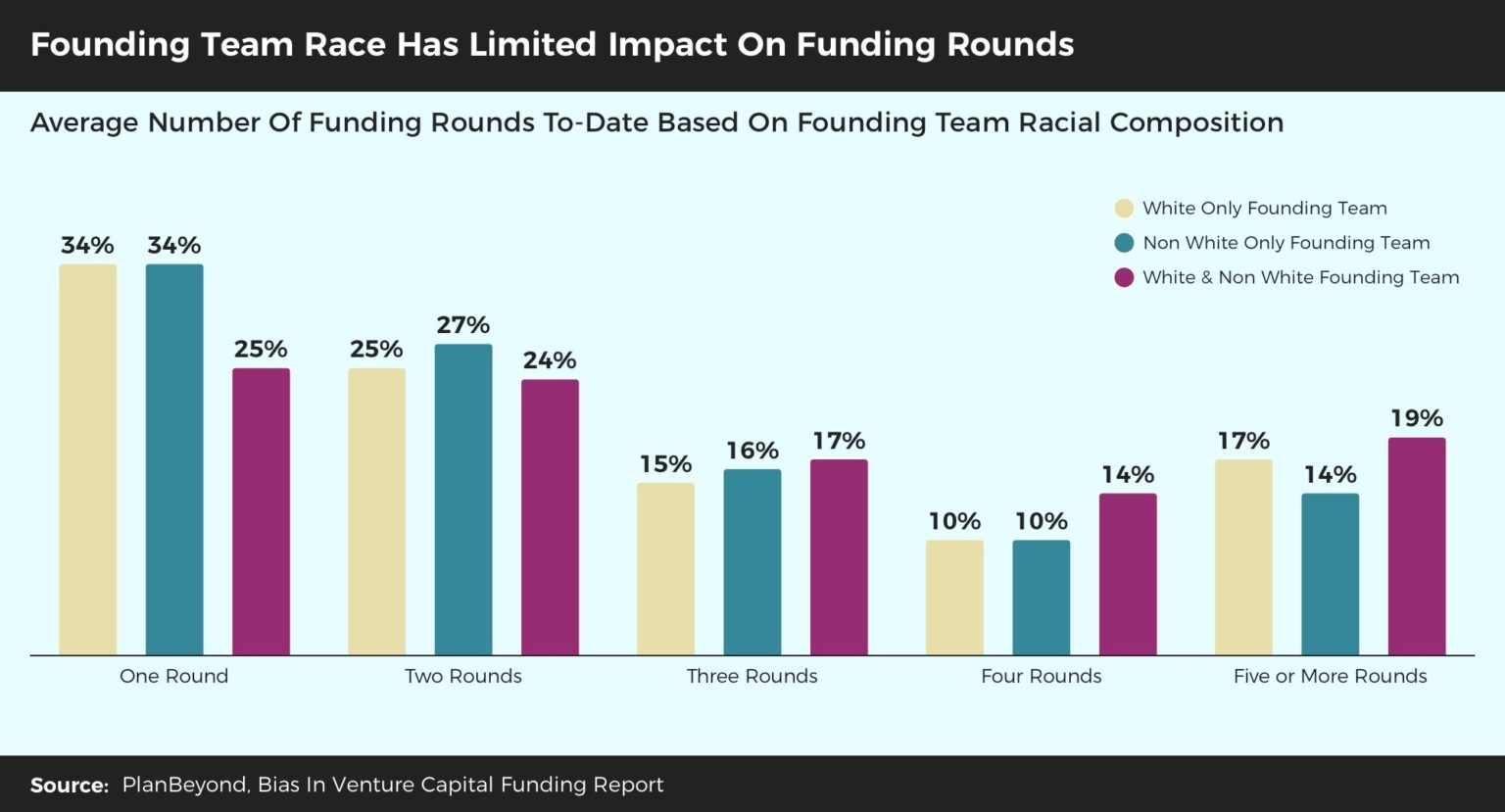

Meanwhile, when it comes to founding team racial composition, we see that team racial composition has little impact on the number of rounds of funding a company has received.

Want To Raise The Big Bucks? It Helps To Be A Man, It Hurts To Be Black

No matter how important it might be to have more investors, what generally really counts is the amount of money a team can raise. As a result, we now have to ask: are certain types of teams being given more money than others?

Yes, they are.

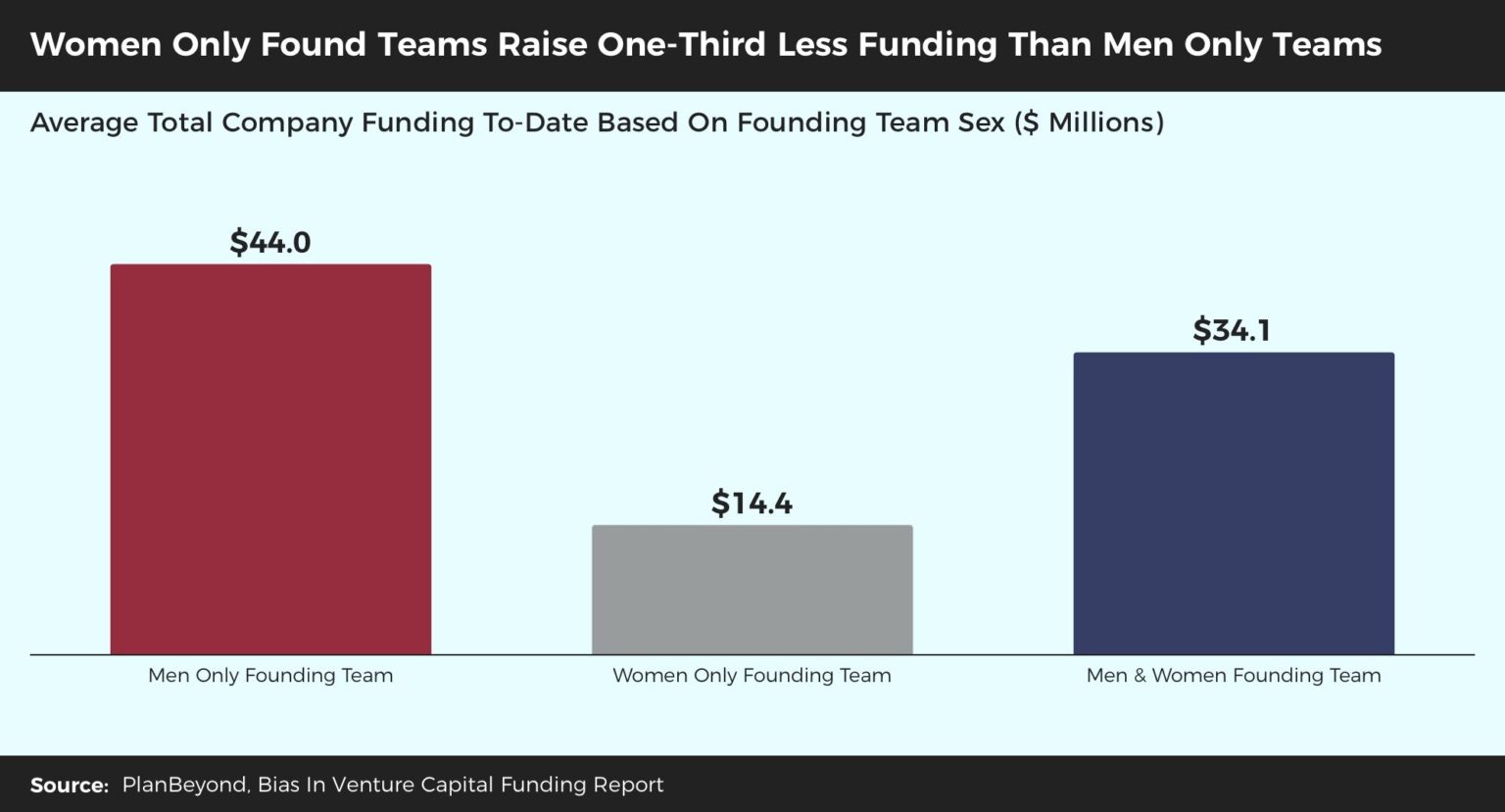

Companies founded exclusively by men received an average of 3 times more funding than companies led by women only teams, independent of life stage. While women only teams have averaged a total of $14.4 million dollars in venture fundings to-date, men only teams have averaged $44.0 million dollars.

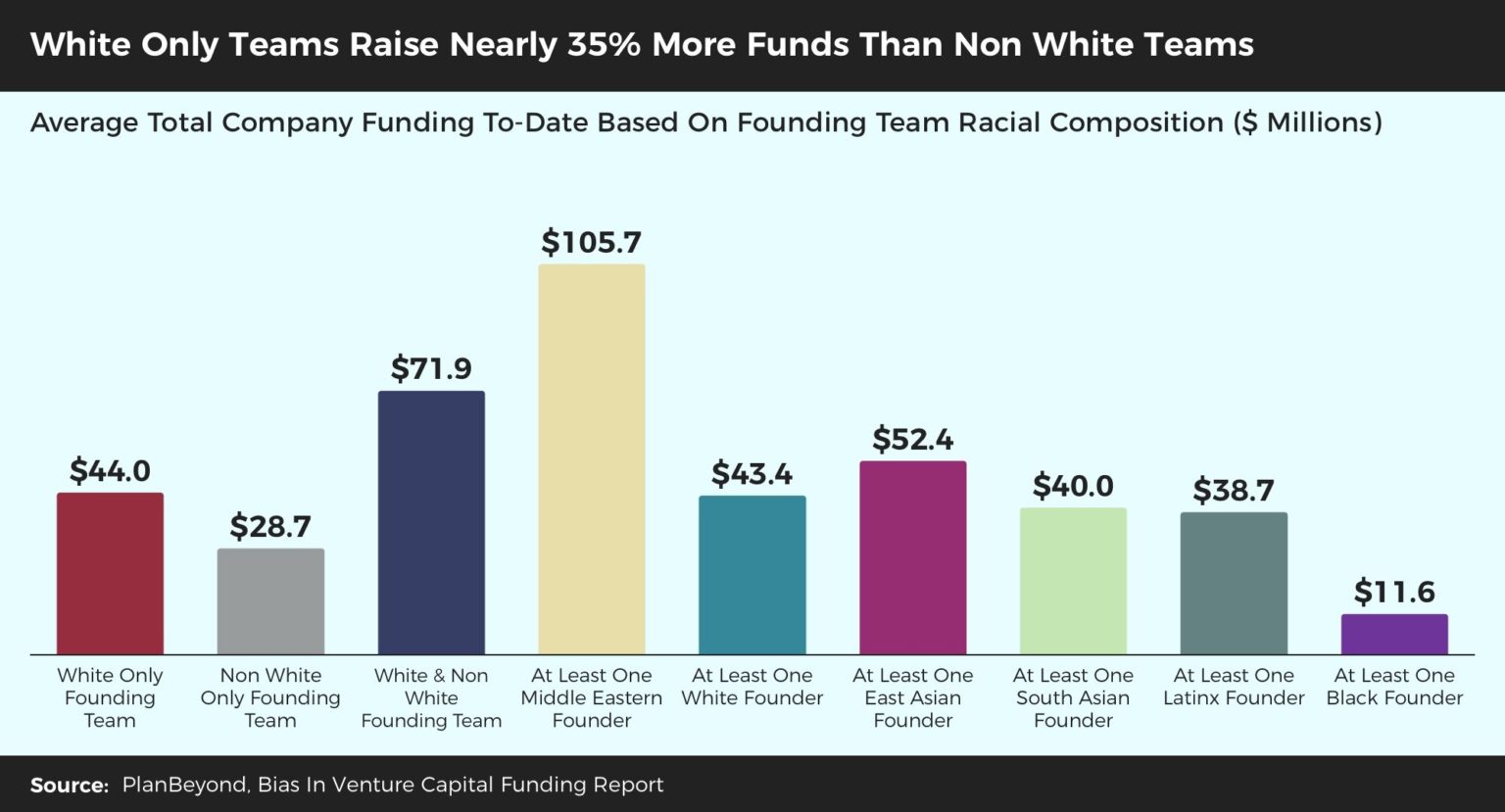

When we look at funding based on team racial composition, the story isn’t as clear cut. Teams made exclusively of white founders have raised nearly 35% more, on average, than exclusively non-white founding teams. Yet teams composed of both white and non-white founders raise the most funds. In fact, having at least one Middle Eastern team member (which turns out to be primarily Israelis), can skyrocket total funding. To a lesser degree, having at least one East Asian also seems to help company founding.

At the opposite end of the spectrum are companies with at least one Black founding member. These companies raise one quarter of what teams with at least one White founder receive, the lowest of any racial cohort.

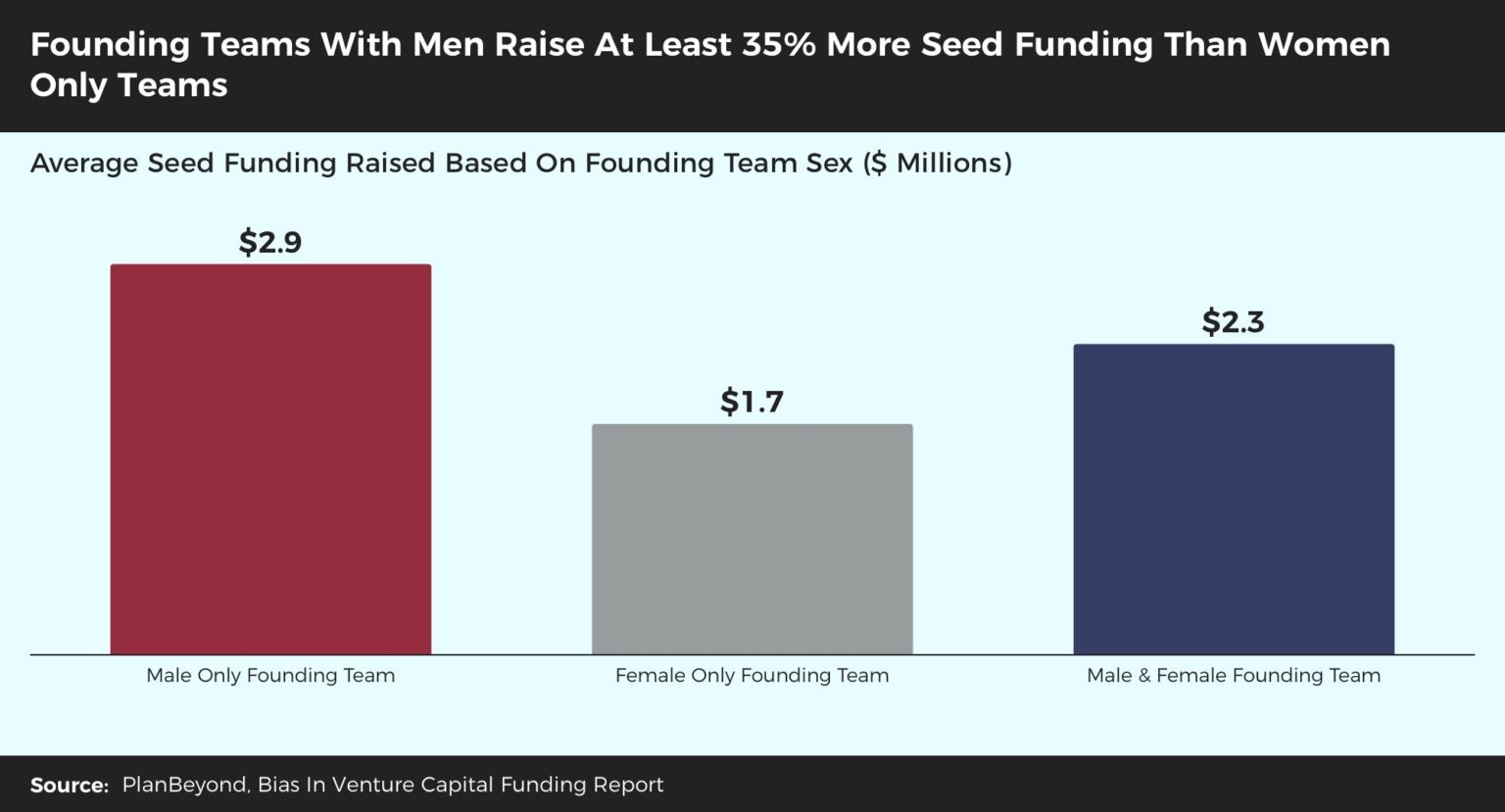

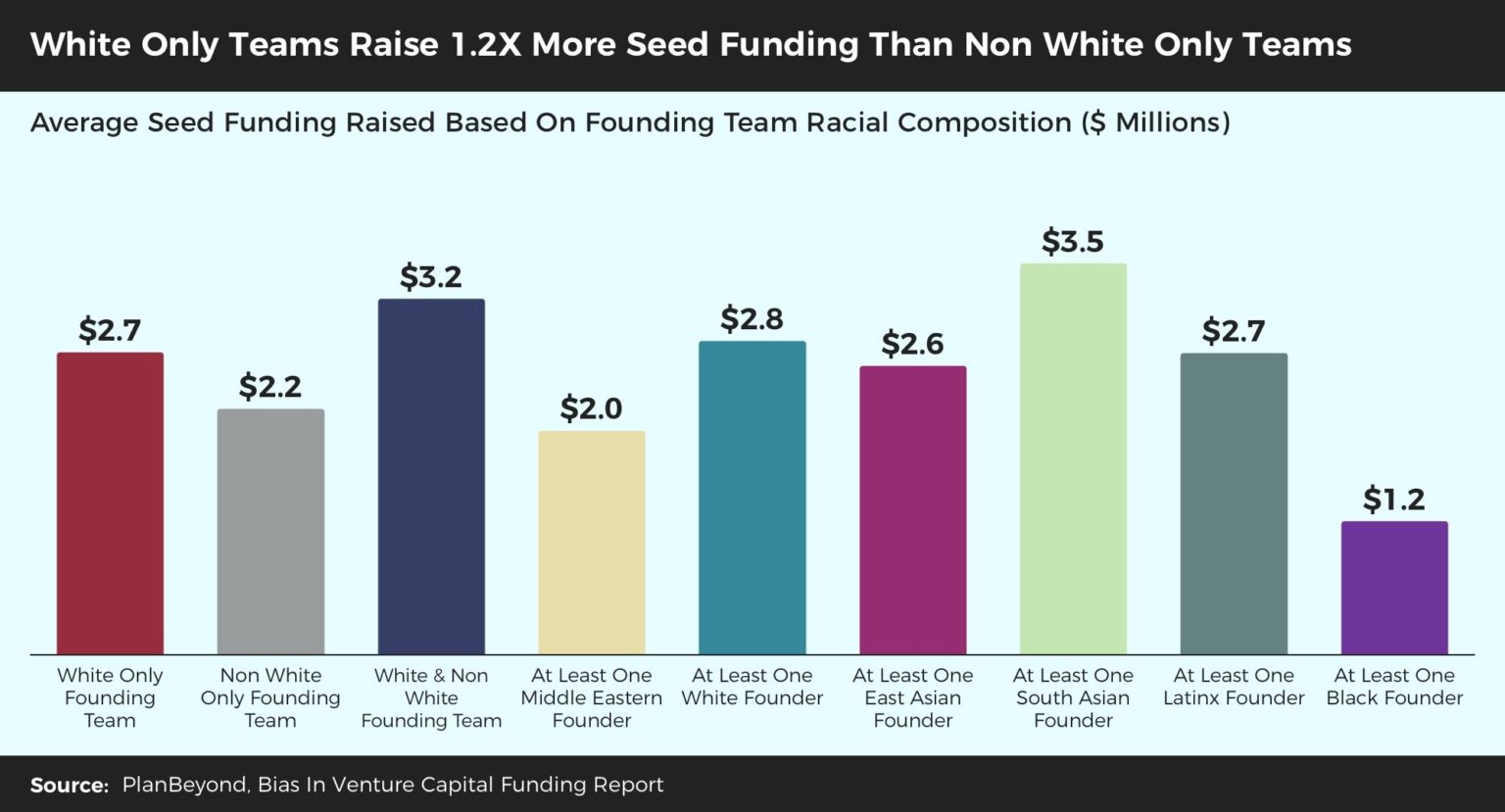

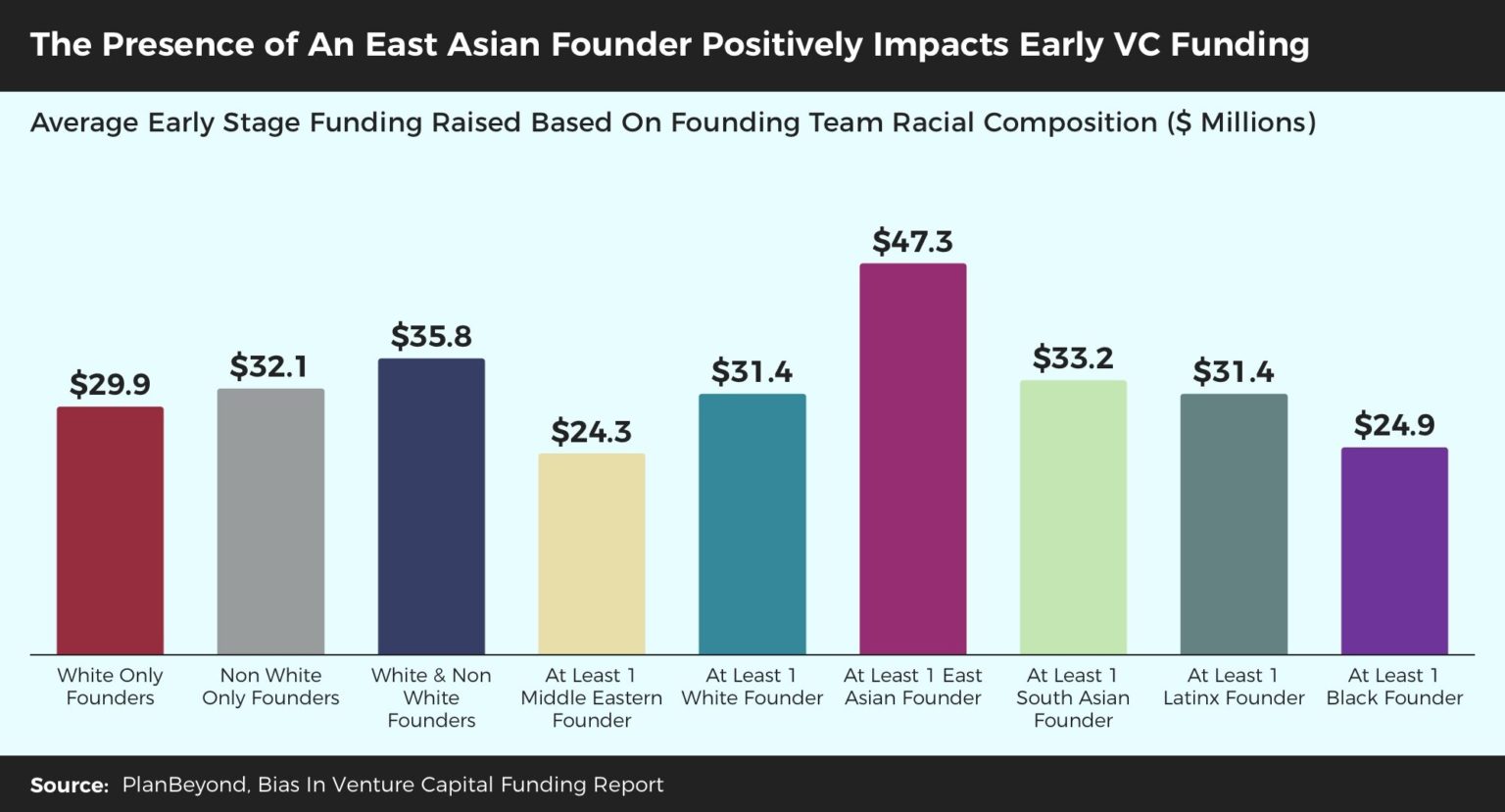

Our data shows that the sex-based disparities we uncovered in funding begin at the seed stage and then follow organizations as they mature. In contrast, we see much more nuance when it comes to the way a team’s racial composition impacts funding per life stage.

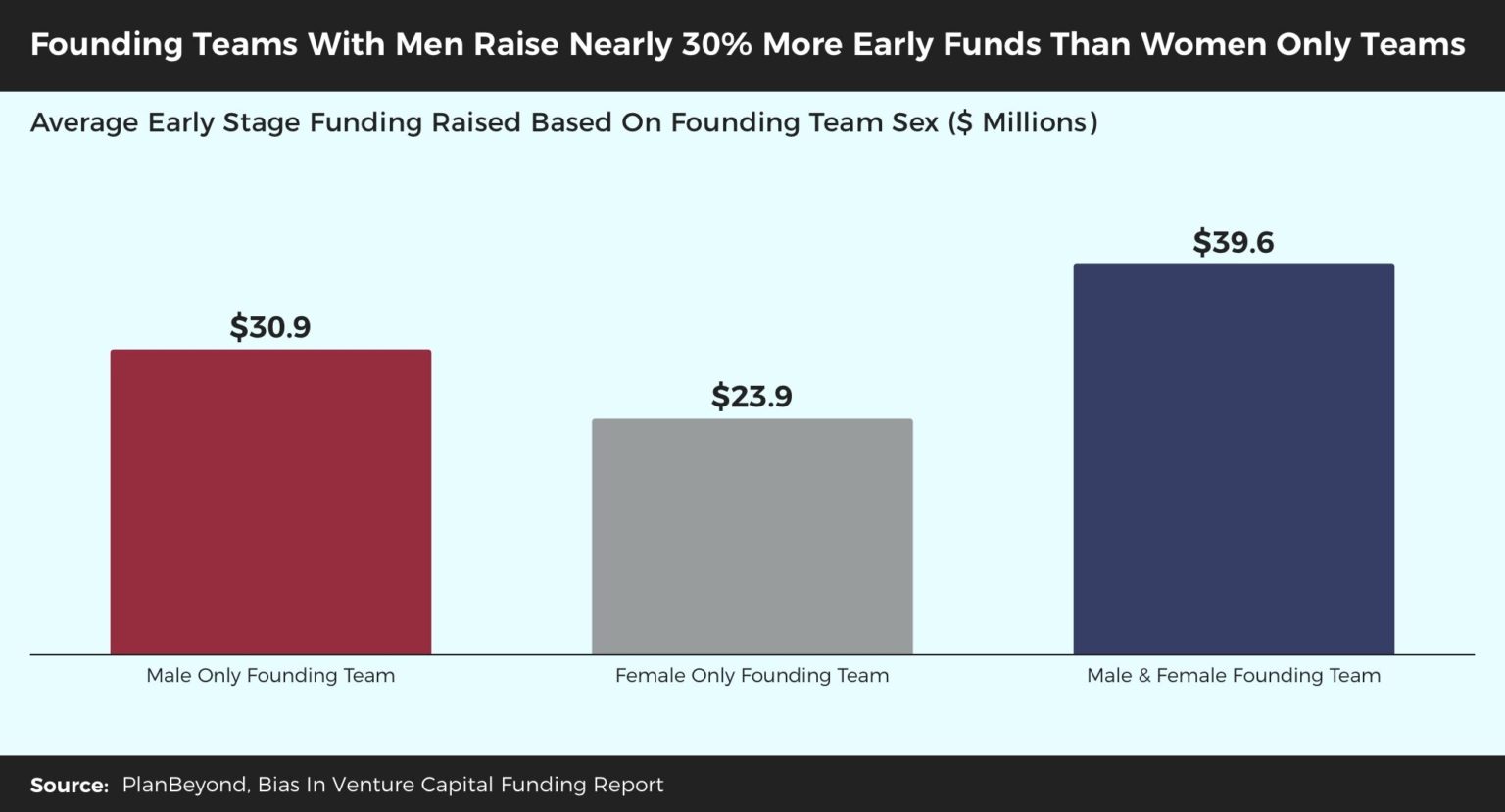

Founding teams with men, be they exclusively men or mixed-sex, raise at least 35% more money at the seed stage than women only teams.

Interestingly, having at least one South Asian founder results in higher seed raises. Though, once again, a fully white team is more likely to raise a higher seed round than a fully non white team.

Interestingly, at this business stage, having at least one East Asian founder on the team can drive funding raises up.

As organizations move into Series A and Series B funding rounds, those with men on their founding teams continue to raise more money.

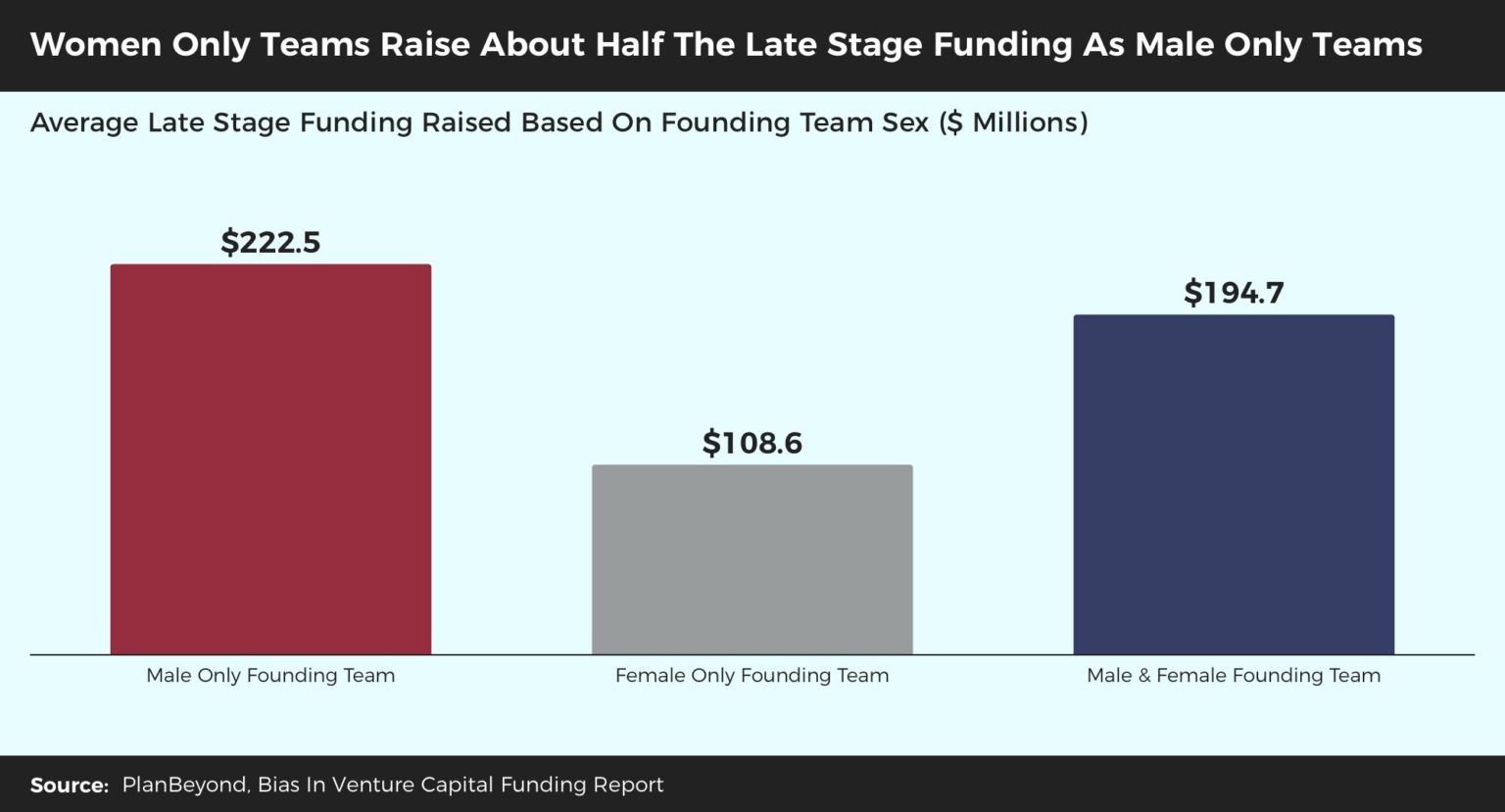

Funding disparities become visibly blatant during later funding stages. Founding teams composed exclusively of women can expect to receive almost half as much as teams with women and men, and considerably less than that when compared to men only teams.

When we look at businesses today, we see very few venture-backed start-ups with women at the top. This data shows us this isn’t surprising at all. Women only teams are less likely to be raising early and late stage funds, and when they do they raise far less than teams with men.

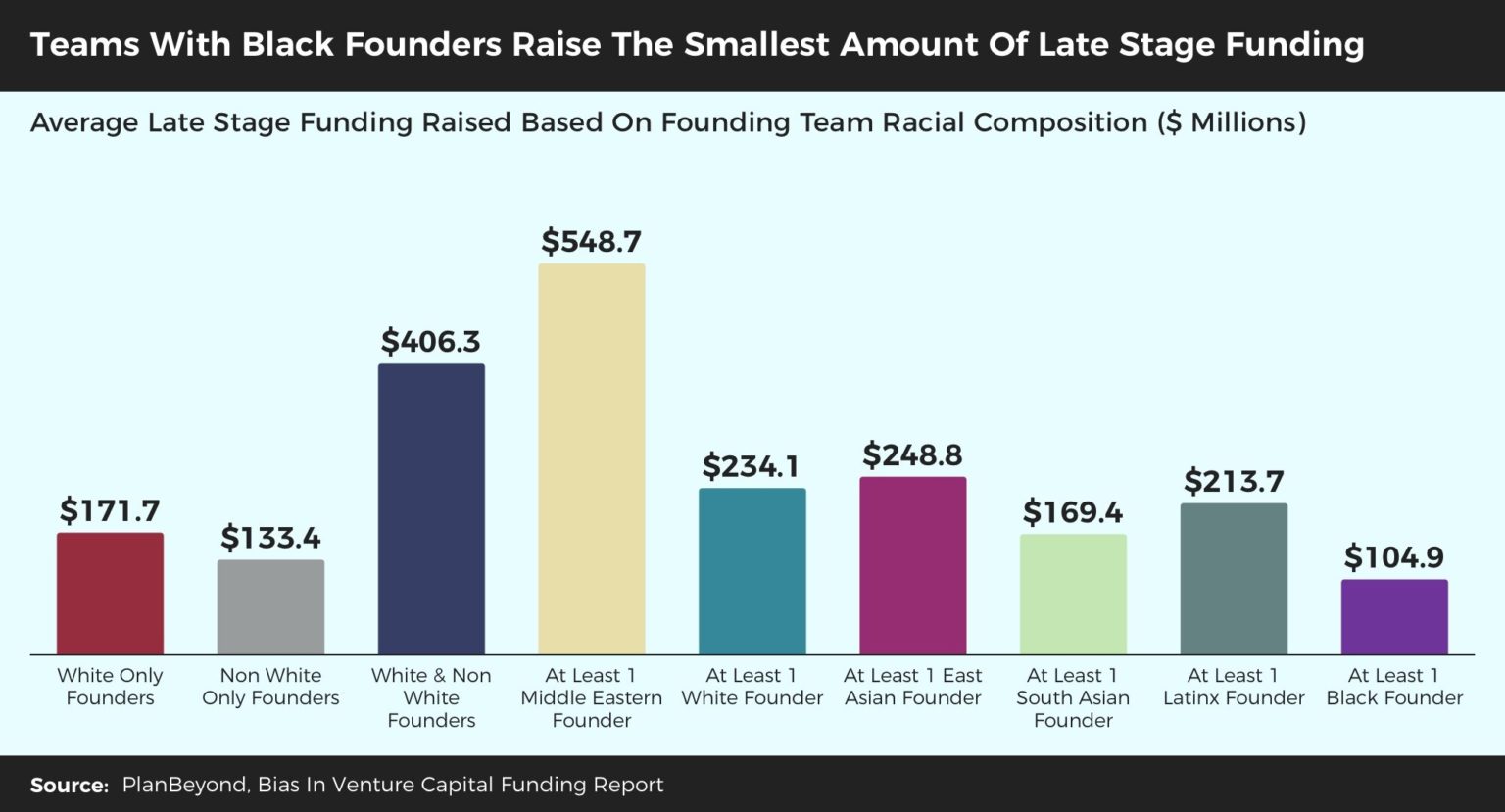

The racial composition picture is much more varied. Companies with at least one White founder may not be the ones receiving the most funds at different stages, but they are never the least funded either. Meanwhile, having a founding team with at least one Middle Eastern, East Asian, or South Asian member can be a boon at different life stages.

However, it must be mentioned that companies with at least one Black member on the founding team raise smaller rounds across each and every life stage. Again, when we look at businesses today, we see very few successful venture-backed start-ups with Black leaders. With such a disproportionately low amount of money going to Black-led teams, how could we expect otherwise?

Interestingly, late stage companies with Middle Eastern founders are extraordinarily successful at raising funds. Teams with at least one Black member, however, receive the smallest amount of late stage funding of any team analyzed by race.

Conclusion

Our research uncovered an extremely unfortunate truth in the venture community. Businesses led by men, and particularly White men, are more likely to not just attract investors but also raise more funds throughout their life spans. Yet, these businesses are less likely to support our communities’ wellbeing. In contrast, organizations led by Women and Black founders are more likely to help our societal well being, but they are less likely to attract investors and funding.

There is slow and steady growth in funds that focus investments on women and minority-lead businesses, though these are still very much outliers. What this research shows us is that these funds don’t just ensure that women and minorities enjoy an opportunity to build successful, scalable businesses. They also are more likely than generalized venture funds to promote products and services that positively enhance our societies.

As existing venture capital firms raise funds for their next batch of investments, and as new venture funds emerge, there’s a very real opportunity to consider what impact their funding can have. There will likely be an expectation that funds have extremely robust returns. After all, these are risky investments. Yet there’s nothing saying that they can’t have robust returns and play a key role in making our communities, and society as a whole, better.

Methodology

Starting with publicly-available data published by Crunchbase, a platform for finding business information about private and public companies, we compiled a list of all companies receiving venture funding in 2019, including seed, early, and late stage funding. Organizations receiving venture funds for IPOs or mergers and acquisitions were excluded.

Again, using Crunchbase, we gathered the names of every founder associated with these organizations. Using a host of public, digital sources (e.g. LinkedIn, Google Image Searches), we gathered information on each founder including sex, race, education, and professional background. To determine race and sex, data coders were asked to select the race and sex they believed most closely described each founder, using cues like physical traits and first and last name. While not a wholly perfect approach, it attaches labels to founders based on easily-visible traits and therefore mimics how founders are likely initially perceived when interacting with investors.

Companies that met the following criteria were coded as benefiting society: having positive environmental impacts, giving resources to traditionally underserved communities, promoting education and/or knowledge sharing, improving access to transportation, and supporting general health. Companies heavily in the medicine or pharmaceutical realm (e.g. require FDA approval) were coded separately as access to advanced levels of medical care are not as critical health determinants as basic healthcare access. Each company’s website was used to determine if they met one of these criteria. To minimize coder bias, companies that expressly mentioned creating these benefits were coded as such, therefore relying on organization marketing to self-categorize rather than on data coders to self-interpret.

Upon collecting all raw data, we analyzed demographic trends in founder team composition, the differences in which the race and sex of founders and founding teams impacts investment rounds and money raised, and the degree to which founder sex and race impacts organizational focus.