With so many potential customers to go after, who is the best target? And, how do you target them?

These are key questions anyone developing marketing or go-to-market plans must answer. After all, how can you create compelling marketing positioning and messaging, let alone pick the right marketing channels, if these questions remain unanswered.

This is where customer segmentation comes in. As a market research method that finds unique groups within a particular population, customer segmentation not only objectively isolates potential customer groups but it also sheds light on what’s needed to attract them to your organization.

What Is Customer Segmentation

Customer segmentation is the practice of dividing a customer base into smaller distinct groups based on shared characteristics. Typically, these characteristics fall into one of two types: demographics and psychographics.

1) Demographic Metrics: These are statistical characteristics within the population. The easiest way to think about this is by considering the types of metrics in a government census like:

- Zipcode

- Race or ethnicity

- Income

- Household size

- Geography

2) Psychographic Metrics: These are characteristics that reflect opinions or attitudes. Think about psychographics as the types of things people think or feel. This includes:

- Political sentiment

- Attitudes about technology

- Opinions about climate change

- Preferred hobbies or activities

By combining demographic and psychographic metrics, you get a robust view of who your target customer is. You can see what drives them..and also what barriers they have. You understand their fears and concerns, but also their hopes. With this deep picture, you begin formulating plans to attract them as customers.

How Segmentation Goes Beyond Population Breakouts

A typical question is: why not just break out a population via simple demographic or psychographic metrics alone? While this is a start, it may be too simplistic and yield less actionable results.

Let’s take an example we speculate happened inside Nissan HQ when considering their next advertising campaign. Nissan wanted to understand the car-buying segment. Specifically, they wanted to understand women car buyers. As primary household purchasers and influencers, this is a typical segment to examine. However, Nissan didn’t just run market research to compare female vs. male car buyers. If they had, they may have seen that that women tend to prioritize reliability and safety versus men and built a marketing campaign around that alone.

Instead, Nissan went a step further. They performed customer segmentation among women car buyers. In doing so, they uncovered something else. Sure, women car buyers want reliability and safety. But, there’s a segment that sees cars as symbols of freedom and empowerment. For these women, cars don’t just get you from point A to point B. Instead, cars represent these womens’ drive to excel.

We think this is how Nissan developed the “Don’t Compromise” campaign. Featuring Brie Larson (a.k.a. Captain Marvel), this campaign speaks directly to women that want the proverbial seat at the table, and want cars that are as powerful as they are.

Sure, it’s had some detractors. But, by being explicit about who their vehicles are for, Nissan is making a deliberate effort to improve their appeal among this distinct segment and win them as customers. In a world of homogenous car ads that just list a car’s features, this makes Nissan truly stand out.

How To Perform Customer Segmentation

For Nissan’s marketing team to even develop that campaign, they first needed to understand the distinct segments within the female car buying population. Enter customer segmentation.

Here’s how it works. We first start with a really large sample population. Ideally 1,000 respondents or more. We then have each respondent take the same, somewhat lengthy survey that captures their demographic data as well as psychographic information. In the case of Nissan, this likely meant asking about aspirations, professional goals, and attitudes towards cars.

With the data fully collected, we can then perform factor analysis. This is a statistical method that isolates distinct clusters within a unique population. Each cluster is comprised of individuals that look alike based on demographic or psychographic variables.

How Segmentation Impacts Marketing

Customer segmentation is an incredible tool when powering marketing strategy for two reasons. First, it lets you see the market share of distinct segments within a population, which helps isolate if certain groups warrant your focus. Second, it identifies how these segments are different across key dimensions, necessary inputs to formulate positioning and value props that fuel future marketing messaging and collateral.

Segmentation & Market Share

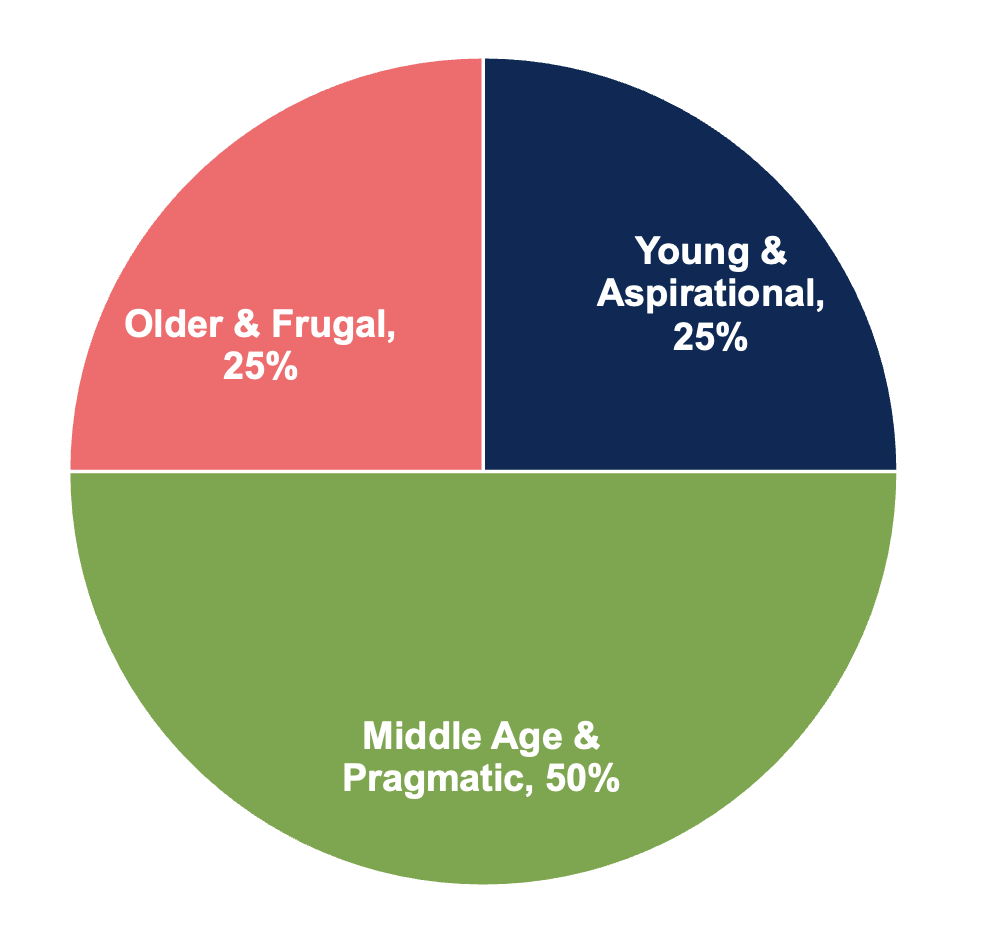

As an example of how to visualize segments and market share, let’s keep using our Nissan example. For instance, let’s say we ran a segmentation study among female car drivers and found 3 distinct groups.

As we look at our 3 fake groups, we see two of them represent 25% of the car buyer population. Meanwhile, one of them represents 50% of the population. As a result, we now know the market share of each segment.

However, this alone isn’t sufficient. After all, we might be tempted to select the segment with the biggest share. But, by looking deeper at each group, we start to see that one of the smaller segments is more attractive.

Segmentation & Customer Targeting

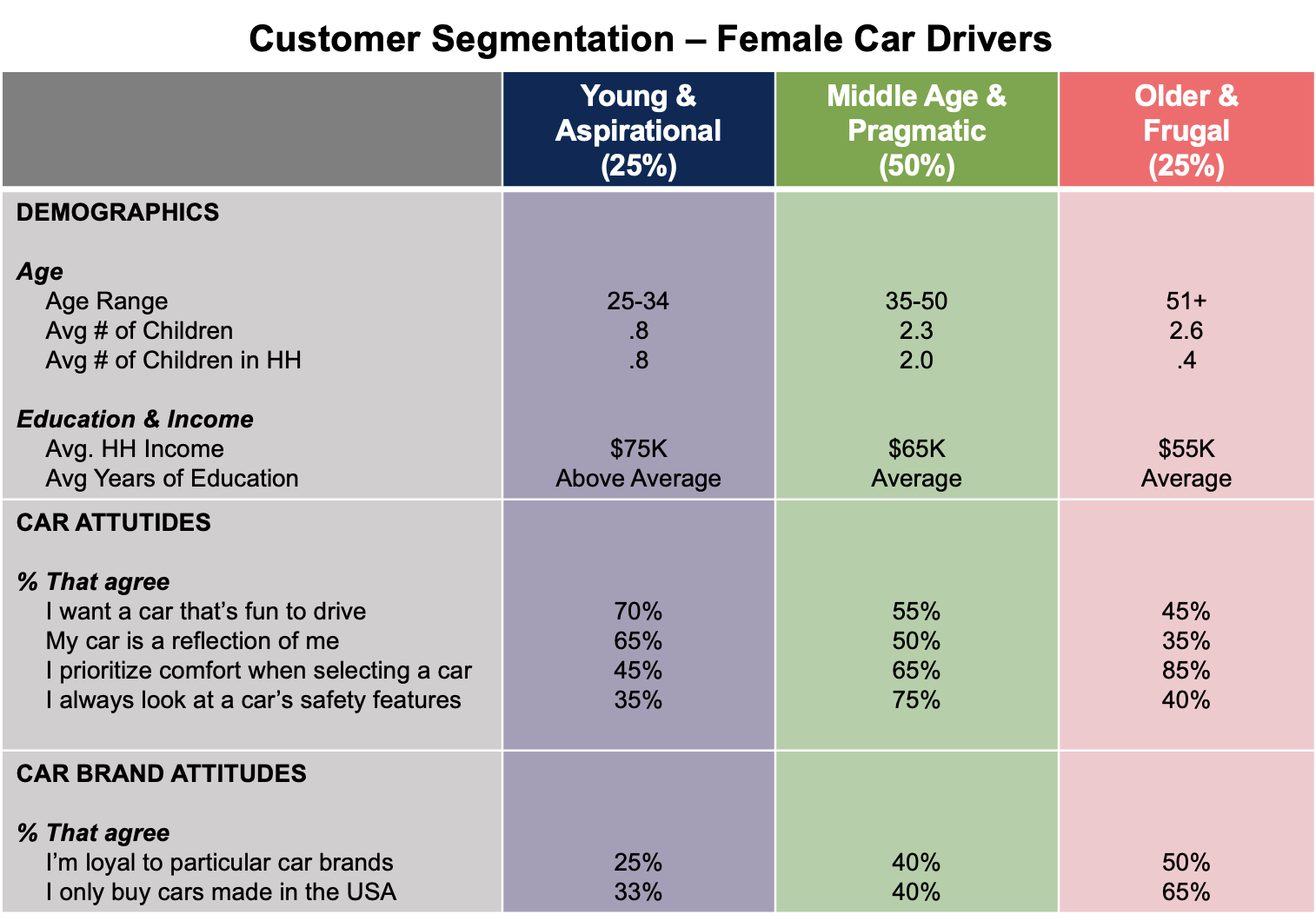

Let’s look at some make-believe data to see how this all plays out. As you’ll see in the table below, we’ve made up some data to visualize how each of the segments nets out in terms of demographics but also car-related psychographics.

We see that the Young & Aspirational segment is only 25% of the total market share. However, they are younger, they have fewer children, and they tend to have a higher household income. Said another way, this segment may be smaller than other segments, but they have more discretionary funds and fewer responsibilities.

Even more interesting are these three segments’ attitudes towards car and car brands. We see our other two hypothetical segments, Middle Age & Pragmatic and Older & Frugal, both skew higher toward prioritizing car comfort and safety. They are also more set in their ways when it comes to car types. In contrast, our Young & Aspirational segment wants fun cars that reflect them. Also, they are more open to considering new brands.

Sure, Young & Aspirational may make up a smaller share of the female car market compared to Middle Age & Pragmatic. But, their ability to pay for cars and their car attitudes make them more attractive to a brand looking for people willing to switch and be able to switch.

Driving Better Marketing With Customer Segmentation

As you saw via the process above, working with customer segmentation data is a mix of art and science. The science comes when doing the statistical analysis and observing how each segment is similar or different than the rest.

However, the art comes via the interpretation and application of that data. It gives us an opportunity to assess which customer target is ideal given an organization’s place in the market today and what they can offer to each target. And, it lets us craft positioning and messaging that we know will strike a chord with that segment.

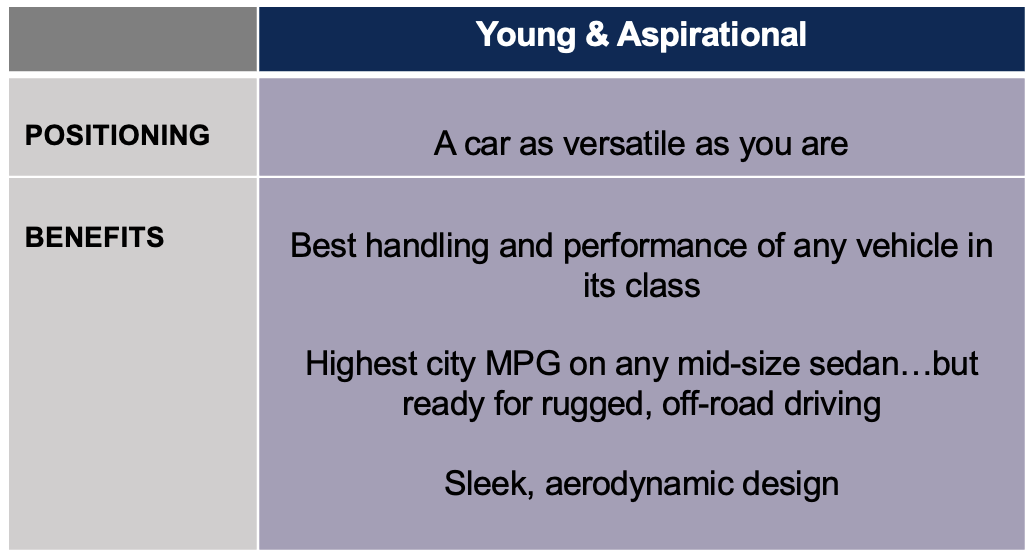

Let’s keep using our female car segment to see how this plays out. For instance, let’s say we decide to focus on the Young & Aspirational segment. Now we need to develop targeted positioning and value props. We take what sets our vehicle apart in terms of its unique features. We then marry it with what we know about our unique customer segment. The end result is something like the table on the right; highly-focused positioning and messaging that will align with the Young & Aspirational segment’s needs and wants.

When it comes to launching this marketing messaging, we can expect that it might not resonate with our other segments. That’s a-okay! Good, targeted marketing will not work for everyone. However, it should be so effective with our target segment that it effectively changes their perceptions and increases their likelihood to buy.