How much effort does it take to get someone to check out your product? Not to mention trial it and buy it. There’s a lot of time, energy, and cost associated with building awareness and acquisition, especially if you’re engaging in any kind of paid marketing activities. If you lose that person and never get them over the finish line, you’ve lost that investment. Right?

Well, not entirely.

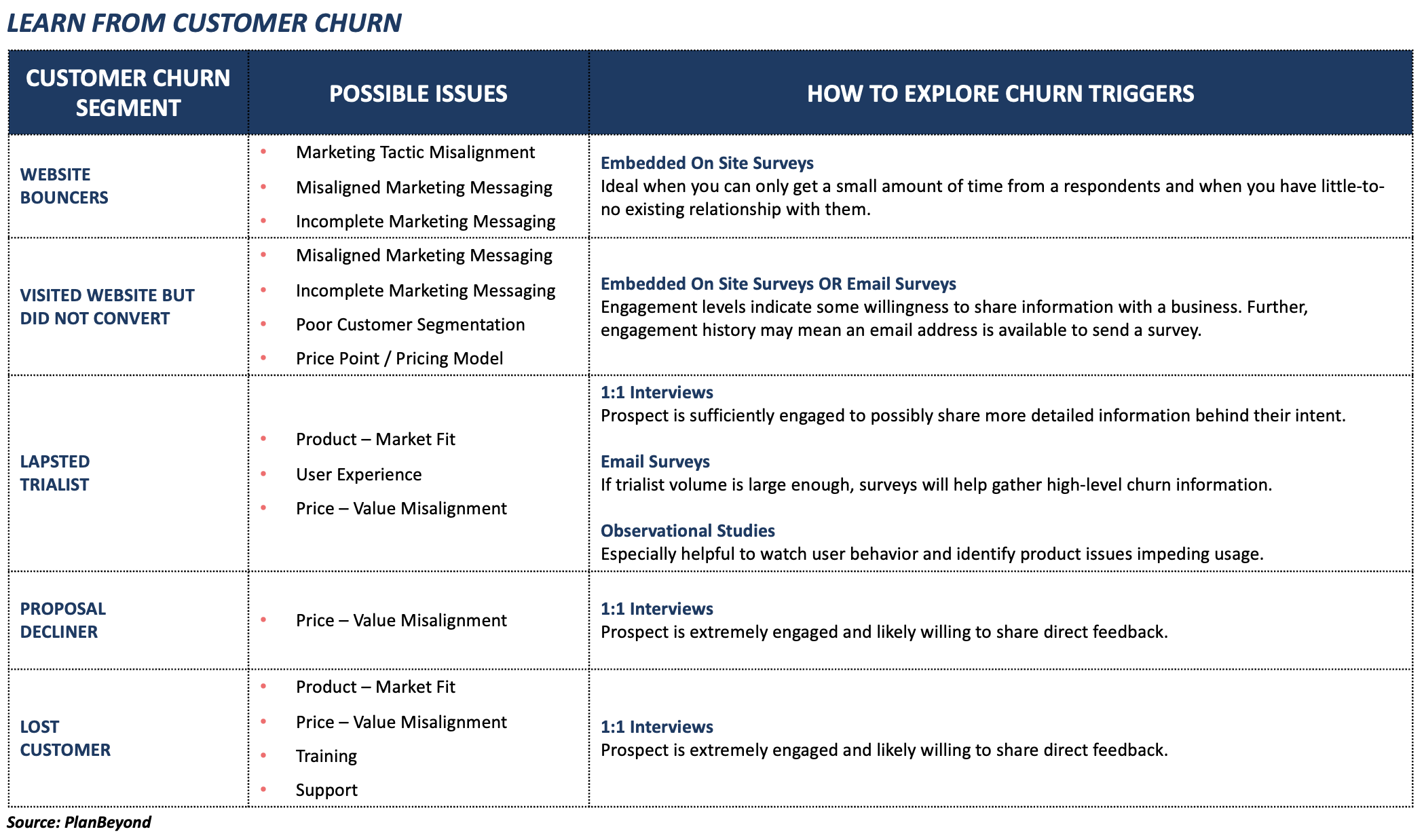

You still have a lot that you can learn from customer churn. By proactively researching each buyer stage’s churn, you’ll build concrete insights to improve marketing, sales, and product operations. And, in doing so, cut that churn number down too!

Customer Churn Segments To Care About

Lost customer opportunities abound in any business. They include fairly unqualified segments just looking around. But, they also include customers that choose not to buy from you again. Apply market research methods to each customer churn segment to identify churn triggers and improve churn rates.

1. Website Bouncers

These are people who visit a single page on your website and then leave. We call this the digital equivalent of a ding-dong-ditch. Their rapid departure shows that whatever they saw on your site was not of interest.

What Can You Learn: While relatively unqualified, this group represents the highest volume of individuals in your customer churn category. As a result, isolating what’s not resonating with them has major business impacts. Ping these individuals with an on-site survey just as they are about to leave your site. This will let you learn….

- Marketing Tactic Misalignment: This tells you that your marketing channel investments (e.g. paid ads, PR, sponsored content, content syndication, etc.) bring in the wrong individuals.

- Misaligned Marketing Messaging: This problem area indicates that the messaging—value propositions, features, or benefits—don’t resonate and therefore not compelling individuals to learn more.

- Incomplete Marketing Messaging: If the information people want is not readily available, they won’t spend further time exploring what you do.

2. Visited But Never Converted

This customer churn group is more invested than the website bouncer segment. These non-converters visited and engaged with your site, but nothing more. This includes multiple page visits or referencing richer information like eBooks, white papers, or webinars.

What Can You Learn: While somewhat unqualified, they are engaged and learning. Use on-site triggered surveys or email surveys to isolate particular marketing issues. This will let you learn….

- Marketing Messaging: As mentioned above, the information on-site may be ambiguous. Prospects could be unsure that your product will actually meet their needs.

- Customer Segmentation: People may be interested in the product, but unsure that it’s for someone like them. For B2C businesses, this could mean thinking that the product is for someone with a different background or profile. For B2B businesses, this could mean thinking the product is for someone in a different industry or profession.

- Pricing: People may not be buying because of a problem with pricing. It could be the static price point itself, or perhaps an issue with the pricing model.

3. Lapsed Trialists

Lapsed trialists are people who tried the product but then ultimately choose not to buy. These individuals are on the cusp of making a purchase, which makes them a very interesting customer churn segment to examine.

What Can You Learn:Â Because this segment stops right before the finish line, they represent your biggest short-term opportunity. Interview them to explore their concerns and what impeded a final purchase. This will let you learn….

- Product-Market Fit: Churned trialists may say the product does not meet their needs. Or, you may uncover that they are not recognizing the full breadth of what the product offers and therefore aren’t deriving enough value from it.

- User Experience: Perhaps the underlying product or service is good. However, the experience around it—on-site or in-app navigation, customer support, etc.—is not user friendly.

- Pricing: Price may again be an issue. This time, pricing issues usually revolve around perceive value issues.

4. Proposal Decliners

Some businesses do not offer free trials. In particular, B2B businesses may require prospects to request a proposal. Choosing not to move forward makes them a Proposal Decliner. This customer churn segment is once again seriously considering a purchase but chooses to pass.

What Can You Learn:Â This segment matches very closely to the lapsed trialists. As a result, you’ll want to perform interviews with this segment as well. You’ll explore the items mentioned above and identify the factors impeding proposal acceptance.

5. Lost Customers

The last segment of note is lost customers. These may be individuals that made a single purchase but never came back. Or, they may represent individuals that actively cancelled a recurring service or subscription. Because customer acquisition is so resource intense, this is an especially critical segment. Their loss represents the biggest hit to your topline revenue.

What Can You Learn:Â Doing one-on-one interviews will help you understand if you have issues impeding long-term retention. This will let you learn….

- Product-Market Fit: Customers may have initially thought there was enough value from the product. However, after usage, they may feel the value just isn’t there.

- Poor Training: For more complex products, onboarding and training drives product usage. Insufficient training could mean they do not reap the product’s full benefits.

- Poor Support: Related to training, customers may need help troubleshooting issues or evaluating how best to use the product. Poor support staff or materials may result in dissatisfaction and churn.

How To Explore Each Customer Churn Segment

Of course, you can’t just use one type of market research method and expect it to work with each customer churn segment. You have zero relationship with a bounced website visitor. Also, you don’t have an email address. As a result, expecting them to spend 30-minutes talking to you is unreasonable. On the flip side, developed a relationship with trialists and lapsed customers. This gives you the opportunity to talk to them and learn more nuanced details. This is why you need to map your research approach to individuals based on their known behaviors.

When To Use Surveys To Explore Customer Churn

Use surveys when you can collect a large-enough sample size to see trends in the numbers. This is one reason to use survey with site bouncers and non-converters. Further, depending on your trialist volume, surveys may work well with that segment as well.

Also, because you can keep surveys fairly short, they are ideal when you can only get a small amount of time from a respondent. This is most likely true from least qualified customer churn groups.

When To Use Interviews To Explore Customer Churn

Interviews require participant time commitment. As a result, you’ll likely find that those who invested more time in your product—lapsed trialists, proposal decliners, lost customers—are more willing to participate. This approach also gives you far deeper, nuanced insights than surveys ever will.

Additionally, you likely won’t have as high a volume of theses individual. This means you won’t get the sample sizes you need if you went the survey route.

When To Use Observational Studies To Explore Customer Churn

Use observational studies watch behaviors that individuals may not even be aware of. This includes doing screen shares with known users, watching people engage with your product or website, or capturing behavior patterns from anonymous visitors. Observational studies are especially useful when trying to understand user experience issues, a common issue with the lapsed trialist segment.

Regardless of which market research method you select, remember that it needs to be oriented around helping you answer and address the core question of, “Why are individuals in each segment not engaging more?” Keeping a clear north star behind your research helps focus efforts and home in on solving issues impacting new customer and revenue growth.