Pricing is one of the most critical business decisions. Price too high and your customers may walk away. Price too low and you leave money on the table. Striking the perfect balance requires more than guesswork.

Data-driven pricing strategies do just that. They allow businesses to align prices with customer expectations and market dynamics, resulting in price points that maximize revenue while keeping customers happy.

The Impact Of Bad Pricing Decisions

Good pricing decisions require weighing customer behaviors, value perceptions, and competitive activity.

Consider GoPro’s high price miscalculation. They launched the Hero 4 Session at $400, overestimating its appeal and demand. The price was later slashed to $200 following poor consumer sales. But, the damage was done. Competition gained a leg up in what was once a niche market, leading to subsequent financial challenges.

On the flip side are stories like that of Kell & Rigby and Reed Construction, both Australian construction firms. Years of bidding below cost to win projects led to financial distress. This resulted in cash flow challenges, substandard work, client disputes, and, ultimately, collapse.

In essence, bad pricing decisions have costly consequences:

- Price points that are too high push customers toward competitors or out of the market entirely.

- Price points that are too low may result in more buyers but they lead to profitability declines, low-quality perceptions, and potentially harmed business health.

Data-driven pricing strategies mitigate these issues. They offer clear insight into what customers are willing to pay while balancing the prices businesses must charge to be viable.

Data Driven Pricing Stratagies

Structured methods exist to pinpoint optimal pricing. These approaches rely on systematic data collection and analysis to understand consumer pricing preferences.

The Price Sensitivity Meter (Van Westendorp)

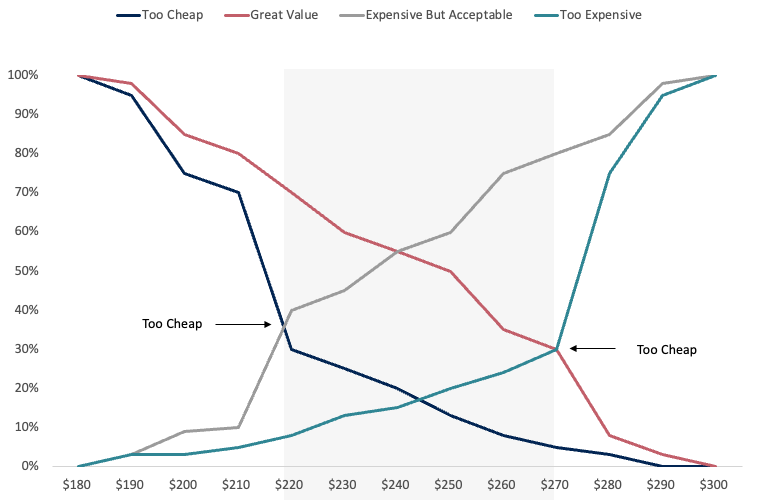

The Van Westendorp Price Sensitivity Meter (PSM) is a survey-based tool to identify customer-acceptable price ranges. This method asks respondents to react to four specific questions to analyze their perception of what’s “too cheap,” “too expensive,” and “just right.”

Here’s how it works. Via a survey, respondents see a product or service description. They then respond to four specific questions:

- At what price would you consider this product too expensive to buy?

- At what price would you consider this product too cheap that you’d question its quality?

- At what price would this product be expensive but still acceptable?

- At what price would this product be a great value for the price?

Responses to these questions create a price range that highlights the sweet spot where perceived value and willingness to pay intersect.

Additionally, by overlaying key financial considerations—break evens, 10% profit price, 20% profit price—companies see where certain prices fall within the sweet spot range. And, they also see if their break even fall outside of the acceptable consumer price range.

The PSM In Action

Imagine a company launching a new premium coffee maker designed for tech-savvy coffee enthusiasts. This product features Wi-Fi connectivity, a sleek modern design, and customizable brewing settings. The company must determine the price point that maximizes revenue without alienating potential buyers.

After running potential buyers through the PSM series of questions, we see that most respondents feel the coffee maker starts to feel “expensive” at $270. But, if the prices goes lower than $220, they begin to question the quality. Using this data, the company narrows the acceptable sweet spot to the $220-$270 range.

They then overlay margin data. If the product costs $110 to produce, pricing it at $270 generates a 59% gross margin. Meanwhile, pricing it at $250 reduces the gross margin to 56%. Given the company’s gross margin thresholds of 50%+, both price points are acceptable. But, since the Van Westendorp data driven pricing strategy shows that $270 is just at the border of too expensive, the company selects $250 to maximize revenue while minimizing customer alienation.

Key Benefits & Limitations

The PSM is powerful because it identifies acceptable price ranges while providing visibility into pricing thresholds. In doing so, it helps companies avoid pricing their products out of the market. But, it doesn’t account for price elasticity or competitive benchmarks. As a result, it often serves as a means of starting price exploration. But, it is not a tool for pricing refinement.

The Gabor-Granger Model

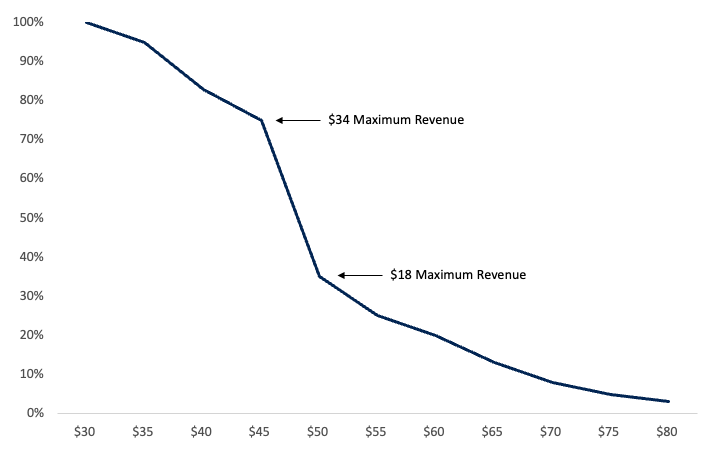

The Gabor-Granger model is another survey-based approach to explore how pricing impacts purchase likelihood.

Here’s how it works. Participants see different price levels for the same product. They are asked whether they would purchase it at each price. The resulting analysis shows the relationship between price and demand. And, in doing so, it helps identify the optimal price to maximizes revenue while minimizing declines in product interest.

Gabor Granger In Action

Let’s say you’re preparing to launch a premium skincare product. Using the Gabor-Granger model, you survey potential customers with price points ranging from $30 to $80. The results indicate that there is nearly 80% demand at $45. But, demand drops to lower than 40% once the price hits $50.

Additionally, the company looks at the maximum revenue potential at each price point, which simply multiplies the price point by the demand percentage. However, they see that the demand decline is so great by moving from $45 to $50 that it isn’t worth adding on the the extra $5. The extra revenue per customer does not make up for the decline in demand.

Based on this data driven pricing strategy, they choose a $45 to capitalize optimize demand and profitability.

Key Benefits & Limitations

As with the PSM, the Gabor Granger model comes with pros and cons. The upside of this method is that it determines optimal pricing based on customer demand while accounting for pricing elasticity. In essence, you see just how much you can extract from a customer before the price becomes too high.

But, just like the PSM, it relies on a very limited hypothetical scenario. As a result, when customers make decisions in the real world, surrounded by competitive options, behaviors may vary.

Rounding Out Data-Driven Pricing Strategies

Pricing decisions don’t exist in isolation. They are always intertwined with competitive behavior, and the market’s perception of those competitors.

As a result, two additional items should be considered when doing data-driven pricing:

- Competitive Analysis/Competitive Pricing: Understanding your competitors’ pricing strategies ensures your product remains competitive in the market. Analyzing competitor pricing identifies pricing gaps while letting you visualize what it means to price a product too high or too low. In doing so, you can align your pricing strategy with market standards while emphasizing its unique value.

- Conjoint Analysis: Conjoint analysis lets you see how customers value different product features relative to its price. By integrating this method, you can identify the trade-offs consumers are willing to make, determine which features drive perceived value, and tailor your pricing strategy accordingly. This ensures pricing that reflects both customer preferences and the most critical aspects of your offering.

By adding just one of these incremental approaches to your pricing research, if not both, you can develop a comprehensive pricing strategy that balances market competitiveness with customer value perceptions. This ensures your pricing decisions are both data-driven and aligned with your business goals.