Estimating your Total Addressable Market (TAM) is one of the most important steps when launching a new product or breaking into a new market. Get it right, and you’ll have a clear roadmap for investment, growth, and strategy. Get it wrong, and you risk misallocating resources, missing opportunities, or even derailing your entire business plan.

Most teams start with the numbers: top-down or bottom-up calculations that promise a tidy, data-driven view of the opportunity ahead. But, here’s the catch. Markets are rarely that simple. Relying on quantitative frameworks alone can leave you blind to the hidden forces, shifting dynamics, and real-world complexities that shape true market potential.

To avoid costly surprises, it’s essential to go beyond the spreadsheets. By pairing your market sizing with in-depth, qualitative insights from industry insiders, you can fill in the gaps, challenge your assumptions, and build a far more accurate picture of what’s possible.

Why Quantitative TAM Inputs Aren't Enough

Let’s first consider the classic approaches to measuring TAM.

Option 1: Top Down. The top-down approach starts with broad industry data. This includes market reports, analyst forecasts, and macroeconomic indicators. You filter down from the total market size to your specific segment. It’s fast and scalable but depends heavily on the quality and relevance of external data.

Option 2: Bottoms Up. The bottom-up approach builds TAM from the ground up. You estimate the number of potential customers and multiply by expected revenue per customer. This method is often more precise but requires detailed assumptions about customer behavior and pricing.

Both approaches offer a solid starting point. They provide objective, data-driven estimates that are essential for planning. However, they’re inherently limited by the data they rely on. That’s where challenges arise.

Market data can be outdated, incomplete, or too generalized. Quantitative models often miss emerging trends, shifts in customer preferences, or regulatory changes that could dramatically expand or shrink your market. The failure of Google Glass is a great example of these misses. The market size seemed huge. But, privacy concerns, public backlash, and bans in various settings made it tank.

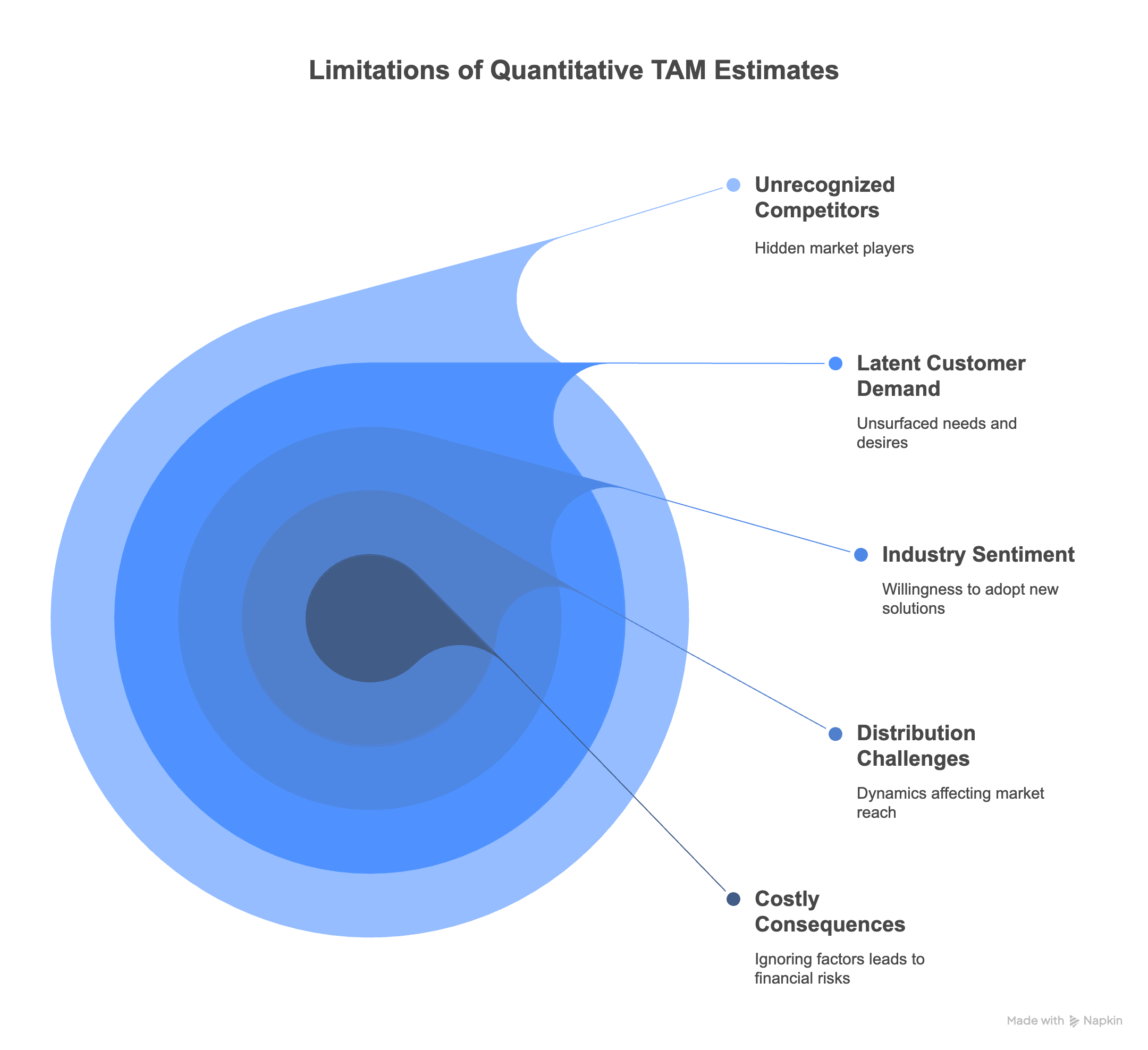

More importantly, these models overlook intangibles. The subtle market forces that numbers can’t capture. Things like:

- Unrecognized competitors or substitute products.

- Latent customer demand that hasn’t yet surfaced.

- Industry sentiment and willingness to adopt new solutions.

- Distribution challenges or channel dynamics.

Ignoring these factors can lead to over- or underestimating your TAM, with costly consequences.

Validating Your Market Size Estimates With Interview Research

To overcome some of the classic market size estimation blinders, add in industry interviews. Speaking directly with market insiders—whether they’re potential customers, channel partners, analysts, or industry experts—adds a qualitative layer of insight that complements your numbers.

Interviews help you:

- Validate assumptions behind your quantitative models.

- Uncover hidden opportunities or risks.

- Understand market dynamics and customer pain points.

- Detect early signals of change, like upcoming regulations or technology shifts.

For example, an interview with a distributor might reveal bottlenecks in reaching certain customer segments, reducing your effective TAM. Or a conversation with a customer could highlight unmet needs that expand your market opportunity.

Structuring Your Market Sizing Validation Interviews

To maximize the value of interviews when validating market size estimates, it’s essential to approach each conversation with a clear structure and targeted questions. A well-crafted discussion guide ensures you cover all the critical areas that could impact your assumptions.

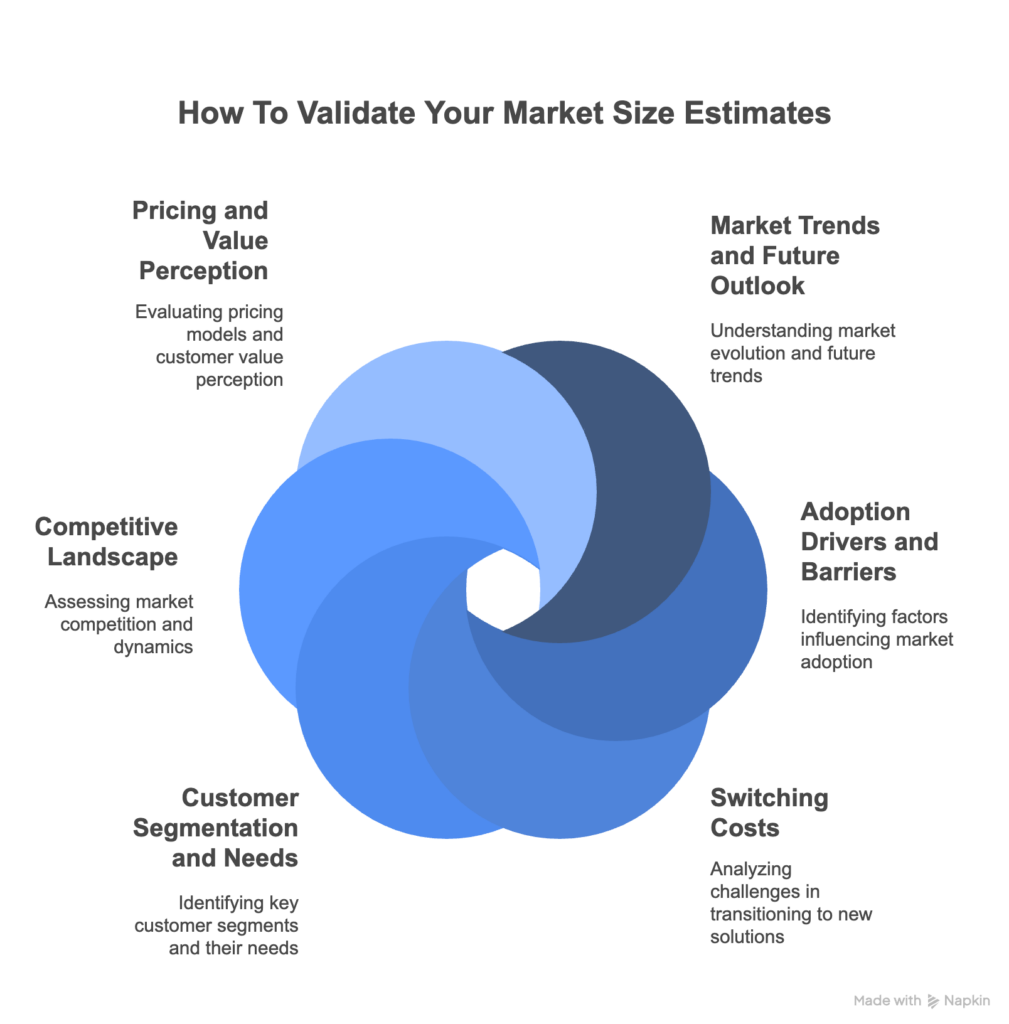

We often see specific areas included in these conversations.

Market Trends and Future Outlook

- What macro or micro trends are shaping the market?

- Are there upcoming regulatory changes, technological shifts, or new entrants to watch?

- How do insiders see the market evolving over the next 2-5 years?

Adoption Drivers and Barriers

- What factors most influence adoption of new solutions in this space?

- Are there regulatory, technical, or cultural barriers to adoption?

- What could accelerate or slow down market growth?

Switching Costs

- What are the main obstacles to moving from a current solution to a new one?

- Are there financial, technical, or operational challenges that make switching difficult or risky?

- How do existing relationships, integrations, or internal processes increase resistance to change?

Customer Segmentation and Needs

- Who are the real buyers and decision-makers?

- What are their key pain points, and how are they currently addressed?

- Are there customer segments that are growing, shrinking, or underserved?

Competitive Landscape

- Who are the main competitors, including emerging or non-traditional players?

- Are there substitute products or services that could impact TAM?

- How is the market share distributed, and is it shifting?

Pricing and Value Perception

- What pricing models are prevalent (e.g., one-time, subscription, usage-based)?

- How do customers perceive value, and what are they willing to pay?

- Are there trends in pricing or bundling that could affect market size?

Blend Quantitative Data and Qualitative Insights For A Full Market Picture

When combined, your market estimate numbers and nuanced interview feedback provide a much fuller picture of the market and where it’s headed.

This is because the numbers just tell one part of the story. They offer a clear, data-driven view of the market’s potential size and help set a foundation for planning. But on their own, they can miss emerging trends, customer hesitations, and the real-world complexities that shape market behavior.

Meanwhile, interviews tell another side. They bring out the context, motivations, and barriers that numbers can’t capture, surfacing insights about decision-making, switching costs, and evolving needs. However, interviews can be subjective and may not always scale across the entire market.

However, when combined, you get a robust, more accurate picture of your market and where it’s headed. Combining quantitative estimates with qualitative feedback ensures that your strategy is grounded in data and informed by real-world perspective, a more complete way to capture market dynamics.