Launching a B2B customer interview project is one of the best ways to make sure your business is on the right path. Data from these interviews validates several key business areas, including product-market fit, industry evolutions, and buying cycles. In essence, they are critical for building better and smarter marketing, sales, and product engines.

Why Opt For A B2B Customer Interview Versus A Survey

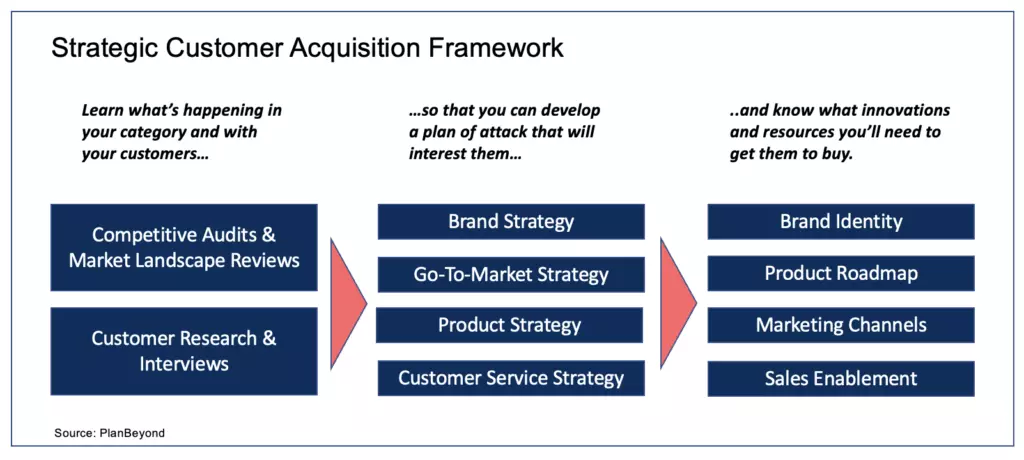

As we’ve written about in the past, performing customer research is a critical step to growing a business in a strategic way. Without inputs gathered from a B2B customer interview, you’ll be left blind in several areas. For instance, you won’t know if selected messaging or value propositions will resonate with your audience. Additionally, you’ll be flying blind when prioritizing your product roadmap and marketing budget allocation. That’s why this activity is a critical first step in the strategic marketing framework!

Now, you will need to decide if it’s customer interviews that are the best course of action as opposed to surveys, pulling secondary research, or some other data collection approach. A good place to start is answering the question, “How much don’t I know?”

This is a crucial question because the more you don’t know, the more you’ll want to do interviews. Consider it this way. If you can write clear cut survey questions with answer choices, then you likely have a decent sense for your customer and have some inclinations about what to ask them. If you’re struggling to even write those questions, then you probably don’t know enough about your customer to draft them up. Hence, you need a more open-ended data collection approach to build those early understandings. This is where customer interviews come in.

In essence when you need to get an initial grasp of who your customer is, what they look like, and what drives them, use customer interviews. This lets you ask broad questions and lets your customers guide your understanding of who they are.

Getting The Interview Process Set Up

Before you even get started, you’ll want to make sure you’re squared away on a few things first:

-

Objectives: At the onset, make sure everyone in your organization agrees on your interview objectives. You’ll often be able to tackle 3-4 main objectives during your interview sessions. If your team has more than four, get together and pair them down. Find the four most critical issues you’re trying to answer. It’s only by being focused on a few key objectives that you’ll be able to get the most out of your interviews.

-

Respondent Profile: Be crystal clear about who you want to talk to. Is it current customers? Prospective customers? Competitor customers? Or, maybe it’s people in a related space that you’re considering entering. Usually your objectives will help guide exactly who it makes sense to talk to.

-

Number of Interviews: You’ll also need to know how many interviews you want to run. Too few and you won’t see trends. Too many and you’re wasting time and money. We generally say you need a minimum of five interviews before you see a topic repeated once or twice. Getting to eight-to-ten interviews lets you have a bit more confidence that those repeated topics are in fact trends.

How To Structure B2B Customer Interviews

Your customer interviews are an opportunity to ask broad but structured questions. Include prompts that help guide your research so that trends as you perform more and more interviews. However, keep those prompts open-ended enough that it’s the customers themselves presenting those trends.

When it comes to prepping a B2B customer interview, we find that the following series question areas helps home in on key details:

-

Business Trends – These questions help you see the bigger issues or questions scrolling through customers’ heads. Again, they help with positioning your product in a way that aligns with organizational evolutions.

-

Job Responsibilities – These questions help you get a feel for the day-to-day work your customers do. What are the big things and little things that take up their day.

-

Performance Measurement – Knowing what key metrics or KPIs assess their performance is a great way to get to the heart of your customers really care about. They may say they have five key responsibilities. But if they only measure on one or two of them, you know what really matters.

-

Main Challenges/Barriers To Performance – These questions help you understand what makes your customers’ jobs harder. They are ideal for starting to get to the heart of how your product or service can align with an existing need your customers have.

-

Organizational Hierarchy – No one works in a bubble. Knowing about your customers’ boss and boss’s boss, as well as their direct reports, helps build a broader picture of their job environment, who is responsible for what, and who is accountable to whom.

-

New Product Or Service Evaluation – Presumably you want to sell something to this customer. To do so successfully, you’ll need to know how they might want to evaluate your product or service. Do they just need a product overview? Will they need a free trial or proof-of-concept? Understanding their investigation process will let you create an internal process for giving them the necessary pieces to evaluate you.

-

Purchase Cycle & Purchase Process – Now we’re back to that bubble issue. In B2B settings, there are usually multiple people involved in a purchase. It can include everyone from a boss and colleagues to a procurement team in larger, enterprise settings. Knowing the number of people involved, and how long each step in the purchasing cycle takes, will help tell you who you’ll have to convince and how long you should expect the process to take.

-

Learning Channels – This series of questions helps you determine where to place your products or services so that prospective customers will find you. Maybe there are go-to digital publications everyone reads. Or, perhaps there’s an annual conference no one misses. Knowing where your customers go to learn and improve helps you direct where to put your limited funds.

B2B Customer Interview Questions

While the topic areas above are general recommendations, you still need to drill down into the actual questions you’ll use in your B2B customer interview discussion guide. As an example, below is a sampling of questions we use based on different research goals.

Persona Questions

Buyer personas are the building blocks of personalized marketing activities. The more you know about what drives your customers, and also what challenges them, the more you can tailor marketing around them. If you’re running B2B customer interviews for persona development, consider some of the questions below.

- Tell me about your role. What are you responsible for?

- How did you get into this field?

- What’s one great thing about what you do?

- What 1-2 things about your job keep you up at night?

- What core metrics or KPI’s are you working towards?

- Tell me about some of the biggest business challenges you face in your everyday tasks?

- What about people challenges? What staffing or skills challenges make achieving your goals difficult?

- If you could remove one thing from your everyday list of to-do’s, what would it be?

- What’s one thing you wish you had more time and attention to do?

- What’s a major professional goal you have for yourself in the next 4-5 years?

Organizational Hierarchy & Intelligence Questions

Are you trying to learn about influencers and stakeholders within an organization? If so, use B2B customer interview questions that delve into organizational hierarchy. These let you understand the key players within an organization and how they impact purchase decisions.

- Are you part of a core team or department? What name do you give it?

- What are the general functions or responsibilities within that team?

- Tell me a little about your core team. Who is part of it?

- Who reports to you? What are their titles and what do they do?

- Tell me about your direct manager. What’s their title? What teams report into them?

- What about your manager’s manager? Who are they? What’s their title and what do they oversee?

- What are the broader initiatives being stressed across your core department?

- Where does [INSERT OTHER DEPT NAME] fall within your organization? Is it part of your core team or department? Does it run in parallel? Or, something else?

- Are certain responsibilities shared across departments? If so, what are those responsibilities and who are they shared with?

- Are there separate departments or individuals overseeing your department’s operations in any way? If so, who are they and what are the reviewing?

Competitor Questions

When doing new product development or marketing strategy work, you’ll want to know more about the competitive landscape. You’ll unearth information about how competitors are perceived in the market, key inputs to determine how best to differentiate yourself.

- What other products come to mind that do this type of thing?

- Who would you say is the best in this category? Why?

- Think about the latest product in this category you evaluated. Why were you looking into it? What problems were you trying to solve?

- When I say the name [COMPETITOR], what comes to mind? What makes you say that?

- If you were to use an adjective to describe [COMPETITOR], what is it? Why?

- When you think about [COMPETITOR], what do you think they do really well?

- When you think about [COMPETITOR], what do you think they don’t do as well?

- Are you using any products like [NAME PRODUCT] today, or have you used them in the past? If so, what was your experience like?

- I’d like to ask you about a few features offered by [COMPETITOR] to see how important they are to you. [LIST FEATURE]. Is that valuable to your organization? Why or why not?

- Thinking about the [SOFTWARE/PRODUCTS/SOLUTIONS] you use in your everyday work, and it can be outside of our core category, are there any that really stand out as exceptionally easy to use? If so, what makes them so easy to use?

New Product Intelligence Questions

As you consider launching new products and services, you’ll want to make sure you include features and benefits customers actually want. Questions that let you delve into the appeal of product concepts help orient your team in the right direction.

- I’m going to read you a description of a product idea we’re considering and would like to hear your initial reactions. [READ DESCRIPTION]. What do you think about this?

- How do you think this would be received in your organization? Why?

- What are 1-2 things you really like about this idea?

- What are 1-2 things you don’t like about this idea?

- Do any questions or concerns come up as you think about this product?

- Would this replace something you use today? If so, what would that be?

- As you look at the [PRODUCT / SCREEN / INTERFACE], what draws your attention? Why?

- How well does this address some of your day-to-day challenges? Why?

- If it could include 1 other thing, what would that be?

- What would be the #1 thing that would prevent you from using this?

Go To Market Questions

Are you ready to start marketing your product? Then you’ll need to develop a solid go to market plan. The questions below tackle key go to market plan elements so that you can build a comprehensive plan.

- Where do you usually go to learn about the latest in your industry?

- Who do you look to as a major influencer in your field?

- As you’re learning about products in this category, how do you like to explore them?

- How important is a product trial when vetting out this type of product? Why do you say that?

- What are the key things you’d want to uncover or answer as you’re evaluating this kind of product?

- Who would be part of evaluating this product?

- How quickly could you make a purchase decision? For instance, is this something you’d have to budget for, or would you be able to purchase it when you want?

- What role, if any, does procurement play in this process?

- Think about other products like this that you’ve used or explored. What do you think would be a reasonable [MONTHLY/YEARLY/ONE-TIME] price for this?

- How would you want to pay for this? For instance, a monthly credit card charge, an annual invoice, or something else?

Where To Source Your Interview Respondents

Once you know what you want to ask, you need a group of people to talk to. As a result, we need to think about where to source participants for a B2B customer interview project. We typically source participants from a few places:

-

Customer Database: If you already sell a product and have a sizable database of customers, this is a great place to start. Other than an interview incentive (usually an Amazon gift card), you generally won’t have to pay to interview this group. However, they might be a biased sample; because they are already customers, they may represent only a subset of a larger customer base that happened to find your product or service.

-

Panel Sampling Organizations: There are major organizations that will help source respondents. These are called panel companies and they are in the business of maintaining large contact databases. By asking a series of screener questions, they can source people who meet your prospective customer criteria. But, in this case a potential downside is cost. We’ve seen the cost to recruit B2B participants range from $300 to $1,200. The more niche the participant, the higher the cost.

-

LinkedIn: If you know the type of person you want to interview (e.g. company, industry, job title), you can connect with them on LinkedIn and request an interview. It’s certainly a great way to reach an unbiased sample. However, this is an extremely time-intensive process since doing cold outreaches can take a very, very long time.

Essentially, there’s no right or wrong answer about where to sample your interviewees. Ideally, you can get a mix of customers and prospective customers to remove any concerns about bias. Nevertheless, your budget will often determine where you’ll have to do your sourcing.

Don’t Be Afraid To Re-Jigger

Once you get started interviewing, you might find that new questions pop up. Don’t be afraid to adjust your questions or interview structure! Those first few interviews are for you to get the ball rolling as much as they are for you to do fact finding. If the initial information you hear pulls you in a slightly different direction, feel free to adapt your questions. Or, add an extra question or two in, and keep plugging away.